VPBank Securities JSC (VPBankS) has announced Resolution No. 87/2025/NQ-HĐQT, approving a plan to issue private bonds in multiple tranches, totaling VND 4,000 billion in face value.

Specifically, the total volume of bonds to be issued is 40,000, with a face value of VND 100 million per bond. These are non-convertible, unsecured bonds without collateral, establishing a direct debt obligation for the issuer.

The maximum number of offering tranches is 5, with a minimum volume of VND 500 billion per tranche. The expected offering periods are in Q3-Q4/2025, with a maximum distribution period of 30 days per tranche.

The bonds have a 12-month term, with a fixed maximum interest rate of 8% per annum for the entire term.

Recently, VPBankS adopted a resolution outlining its strategy and goals, along with guidelines for implementing the medium-term development strategy for 2026-2030.

By the end of 2025, the company aims to achieve market shares of 2.9% in stock brokerage, 3.5% in derivatives, 10.2% in non-banking corporate bond issuance, and 10% in margin lending. By 2030, these figures are expected to rise significantly to 10%, 20%, 18.5%, and 15%, respectively.

Financially, VPBankS anticipates revenue and profit growth in the coming years. Total revenue is projected to reach VND 7,177 billion, with pre-tax profit of VND 4,450 billion in 2025, representing a 58% increase in revenue and a 122% surge in profit compared to the previous plan approved at the 2025 Annual General Meeting.

Within this structure, revenue from listed securities is expected to reach VND 2,589 billion (up 23%), bond issuance advisory revenue is projected at nearly VND 843 billion (quadrupling), and revenue from bond trading and other activities is estimated at VND 3,745 billion (up 68%).

By 2030, VPBankS’ total revenue is forecasted to grow to VND 29,051 billion, with pre-tax profit reaching VND 17,520 billion.

In terms of business operations, VPBankS recorded a pre-tax profit of nearly VND 900 billion in the first half of 2025, an 80% increase compared to the same period last year.

During this period, operating revenue reached VND 1,885 billion, up 58% year-on-year. Key drivers included profit from FVTPL financial assets at VND 1,058 billion (up 94%), profit from loans and receivables at VND 646 billion (up 38%), and a significant surge in financial advisory revenue from VND 4 billion to VND 104 billion.

While revenue increased, operating expenses were reduced by 15% to under VND 400 billion.

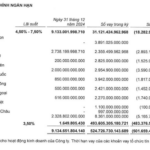

As of Q2/2025, VPBankS’ total assets exceeded VND 50,901 billion, a dramatic increase from the VND 26,714 billion recorded at the beginning of the year.

Cash holdings rose from over VND 2,313 billion to more than VND 14,773 billion, while FVTPL financial assets increased from nearly VND 12,538 billion to almost VND 15,204 billion, primarily due to the fair value of unlisted bonds and equities.

The company also expanded its lending activities, with loans increasing from over VND 9,513 billion to nearly VND 17,758 billion, primarily in margin lending.

To finance this asset growth, VPBankS increased short-term borrowings from nearly VND 9,135 billion to almost VND 32,202 billion, mostly from banks, with individual and other institutional borrowings totaling VND 10,230 billion.

VPBank Seeks to Raise $175 Million Through Private Bond Issuance

On September 18th, the Board of Directors of VPBank Securities Joint Stock Company (VPBankS) approved a resolution to issue private bonds, aiming to raise up to VND 4,000 billion for debt restructuring purposes.

LPBS Set to Boost Capital to Nearly VND 13 Trillion

On September 15th, the Board of Directors of LPBank Securities JSC (LPBS) passed a resolution to offer up to 878 million shares to existing shareholders. This move is expected to increase the company’s chartered capital to VND 12,668 billion, a 3.3-fold increase from its current level. The majority of the proceeds from the offering will be allocated to investments in bonds, deposit certificates, and margin lending.

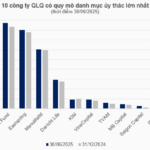

Unraveling the Puzzle: A $26 Billion Investment Trust Landscape in the Fund Management Industry

By the end of Q2 2025, Vietnam’s asset management industry boasted a combined discretionary portfolio value exceeding 614 trillion VND, marking a nearly 5% increase from the year’s start. This growth fueled a surge in management fee revenue. Notably, three firms stood out with colossal portfolios, each managing hundreds of trillions of VND, heavily invested in bonds. Their success is attributed to the robust support from their insurance ecosystem.

“Shrimp Magnate” Reports 32% Surge in August Revenue, the Highest Since the Year’s Inception, as it Sets Aside Nearly $4 Million for Three New US Market Taxes.

“FMC’s primary growth driver stems from the US market, where importers have been front-loading purchases to pre-empt potential tariff policy changes. This strategic move has created a significant boost for FMC, as importers stock up in anticipation of potential shifts in trade policies.”