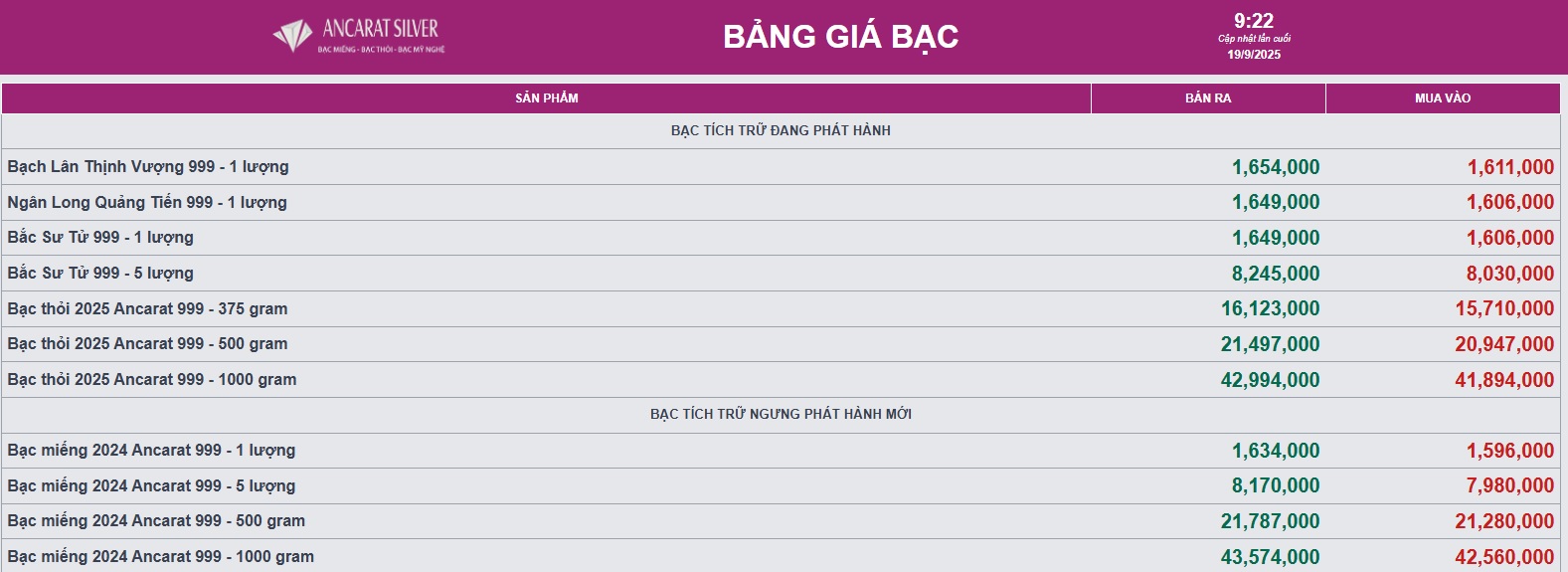

Explore the latest updates on silver prices at Ancarat Silver, where 999 fine silver bars (1 tael) are trading at VND 1,596,000 (buy) and VND 1,634,000 (sell). Meanwhile, 1 kg silver bars are priced at VND 42,560,000 (buy) and VND 43,570,000 (sell).

Over the past year, domestic silver prices have surged by 58%, with a notable 10% increase in the last month alone.

Internationally, silver is holding steady at USD 41.9 per ounce, slightly below its recent peak of USD 42.6. Analysts remain optimistic about silver’s future, predicting it could reach USD 45-50 per ounce by next year, or even by year-end.

As a safe-haven asset, similar to gold, silver is gaining traction amid global economic uncertainties and U.S. tariff policies. ETF funds have also been actively buying silver in recent weeks.

Additionally, silver’s role as an industrial metal has led to persistent deficits over the past few years, driven by rising demand in renewable energy and electronics sectors.

The recent 25-basis-point rate cut signals a weakening U.S. labor market and persistent inflation, prompting policymakers to act. “This isn’t a turning point but a carefully considered move. For investors, it’s not a fireworks display,” notes Gina Bolvin, Chair of Bolvin Wealth Management Group. The Federal Reserve’s cautious stance has bolstered the U.S. dollar, putting pressure on gold and silver.

However, long-term forecasts suggest gold and silver will continue to rise due to ongoing economic and geopolitical instability.

Silver Prices Plummet on September 18th

Compared to the morning of September 17th, domestic silver prices have dropped by approximately VND 45,000 per tael on the selling side.

Silver Prices Retreat After Hitting Fresh Highs

Today, silver prices in the domestic and global markets have taken a downturn, reversing the previous session’s strong gains.