According to a recent Forbes update, as of September 19th, billionaire Pham Nhat Vuong boasts a net worth of $15 billion, ranking 175th among the world’s wealthiest individuals. This marks the first time in history that a Vietnamese national has reached this level of wealth.

With $15 billion, Vuong surpasses numerous high-profile figures on the rich list, including Samsung Chairman Lee Jae-yong, former US President Donald Trump, and legendary investor George Soros.

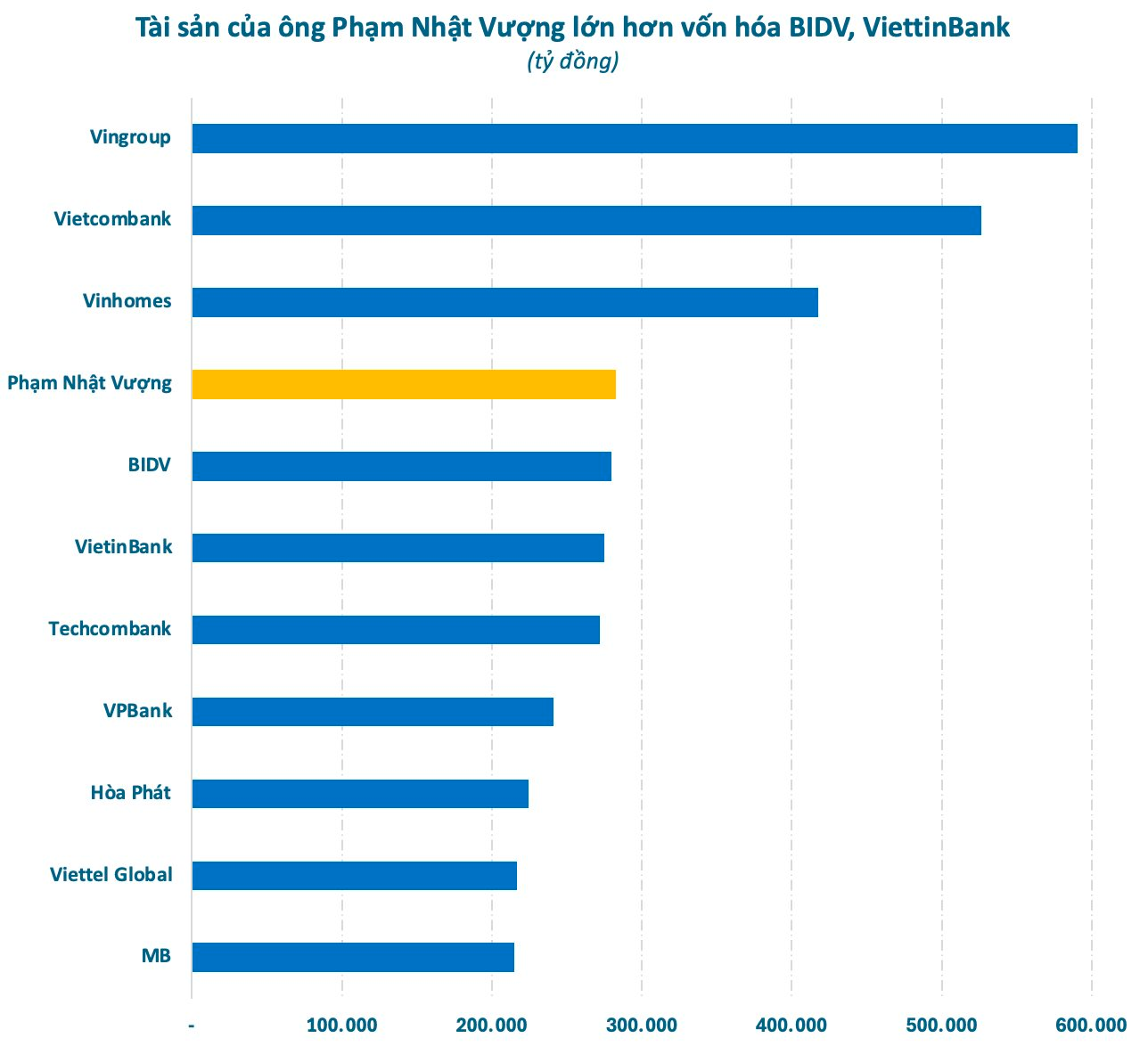

On the Vietnamese stock market alone, Vuong’s assets (including direct and indirect holdings of VIC shares) are estimated at nearly 283 trillion VND. This figure even surpasses the market capitalization of major banks like BIDV, VietinBank, Techcombank, and VPBank.

Vuong’s wealth surge is primarily driven by the strong performance of Vingroup shares (ticker: VIC). Since the beginning of 2025, the stock has soared nearly 280%, reaching a new peak of 153,200 VND per share. Vingroup’s market capitalization has also hit a record high of over 590 trillion VND (~$22 billion), an increase of more than 435 trillion VND since the start of the year.

VIC’s impressive rally comes as Vingroup was recently named one of the World’s Best Companies by TIME magazine. This marks the first time a Vietnamese company has made it onto this prestigious global ranking.

In the first half of 2025, Vingroup reported revenues of 130.476 trillion VND, doubling year-on-year. After expenses, pre-tax profit reached 11.159 trillion VND, up 69% compared to the same period in 2024.

In the Technology & Industry segment, VinFast delivered 72,167 electric vehicles globally, a 3.2-fold increase year-on-year. Domestically, VinFast maintained its market leadership with 67,569 vehicles delivered in the first half. In the electric motorcycle segment, VinFast set a new record with 114,484 units delivered, a 5.5-fold increase.

In the Commerce & Services segment, Vingroup recorded real estate sales revenue of 70.5 trillion VND in the first half of 2025, nearly tripling year-on-year. Vinhomes led the real estate market recovery with 67.5 trillion VND in sales and 138.2 trillion VND in unrecorded sales as of Q2 2025.

In a recent analysis, Vietcap forecasts electric vehicle sales to grow 55%/24% year-on-year in 2025/26, reaching 151,000 and 187,000 units respectively. Vietnam is expected to remain VinFast’s core market, driven by increasing electric vehicle adoption among both individual and B2B customers (ride-hailing, delivery services).

Vietcap projects Vingroup’s 2025 pre-tax profit at 20.1 trillion VND. Second-half profits are expected to be driven by stronger real estate sales, thanks to unrecorded contract values from projects like Royal Island and new bulk sales. Hotel segment operating profits are forecast to remain positive from Q2 2025, offsetting industrial segment losses.

Vingroup Sets New Record: Billionaire Pham Nhat Vuong on the Brink of Making History

Billionaire Pham Nhat Vuong’s conglomerate reigns supreme as the most valuable company on Vietnam’s stock market, poised to make history as the first Vietnamese enterprise to achieve a staggering $25 billion market capitalization.

Uniting for a Green Future: 600 VinFast Distributors Commit to Selling 1.5 Million Electric Motorcycles by 2026

Uniting in a shared commitment to support the green transition and restore clean air for communities, over 600 VinFast electric motorcycle distributors nationwide have collectively set an ambitious 2026 sales target of 1.5 million units, positioning VinFast to become the leading motorcycle brand in the market.

Unveiling Vietnam’s New Stock Market Capitalization King

Vingroup’s market capitalization soared to the highest level on the entire exchange, surpassing Vietcombank. VIC shares emerged as the strongest driver, significantly curbing the decline of the VN-Index during today’s session (September 18). However, the benchmark index failed to reverse its downward trend.