Phat Dat Real Estate

According to the Hanoi Stock Exchange (HNX), Phat Dat Real Estate Investment and Development LLC (Phat Dat Real Estate) has released its key financial metrics for the first half of 2025.

As of June 30, 2025, the company’s equity stood at VND 7,581 billion, a VND 73 billion increase compared to the same period last year. Phat Dat Real Estate reported a net loss of nearly VND 37 billion for the first half of 2025, compared to a loss of over VND 33 billion in the same period the previous year.

Persistent losses have led to an accumulated deficit of nearly VND 115 billion by the end of Q2 2025.

By the end of the reporting period, total liabilities reached VND 11,010 billion, a VND 2,822 billion increase from the previous period and 1.45 times the equity. This was primarily due to a rise in bank loans from VND 860 billion to VND 2,910 billion. Conversely, other payables improved significantly, decreasing from VND 7,328 billion to VND 4,727 billion.

Additionally, in the first half of 2025, Phat Dat Real Estate recorded domestic private bond issuance debt of nearly VND 3,374 billion, whereas no such debt was reported in the same period last year.

The bond debt stems from the PDACB2425001 issuance on September 12, 2024, with a face value of VND 3,490 billion and a 12-month term.

Overview of the Vinhomes Royal Island-Vu Yen project. Image: Vinhomes

Notably, just days before the bond issuance, Phat Dat Real Estate pledged the rights arising from the Investment and Business Cooperation Contract No. 01/2024/HĐHTĐT/TPX-PHATDAT (effective September 5, 2024) and its appendices (if any) with Green City Development Corporation regarding profit-sharing for the Vu Yen (Hai Phong) project to Techcombank.

By May 2025, Phat Dat Real Estate further pledged the rights arising from Collateral Contract No. 01/HĐTCQTSDA/VHM-PĐ, signed on May 15, 2025, to VPBank.

According to the latest corporate registration update in May 2025, Phat Dat Real Estate’s charter capital is nearly VND 7,696 billion, contributed by three shareholders: Phuc Son High-Tech Agriculture LLC (45.57%), Hung Nghia Investment and Development LLC (41.85%), and Ms. Bui Thi Mai (12.58%).

Mr. Vo Phuoc Thanh and Mr. Nguyen Phi Long are authorized to represent the capital contributions of Phuc Son and Hung Nghia in Phat Dat Real Estate.

Currently, Ms. Bui Thi Mai serves as the CEO and legal representative of the company.

Hai Dang Real Estate

Another real estate company with a trillion-dong capital, Hai Dang Real Estate Investment and Development LLC (Hai Dang Real Estate), also reported lackluster results in the first half of 2025.

As of June 30, 2025, the company’s equity was nearly VND 4,952 billion, a VND 216 billion decrease from the same period last year.

In the first half of 2025, Hai Dang Real Estate reported a net loss of nearly VND 95 billion, bringing the accumulated loss as of June 30, 2025, to over VND 307 billion.

By the end of Q2 2025, total liabilities surged from over VND 3,064 billion to more than VND 18,377 billion, 3.49 times the equity. This was primarily due to a significant increase in other payables to nearly VND 12,936 billion, compared to just over VND 564 billion in the same period last year.

During the reporting period, Hai Dang Real Estate also recorded bank loans of over VND 91 billion.

Additionally, bond debt increased from VND 2,500 billion (Q2 2024) to VND 5,350 billion (Q2 2025).

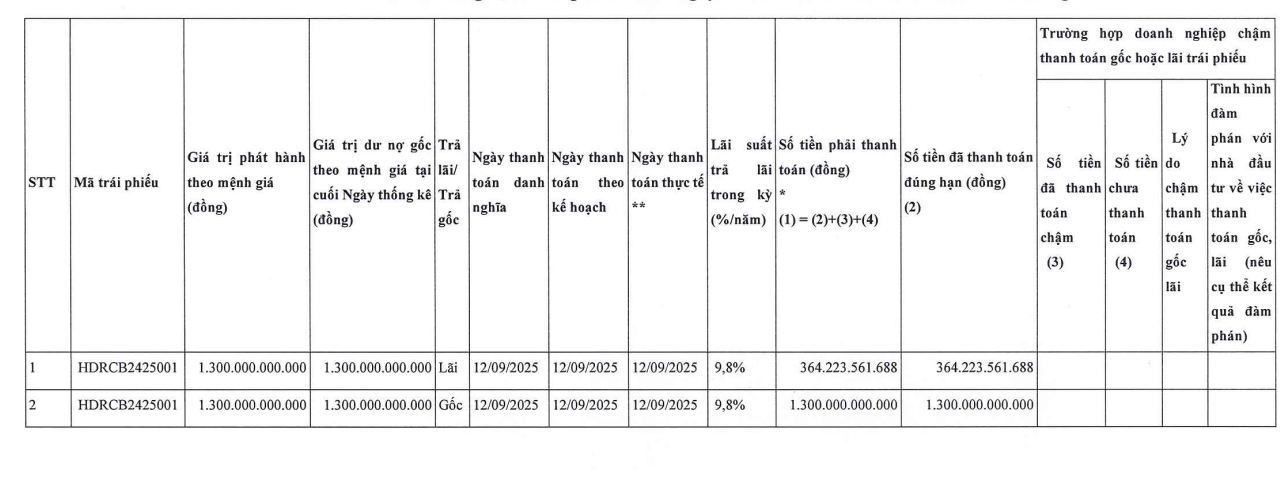

According to HNX, on March 12, 2024, the company successfully issued the HDRCB2425001 bond with a face value of VND 1,300 billion and an 18-month term. On September 12, 2025, the company repaid VND 1,300 billion in principal and over VND 364 billion in interest, fully settling this bond issuance.

Hai Dang Real Estate fully settles the HDRCB2425001 bond. Source: HNX

Also on March 12, 2024, Hai Dang Real Estate successfully issued 12,000 HDRCB2427002 bonds with a face value of VND 100 million each. The issuance value was VND 1,200 billion, with a 36-month term, maturing on March 12, 2027.

Just a few months later, on July 26, 2024, Hai Dang Real Estate issued 28,500 HDRCB2426003 bonds with a face value of VND 100 million each. The issuance value was VND 2,850 billion, with an 18-month term, maturing on January 26, 2026.

Details about bondholders, arrangers, and issuance purposes were not disclosed. However, according to HNX, this bond carries an interest rate of 9.8% per annum.

Hai Dang Real Estate was established in August 2022, headquartered at the Dream City Eco-Urban Project in Nghia Tru Commune, Van Giang District (formerly), Hung Yen Province, with a focus on real estate business.

Initially, the company’s charter capital was nearly VND 5,260 billion. After several changes, by February 2025, the shareholder structure included Hung Yen Urban Development and Investment Corporation (98%) and Ms. Nguyen Linh Phuong (2%).

Currently, Hai Dang Real Estate has two legal representatives: Mr. Ngo Van Kien (born 1996), Chairman of the Board, and Mr. Hoang Trong Hung (born 1988), CEO.

According to reports, just one day before issuing the HDRCB2425001 and HDRCB2427002 bonds (on March 11, 2024), Hai Dang Real Estate entered into a secured transaction with Techcombank. The collateral included investment and business cooperation contracts related to the Dream City (Hung Yen) project.

On July 25, 2024 (one day before issuing the HDRCB2426003 bond), Hai Dang Real Estate pledged all rights arising from Investment and Business Cooperation Contract No. 0507/2024/HĐHTĐT/VHM-HAIDANG (effective July 5, 2024) and its amendments to Techcombank.

Bach Hien

Orchard Grand: Elevating Urban Living with a Holistic Lifestyle in the Heart of the New City

In today’s real estate landscape, where homebuyers increasingly prioritize health and well-being, developments offering comprehensive wellness amenities like Orchard Grand are setting a new market trend.

Unlock Investment Opportunities in Hoàng Giang Subdivision – Quy Nhơn’s Iconic Urban Hub

On September 21, 2025, the “Riding the Wave of Investment – Unlocking Success” event will unveil the Hoàng Giang sub-division, the commercial heart of the Quy Nhơn Iconic project. Strategically located and offering enticing incentives, this launch is poised to ignite a new wave of excitement in Central Vietnam’s real estate market.

Vietnam Han Real Estate Profits Over 1 Trillion VND in First Half of the Year

According to the recently released financial report, Viet Han Trading – Advertising – Construction – Real Estate Joint Stock Company recorded an after-tax profit of 1,035.8 billion VND, marking a 10% increase compared to the previous reporting period.