The 14th Annual Retail Banking Forum and Vietnam Outstanding Banking Awards (VOBA) took place in 2025, honoring banks with exceptional achievements, innovation, and positive contributions to Vietnam’s financial and banking sector. The award’s judging panel comprises representatives from government agencies, ministries, associations, and experts in finance, banking, and technology.

The “Most Innovative Banking Product and Service” award recognizes SHB’s relentless efforts in innovation, customer-centricity, and delivering practical financial solutions tailored to diverse customer segments, particularly small traders.

“This award is not only a motivation but also a commitment for SHB to continue driving digital transformation, adopting modern technology, and developing innovative products and services. Our goal is to promote financial inclusion and support Vietnam’s economic growth,” shared an SHB representative.

Amid the banking sector’s rapid evolution, fueled by digital technology and shifting consumer behavior, SHB identifies innovation as the key to differentiation and enhanced customer experience.

SHB representative (right) receives the “Most Innovative Banking Product and Service” award in 2025

|

Leveraging deep customer insights, SHB offers a tailored “solution combo” addressing small traders’ financial needs at every stage of their journey. This comprehensive package starts with basic payment and cash flow management, expands to suitable credit services, and integrates additional financial utilities for sustainable business support.

SHB’s “Small Trader Solution Combo” provides exceptional benefits, including a complimentary premium account number valued up to 25 million VND, enhancing transaction credibility. Customers also enjoy free international debit card issuance, up to 3.6 million VND annual cashback on card spending, and waived online transaction fees—ideal for businesses requiring online advertising, procurement, or payments.

SHB has designed a flexible business loan package offering immediate capital without collateral. Customers can access up to 85% of their capital needs based on transaction turnover, with a maximum limit of 300 million VND at a daily interest rate of 0.05%. Notably, no interest is charged if the loan is settled within the same day.

Beyond transactions and loans, SHB encourages efficient savings with online deposit packages offering higher interest rates than in-branch options, optimizing idle funds securely and flexibly. The solution combo also ensures compliance with State Bank regulations, promoting revenue transparency.

Since the beginning of the year, SHB has been honored by domestic and international organizations with prestigious awards, including “Best Payment Solution Initiative in Vietnam” (The Asian Banker), “Best Bank for Public Sector Clients in Vietnam” (FinanceAsia), and “Best Sustainable Finance Bank in Vietnam” (Global Finance).

According to Decision Lab’s latest ranking, SHB is among Vietnam’s Top 10 banks with the highest customer satisfaction. Notably, SHB has achieved the fastest growth in customer satisfaction for two consecutive years and is ranked among Vietnam’s Top 10 Most Reputable Private Commercial Banks in 2025 by Vietnam Report.

The bank is focusing resources on implementing a comprehensive transformation strategy centered on four pillars: reforming mechanisms, policies, and processes; prioritizing people; customer and market-centricity; and modernizing IT and digital transformation.

SHB aims to become the most efficient bank, the most preferred digital bank, the leading retail bank, and a top provider of financial products and services to strategic private and state-owned enterprises, focusing on supply chains, ecosystems, and green development.

– 09:50 20/09/2025

Latest SHB Bank Interest Rates September 2025: 36-Month Term Offers Highest Interest Rate

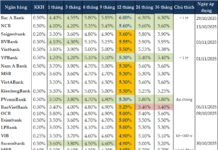

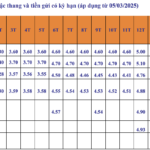

In September 2025, Saigon-Hanoi Commercial Joint Stock Bank (SHB) offers its highest deposit interest rate of 5.8% per annum, exclusively for individual customers who deposit online for 36 months or more.

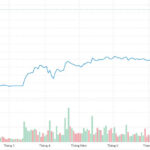

“Aggressive Foreign Sell-Off Ahead of Holiday Lull”

The Vietnamese stock market witnessed another volatile session on August 29th. The VN-Index ended the day slightly higher, gaining just over 1 point. Domestic funds made a strong comeback, boosting liquidity, while foreign investors continued to offload Vietnamese shares, with net sell orders totaling more than VND 3,500 billion.