Vietnam – A Global FDI Magnet

Amidst the shifting global economic landscape, Vietnam has emerged as a secure and efficient destination for foreign direct investment (FDI). Its strategic location at the heart of the Asia-Pacific region, intersecting major transportation routes, has solidified its appeal.

According to the General Statistics Office (Ministry of Finance), in the first seven months of 2025, realized FDI surpassed $13 billion, with numerous large-scale projects. New registered projects increased by 15.2% compared to the same period last year, attracting investors from countries such as Singapore, China, Sweden, and Japan.

Vietnam shines as a global FDI attraction hub

Vietnam’s FDI appeal stems from its competitive labor costs and young workforce, which align well with global production chain demands. Additionally, upgrades to logistics, transportation, and energy infrastructure, coupled with the government’s push for digital transformation and a modern, transparent administrative system, have further bolstered stable FDI growth.

A Comprehensive Financial Ecosystem – Launchpad for FDI Enterprises

The surge in international capital demands a synchronized financial ecosystem tailored to FDI enterprises. Alongside government investment procedure reforms, commercial banks play a pivotal role in channeling foreign capital into the economy.

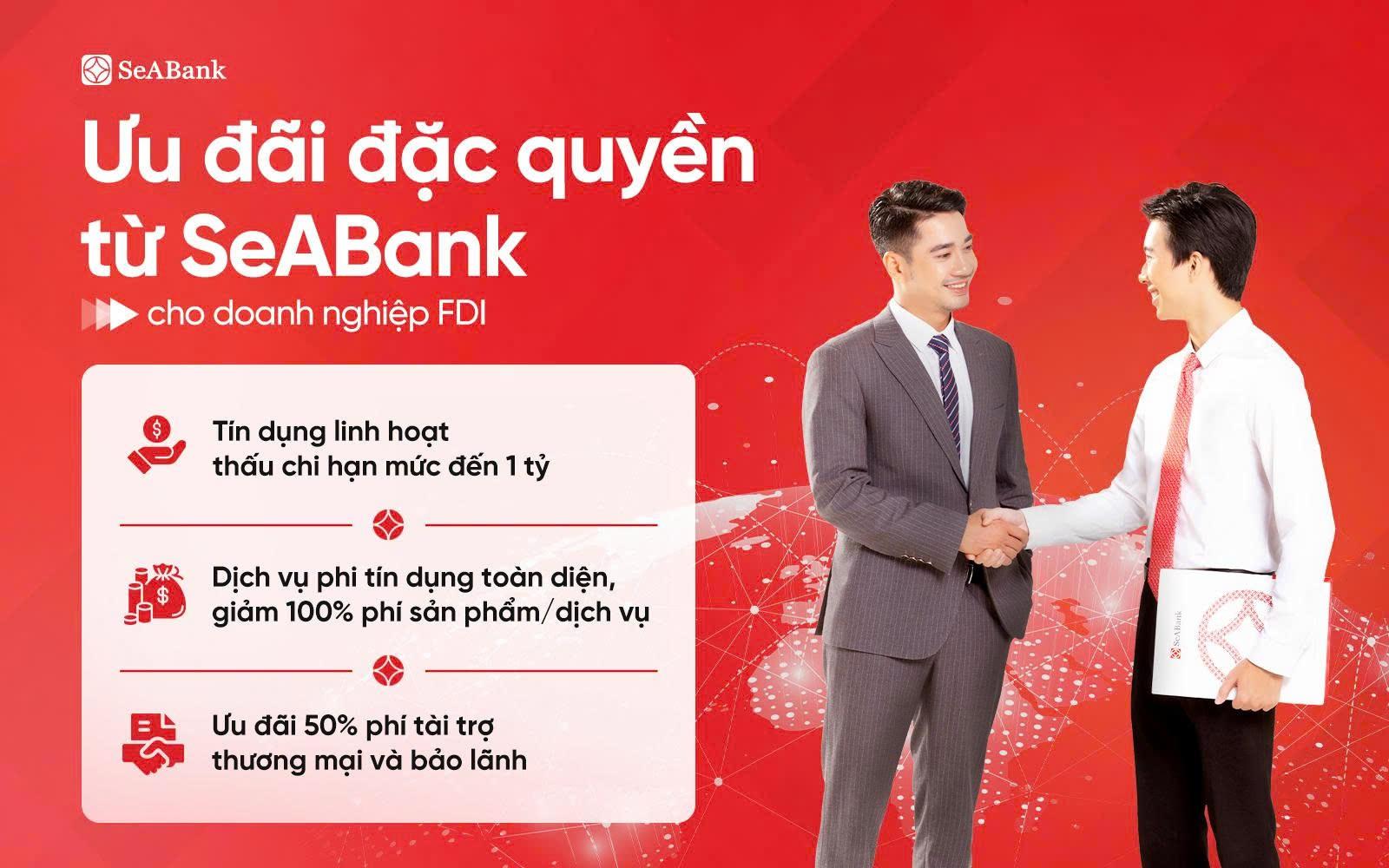

Notably, Southeast Asia Commercial Joint Stock Bank (SeABank) has implemented specialized solutions and optimized services to help FDI enterprises streamline capital, manage cash flow efficiently, reduce operational costs, and enhance competitiveness. SeABank’s integrated credit and non-credit approach enables enterprises to achieve comprehensive financial management, stabilize operations, and expand development.

In credit services, SeABank offers flexible collateral policies to maximize client capital needs, with financing up to 100% of asset value (depending on the asset type). Enterprises can access credit through unsecured loans or collateralized receivables from export contracts, letters of credit (LC), including receivables from parent companies. Additional policies include overdraft limits up to 1 billion VND, waived overdraft account management fees, and priority access to preferential interest rate programs, all aimed at optimizing capital and sustainably supporting business operations.

Beyond credit, SeABank provides non-credit financial benefits to help FDI enterprises minimize costs, manage cash flow effectively, and meet specific daily needs. These include waived domestic payment and payroll services, streamlined capital account opening, and discounted beautiful account number fees. FDI enterprises also benefit from SeABank’s modern corporate e-banking systems, such as SeANet/SeAMobile Biz, SMS Banking, and Email Banking, ensuring secure, transparent, and convenient transactions without registration or usage fees.

Furthermore, SeABank issues corporate debit/credit cards with waived issuance and annual fees for up to five years. The bank also offers attractive services, including up to 100% waived international money transfer fees for both outgoing and incoming transactions, and up to 50% reductions on trade finance and guarantee fees.

Notably, SeABank’s competitive deposit interest rates help enterprises optimize idle capital, enhancing their advantage in a volatile global economy.

SeABank delivers tailored financial solutions and optimized services for effective FDI cash flow management

By harmoniously combining credit and non-credit policies, SeABank creates a comprehensive and specialized financial ecosystem that fully meets FDI enterprise needs. This foundation positions the bank as a trusted partner for FDI enterprises, optimizing financial management to empower their growth. SeABank’s efforts also enhance Vietnam’s investment environment, driving economic development.

Expanding Connections, Sustaining Partnerships with FDI Enterprises

Beyond financial solutions, SeABank continuously supports FDI enterprises through non-financial programs.

A standout initiative is the Affiliate Program, designed to expand the FDI customer network. With transparent commission policies, affiliates can earn up to 15 million VND per successful customer introduction (unlimited). Affiliates maintaining at least three FDI customers monthly for three consecutive months receive an additional 5 million VND loyalty bonus (evaluated every three months). This flexible approach benefits both SeABank’s network expansion and its partners.

The Affiliate Program offers attractive rewards for FDI customer referrals

The consistent growth of FDI underscores Vietnam’s appeal as a strategic investment destination. As a capital conduit, SeABank continuously builds a comprehensive financial ecosystem with flexible, specialized solutions, complemented by non-financial support to help FDI enterprises operate efficiently, integrate, and grow sustainably. By combining macroeconomic advantages with preferential policies and services, SeABank has become a trusted FDI partner, solidifying its market position and contributing significantly to Vietnam’s global investment standing.

Crypto Market Trial: What Concerns Investors When Switching Exchanges?

Unlocking the complexities of cryptocurrency repatriation, our experts dissect the pressing concerns that leave investors uneasy about transferring digital assets from abroad to Vietnam. With a keen eye for detail, we navigate the intricate landscape, offering clarity and confidence in every step of the process.

Vietnamese Consumers Spend Trillions of Dong on iPhone 17 Purchases

On the first day of the official launch of the iPhone 17 and iPhone Air in Vietnam, the mobile device market witnessed a record-breaking number of pre-orders and deliveries.