Is Vietnam Under Pressure to Raise Interest Rates?

Speaking at the 2025 Housing Real Estate Forum themed “Satellite Waves” on the afternoon of September 18 in Ho Chi Minh City, Dr. Can Van Luc noted that the global economy is slowing down, with this year’s growth projected at around 2.3%. Meanwhile, Vietnam aims for a minimum growth of 8% this year and double-digit growth in subsequent years. This presents a significant challenge but reflects the strong determination of the Party, State, and Government to maintain high and sustainable growth.

Dr. Can Van Luc described the current VND/USD exchange rate dynamics as rare.

The U.S. Federal Reserve (Fed) recently cut interest rates by 0.25 percentage points, lowering the range to 4% – 4.25%. This is the first reduction since the beginning of the year, amid U.S. inflation dropping to 3%, declining employment, and weak consumer spending. The Fed hinted at another possible cut in December. Many are asking: Is Vietnam under pressure to raise interest rates?

Currently, the State Bank of Vietnam maintains the overnight lending rate above 4%, considered low and stable despite potential fluctuations in deposit rates, gold prices, or the stock market.

Another notable issue highlighted by Dr. Can Van Luc is the VND/USD exchange rate dynamics. Last year, the VND depreciated by about 5%, while this year the USD has lost about 10%, yet the VND still weakened by an additional 3.4%. This rare phenomenon has three main causes:

Vietnam’s balance of payments is negative due to a trade surplus in goods but deficits in services, particularly tourism and logistics. Tariff fluctuations have increased foreign currency hoarding. Gold price volatility has also spurred smuggling, pressuring the foreign exchange market.

Interest rate differentials are another factor. The U.S. maintains rates around 4.2% – 4.5%, similar to Vietnam’s interbank rates. With low exchange rate risk, foreign currency flows tend to return to the U.S.

However, even if the exchange rate rises, VND interest rates will remain stable to support economic growth. Notably, the exchange rate is expected to stabilize by year-end and into next year, especially as the Fed continues rate cuts. The VND is projected to depreciate by about 4% this year.

Dr. Can Van Luc emphasized the importance of stable interest rates, particularly as the real estate market needs additional recovery momentum. Additionally, falling Brent crude oil prices have reduced inflationary import risks for Vietnam, shielding the economy from significant external price pressures.

Global economic risks persist, however. Trade policies of major economies are increasingly unpredictable, and global trade shows signs of slowing. While inflation and interest rates are declining, they remain high, and public and private debt in many economies remain long-term concerns.

Businesses Must Be More Agile

Amid mixed global conditions, Vietnam’s economy has shown bright spots over the past eight months. Dr. Can Van Luc highlighted recovering domestic consumption and improved exports. Private investment and foreign direct investment (FDI) remain robust, while public investment continues to be strongly promoted.

Public investment is another key focus. This year’s plan totals about $33 billion, 31% higher than last year. If successfully disbursed, it could contribute over 2% to GDP growth.

Macroeconomic conditions will significantly influence housing supply and demand.

According to Dr. Luc, nearly 3,000 projects totaling about $235 billion are currently stalled. Unblocking 10% this year and another 10% next year could release about $60 billion annually, creating substantial capital for the economy.

Similarly, Dr. Nguyen Van Khoi, a member of the Prime Minister’s Advisory Council, noted that macroeconomic conditions will significantly influence housing supply and demand. Lower interest rates improve credit access for genuine buyers, but tight real estate credit controls require businesses to be more flexible in capital mobilization.

Meanwhile, public investment in key infrastructure projects—from highways and metro lines to Long Thanh International Airport—is creating new market hubs, especially in satellite areas.

“Key Party resolutions on national development by 2045 continue to drive innovative thinking, requiring real estate to align with regional and national development strategies,” said Dr. Khoi.

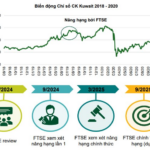

VN-Index Projected to Reach 1,854 Points by Year-End, Yet Volatility Remains Inevitable

The broader domestic and global macroeconomic landscape, coupled with the impending stock market upgrade narrative, serves as a powerful catalyst fueling the market’s upward trajectory.

Young Couple’s Dilemma: Saving for a Year Can’t Keep Up with Rising Condo Prices

The soaring prices of new apartment projects in Hanoi have reached staggering levels, with per square meter costs running into the hundreds of millions of dong. This has forced many young couples to consider pre-owned apartments, only to be met with further sticker shock as prices continue to climb relentlessly.