Yeah1 Group Joint Stock Company (Stock Code: YEG, HoSE) has announced a report on changes in ownership by major shareholders and investors holding 5% or more of the company’s shares.

On September 11, 2025, Pyn Elite Fund, a Finnish investment fund, successfully purchased 1 million YEG shares on the stock exchange. This acquisition increased their holdings from over 15 million shares to 16 million shares, raising their ownership stake from 7.82% to 8.35% of Yeah1’s capital.

Based on the closing price of YEG shares on September 11, 2025, at VND 14,250 per share, the fund is estimated to have spent nearly VND 14.3 billion on this transaction.

Illustrative image

In other news, Yeah1 recently announced a resolution by the Board of Directors to relieve Mr. Yam Kong Fatt from his position as Deputy General Director of Strategy, effective September 17, 2025, due to personal reasons.

Regarding business performance, according to the consolidated semi-annual financial report for 2025, Yeah1 achieved a net revenue of over VND 676.8 billion, a 138.3% increase compared to the first half of 2024. Post-tax profit reached nearly VND 59.3 billion, up 175.8%.

For 2025, Yeah1 has set a business plan with a consolidated revenue target of VND 1,300 billion and a post-tax profit of VND 140 billion, representing increases of 27% and 14%, respectively, compared to 2024.

By the end of the first two quarters, the company has achieved 52.1% of its revenue target and 42.4% of its post-tax profit goal.

As of June 30, 2025, the company’s total assets increased by 5.3% from the beginning of the year to nearly VND 2,645.9 billion. Short-term receivables accounted for VND 1,387.8 billion, or 52.5% of total assets.

On the liabilities side, total payables stood at over VND 543.9 billion, a 46.3% decrease from the start of the year. Short-term and long-term loans totaled nearly VND 212.6 billion, making up 39.1% of total liabilities.

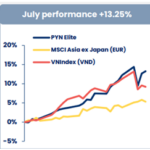

“The Billion-Dollar Pyn Elite Fund: Why 2025 Could be a Landmark Year for Stock Markets”

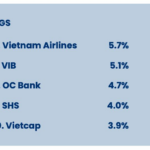

According to the Pyn Elite Fund, this could be a “Big Year” for stock market performance, based on the current fundamentals. The fund manager also highlights seven compelling reasons why a “Big Year” is feasible at this juncture.