Vietnam’s stock market recently experienced a turbulent ETF portfolio restructuring session, particularly during the ATC session. Vingroup’s stock (ticker: VIC), owned by billionaire Pham Nhat Vuong, gained significant attention with a sudden surge of nearly 5.7% to VND 153,200 per share, setting a new record high. Since the beginning of 2025, the stock has soared by approximately 280%.

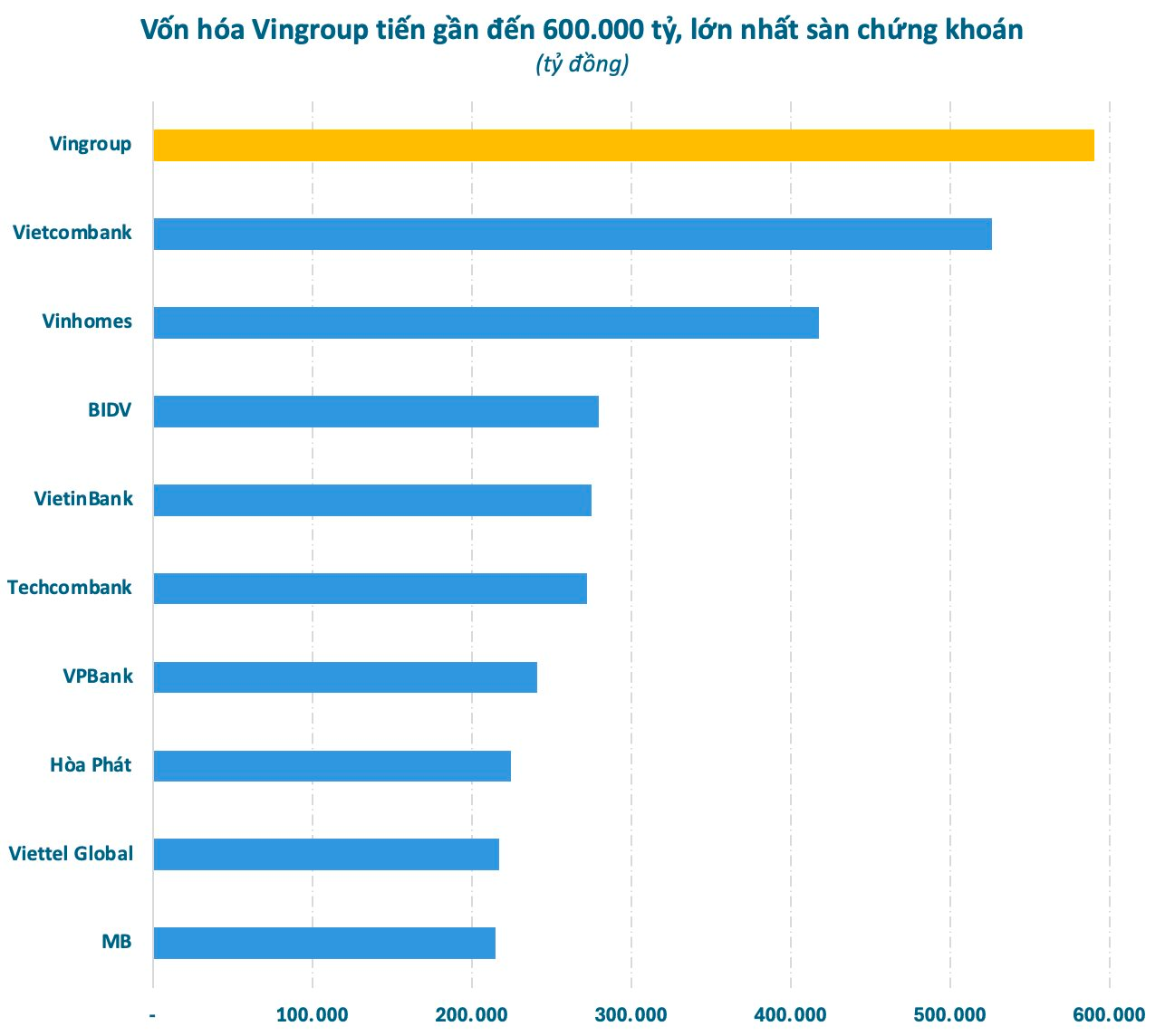

Vingroup’s market capitalization has also surged by over VND 435 trillion since the start of the year, reaching a record high of more than VND 590 trillion (~USD 22 billion). This positions the conglomerate, led by billionaire Pham Nhat Vuong, firmly at the top of the stock market and on the cusp of becoming the first Vietnamese company to hit a VND 600 trillion valuation.

The surge in VIC shares comes as Vingroup was recently honored as one of the World’s Best Companies by TIME Magazine. This marks the first time a Vietnamese enterprise has made it onto this prestigious global ranking.

The World’s Best Companies list, compiled by TIME Magazine in collaboration with leading data firm Statista, evaluates companies based on revenue growth, employee satisfaction, and a comprehensive ESG analysis (covering environmental, social, and governance factors).

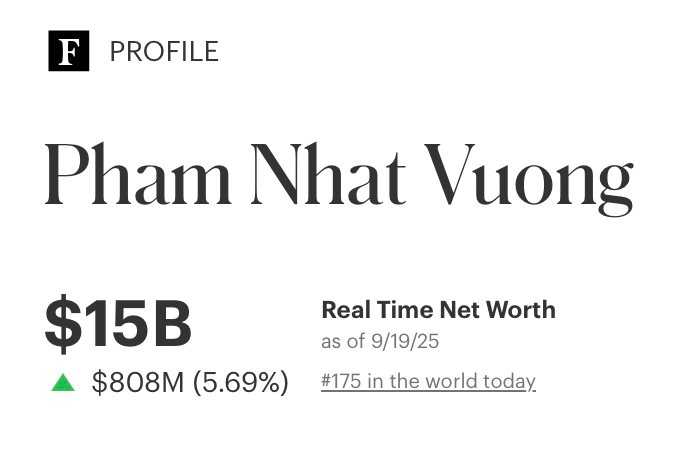

The rally in Vingroup’s shares has significantly boosted the wealth of billionaire Pham Nhat Vuong. His estimated assets on the Vietnamese stock market currently stand at around VND 270 trillion. However, a substantial portion of his wealth is also tied to VinFast, which is listed on Nasdaq with a market capitalization of approximately USD 7.5 billion.

According to the latest update from Forbes on September 19th, Pham Nhat Vuong’s net worth is USD 15 billion, ranking him 175th among the world’s richest individuals. Notably, his wealth surpasses that of Samsung Chairman Lee Jae-yong and Thai billionaire Charoen Sirivadhanabhakdi, Chairman of TCC Group and founder of Thai Beverage.

Unveiling Vietnam’s New Stock Market Capitalization King

Vingroup’s market capitalization soared to the highest level on the entire exchange, surpassing Vietcombank. VIC shares emerged as the strongest driver, significantly curbing the decline of the VN-Index during today’s session (September 18). However, the benchmark index failed to reverse its downward trend.

Which Sectors Stand to Gain if Vietnam’s Stock Market is Upgraded in October?

Should FTSE Russell upgrade Vietnam’s stock market to “Emerging Market” status in October 2025, the outlook would be exceptionally positive.