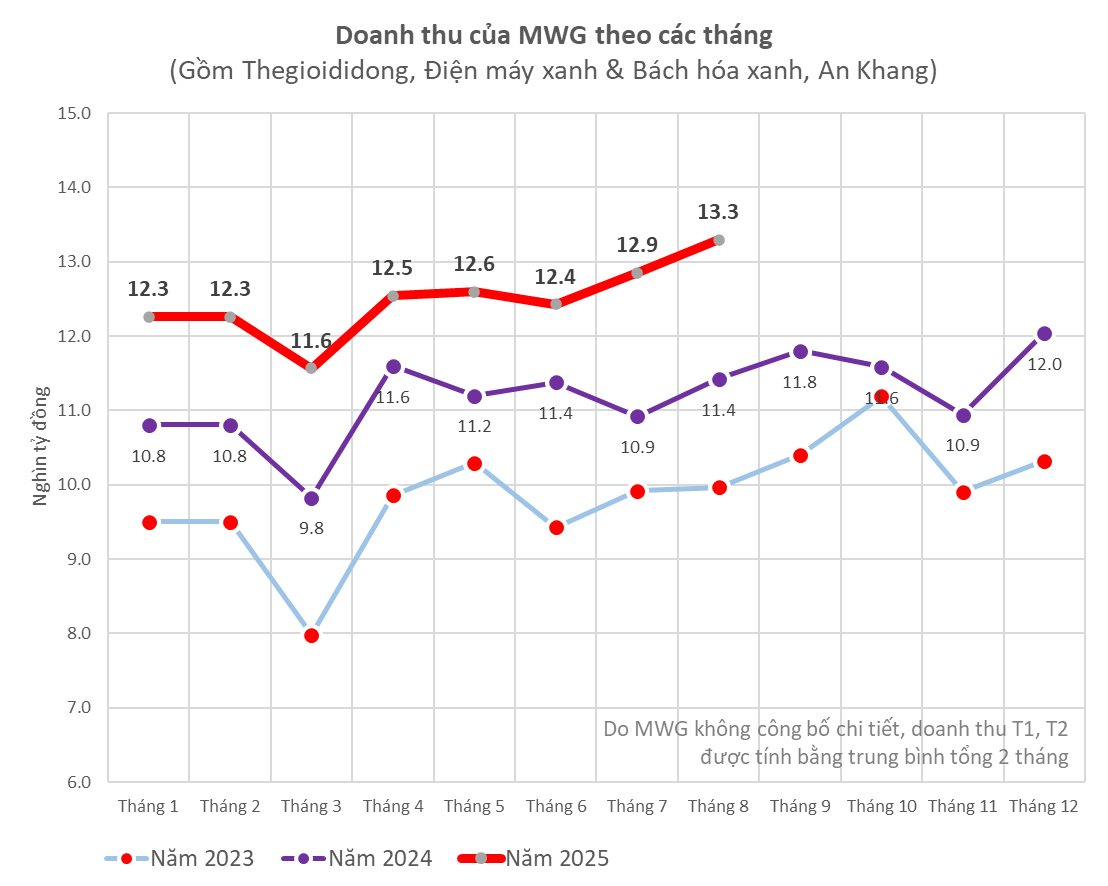

According to the business report for the first 8 months of 2025, Mobile World Investment Corporation (HoSE: MWG) recorded a consolidated net revenue of VND 99,801 billion, a 13.5% increase compared to the same period in 2024. With this result, the company has achieved 67% of its annual revenue target of VND 150,000 billion.

Monthly revenue has shown steady growth over the past 6 months, rising from VND 11,600 billion in March to a peak of VND 13,300 billion in August. August’s figure not only marks the highest level in the first 8 months but also reflects a 16.7% growth compared to the same period in 2024 (VND 11,400 billion).

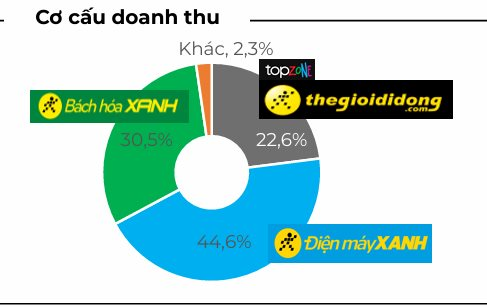

The two core retail chains, The Gioi Di Dong and Dien May Xanh, remain the primary growth drivers, contributing VND 67,000 billion to total revenue, a 14% increase year-over-year.

Notably, this growth stems from operational efficiency improvements, with same-store sales rising by 15%.

In August 2025 alone, these two chains generated nearly VND 9,000 billion in revenue, up 19% year-over-year and 3% compared to July 2025, marking the sixth consecutive month of positive growth.

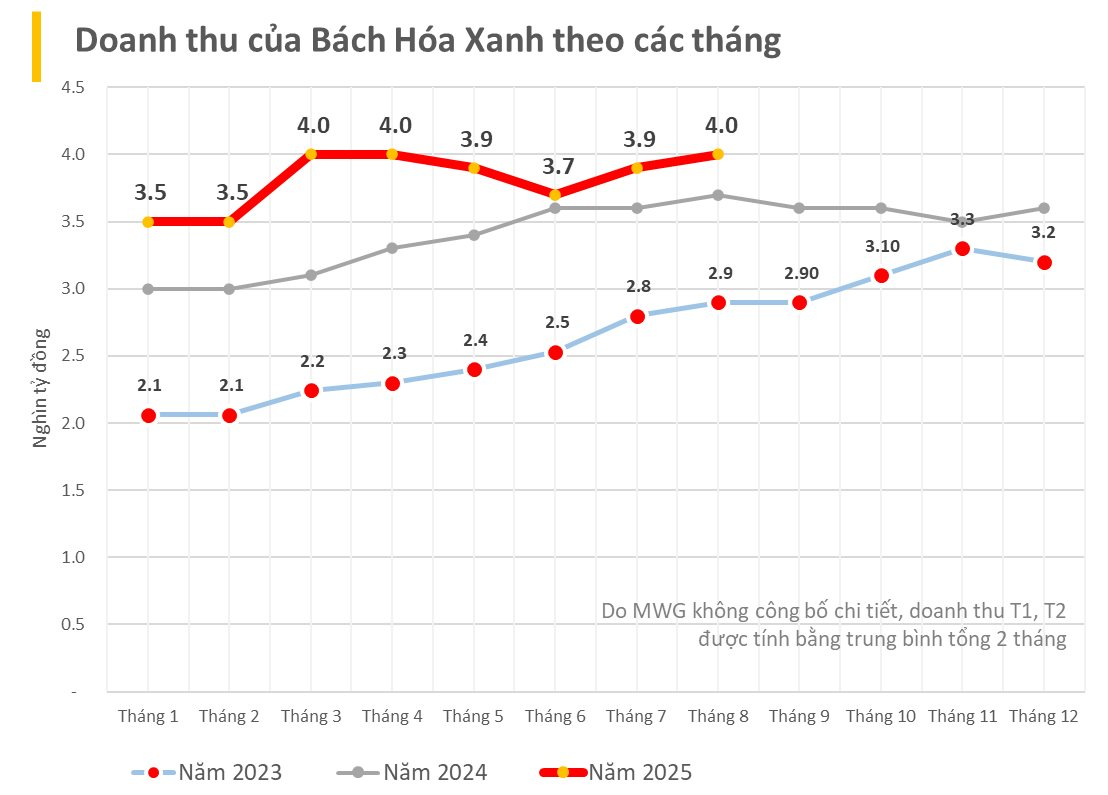

In the food retail segment, Bach Hoa Xanh generated VND 30,500 billion in revenue after 8 months, a 14% increase year-over-year. Detailed monthly business results show that 2025 has set a new revenue benchmark for the chain, with monthly revenue ranging from VND 3,500 to 4,000 billion, significantly higher than previous years.

Specifically, August 2025 revenue reached VND 4,000 billion, up 8.1% from VND 3,700 billion in August 2024 and a significant 37.9% increase from VND 2,900 billion in August 2023. This trend confirms a return to growth in July and August after a slight decline in June (VND 3,700 billion), aligning with the company’s cost optimization efforts during the rainy season.

Alongside revenue growth, Bach Hoa Xanh has accelerated its expansion strategy by opening 463 new stores. According to MWG, these new stores have collectively achieved positive store-level profitability.

Other business segments also reported positive results. The EraBlue joint venture in Indonesia saw an over 70% year-over-year revenue increase for the first 8 months and has achieved company-level profitability.

The average revenue of the M store model in Indonesia is approximately VND 4 billion per month. The AVAKids chain also reported company-level profitability, with average store revenue nearing VND 1.8 billion per month. Meanwhile, the An Khang pharmacy chain recorded an average revenue of VND 530 million per store in August.

With the results achieved after 8 months, MWG is closing in on its 2025 business targets.

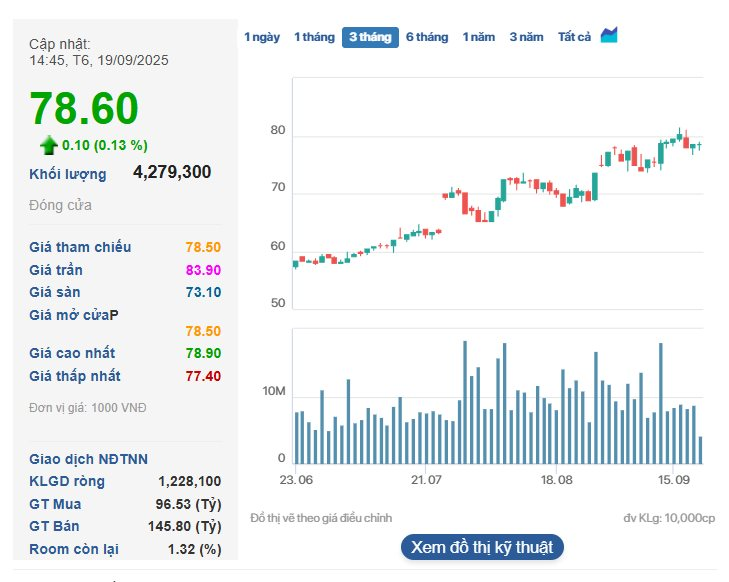

On the stock market, MWG shares have positively reflected the business results. Over the past 3 months, the stock price has risen from VND 58,000 per share at the end of June 2025 to VND 78,600 per share in the trading session on September 19, 2025, representing a more than 35% increase.

Dragon Capital Exits Major Shareholder Status at The Gioi Di Dong, Selling Over 3 Million Shares

Dragon Capital Group has offloaded over 3.2 million shares of MWG, reducing its ownership stake below 5% and ceasing to be a major shareholder in the retail company. This transaction occurred amid a rising MWG stock price and the company’s positive first-half 2025 financial performance.

LPBS Set to Boost Capital to Nearly VND 13 Trillion

On September 15th, the Board of Directors of LPBank Securities JSC (LPBS) passed a resolution to offer up to 878 million shares to existing shareholders. This move is expected to increase the company’s chartered capital to VND 12,668 billion, a 3.3-fold increase from its current level. The majority of the proceeds from the offering will be allocated to investments in bonds, deposit certificates, and margin lending.

Unraveling the Puzzle: A $26 Billion Investment Trust Landscape in the Fund Management Industry

By the end of Q2 2025, Vietnam’s asset management industry boasted a combined discretionary portfolio value exceeding 614 trillion VND, marking a nearly 5% increase from the year’s start. This growth fueled a surge in management fee revenue. Notably, three firms stood out with colossal portfolios, each managing hundreds of trillions of VND, heavily invested in bonds. Their success is attributed to the robust support from their insurance ecosystem.