According to the Vietnam Securities Depository and Clearing Corporation (VSDC), the final registration date for shareholders to exercise their dividend rights is October 2, 2025. The payment is expected to be made on October 15, 2025.

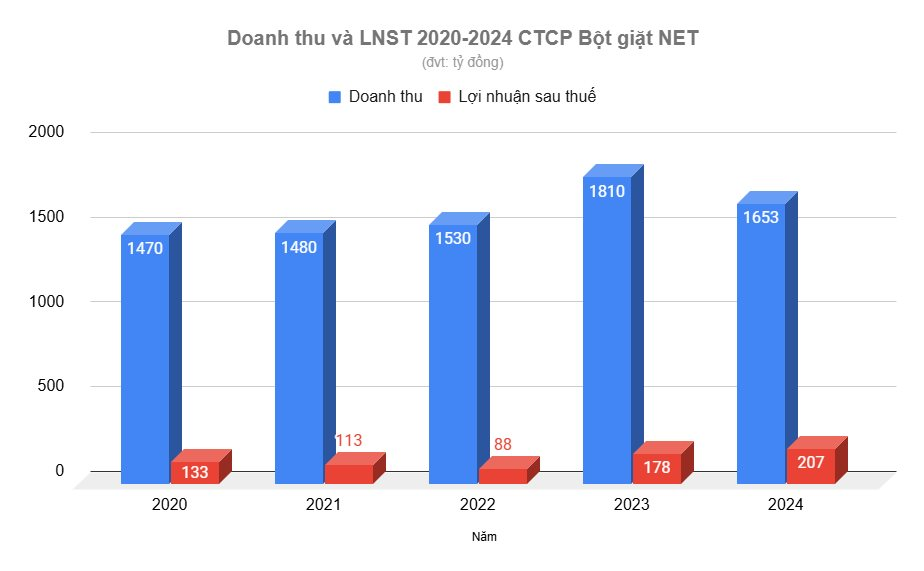

This dividend policy is the result of a successful fiscal year 2024, where NET reported an after-tax profit of 207 billion VND, a 16% increase compared to the previous year, despite a 8.7% decline in net revenue to 1,653 billion VND. Efficient cost-cutting measures, particularly in sales expenses, significantly boosted the company’s profitability. By the end of 2024, NET’s estimated EPS exceeded 9,000 VND.

NET is also renowned for its consistent and high cash dividend policy. Most recently, the company paid a 100% dividend (10,000 VND per share) for 2023 and a 22% dividend (2,200 VND per share) for 2022.

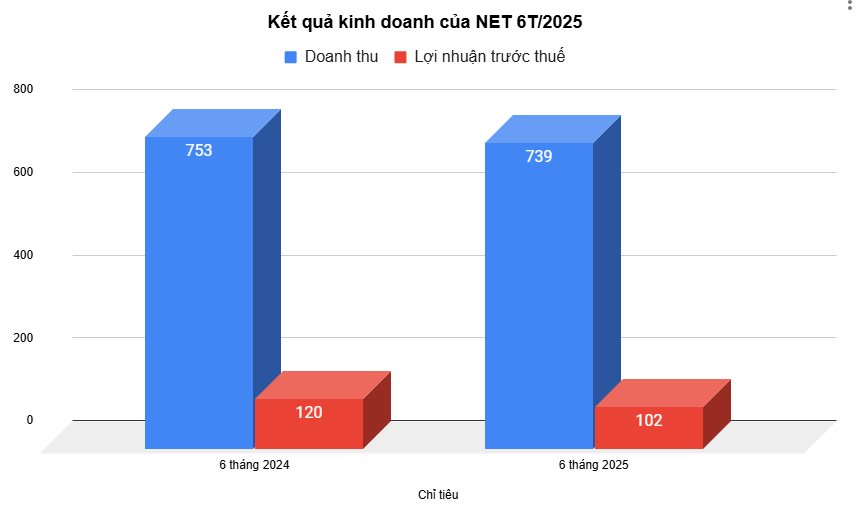

However, the first half of 2025 presented certain challenges. According to the semi-annual financial report, NET’s detergent segment recorded a net revenue of 739 billion VND in the first six months of 2025, a slight 2% decrease compared to the same period last year. The disproportionate reduction in the cost of goods sold narrowed the gross profit margin from 26.6% to 23.9%.

Consequently, the company’s pre-tax profit for the first half of 2025 reached 102 billion VND, a 15.3% decline from the 120.5 billion VND recorded in the first half of 2024. A structural analysis reveals that a 15.6% drop in overseas market revenue was a primary factor affecting the overall results.

Despite recent profit adjustments, NET’s financial foundation remains stable. As of June 30, 2025, the company’s total assets stood at 1,044.8 billion VND. Cash, cash equivalents, and short-term financial investments totaled 492.5 billion VND, accounting for nearly 47% of total assets. Additionally, NET’s undistributed after-tax profit remained high at 357.7 billion VND, serving as a crucial resource for future dividend payments and investment plans.

The Penultimate Proposal: Unveiling the Ministry of Finance’s New Suggestions for Service Pricing in the Securities Sector

The Ministry of Finance is seeking feedback on the draft circular guiding service prices in the securities sector applied at the Vietnam Stock Exchange and its subsidiaries, and the Vietnam Securities Depository and Clearing Corporation.