For the cumulative 8 months of 2025, The Gioi Di Dong and Dien May Xanh chains achieved a total revenue of 67 trillion VND, a 14% increase compared to the same period last year. This growth was driven by a 15% rise in existing store revenue, while the average number of stores decreased by over 150 compared to the same period.

Both the mobile phone and electronics sectors of The Gioi Di Dong Investment Corporation (HOSE: MWG) are led by Mr. Doan Van Hieu Em through the managing entity, The Gioi Di Dong JSC (MW). During a strategic investor dialogue event in early August, MWG leaders revealed, for the first time, plans to IPO the subsidiary MW before 2030.

Mr. Doan Van Hieu Em – Executive Board Member at MWG, CEO of MW, and CEO of An Khang Pharma

|

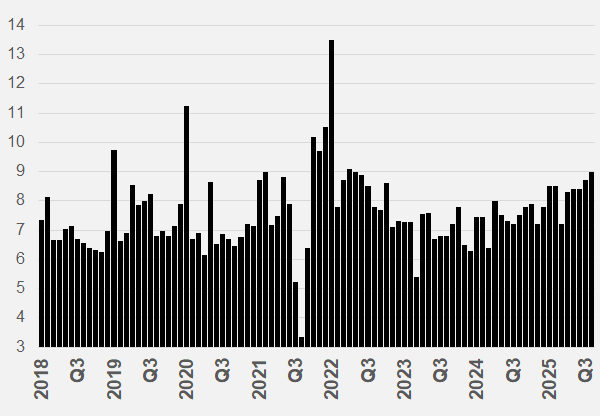

Returning to the business performance in August 2025, typically a low sales period, the mobile phone and electronics chains still achieved nearly 9 trillion VND in revenue, a 19% growth compared to the same period last year and a 3% increase from the previous month. According to MWG, major product categories, particularly laptops and home appliances, showed significant improvement compared to July.

Starting from August this year, The Gioi Di Dong, Dien May Xanh, and Topzone chains have begun preparations for the iPhone launch event in September, marking the first time the product is released in Vietnam simultaneously with the U.S. market.

|

Returning to Growth

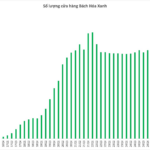

Total revenue of The Gioi Di Dong and Dien May Xanh in August 2025 was the highest since May 2022 Unit: Trillion VND

Source: Compiled from MWG reports

|

Meanwhile, MWG’s mini grocery store chain, Bach Hoa Xanh, achieved nearly 30.5 trillion VND in cumulative revenue for the first 8 months of 2025, a 14% increase compared to the same period. The company reported that after a cost optimization phase during the rainy months, the chain returned to revenue growth in July and August, with a 4% monthly improvement.

In 2025, the chain opened 463 new stores by the end of August, with over 50% of new locations concentrated in the Central region. These new stores recorded positive profits at the store level after deducting all direct operating costs.

In the remaining 4 months of the year, the chain plans selective expansion in provinces where it already has a presence.

At an investor meeting in mid-August 2025, MWG’s CEO, Mr. Vu Dang Linh, stated that Bach Hoa Xanh aims to open 1,000 stores in 2026 and begin expanding into the Northern market, where the chain currently has no presence.

In August 2025, MWG’s pharmaceutical and mother-and-baby product chains also reported positive results. An Khang Pharmacy recorded an average monthly revenue of 530 million VND per store and is moving toward profitability. The AvaKids chain achieved an average revenue of nearly 1.8 billion VND per store for the cumulative 8 months, showing growth compared to the same period and reaching profitability at the company level.

In the Indonesian market, MWG reported that the EraBlue chain grew by 80% in revenue for the first 8 months of the year, while maintaining profitability at the company level. Average revenue per electronics store in Indonesia is twice as high as that of similar models like Dien May Xanh Mini and Supermini in Vietnam.

MWG announced that EraBlue will continue to expand to reach the target of 150 stores by the end of this year.

– 10:03 20/09/2025

The Winning Stocks for the $1.3 Billion Foreign Fund

PYN Elite Fund had an impressive run in August, with a focus on banking stocks (+20%) and securities firms (+19%)—the two sectors that dominated the fund’s portfolio—leading to substantial gains.

The Green Grocer Prepares for Northern Expansion: A Thousand Stores Strong

“According to Mr. Nguyen Duc Tai, reaching the $10 billion milestone would require BHX to expand to tens of thousands of stores.”