Over the years, Vietnam’s retail and service market has witnessed numerous ambitious “big chain dreams,” aiming to establish hundreds, even thousands of stores nationwide to compete with industry giants. However, the reality of implementation has proven far from straightforward.

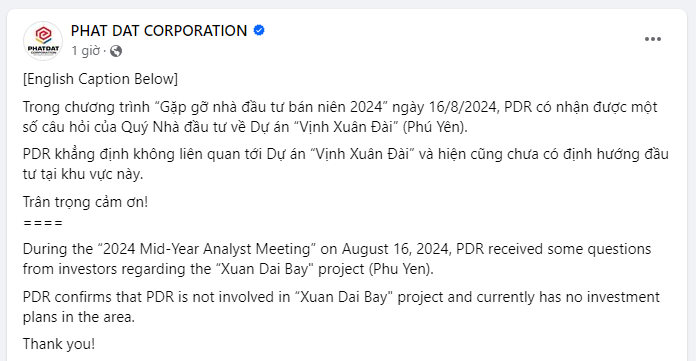

Phượng Hoàng Pharmacy Once “Declared War” on Long Châu

Phượng Hoàng Pharmacy made a grand entrance in 2024, aiming to create a “new game” in the pharmaceutical retail market.

However, it took nearly a year for the chain to launch its e-commerce website and open its fourth physical store. The initial move to place the first store directly opposite Long Châu was seen as a bold declaration of competition, but it now contrasts sharply with the slow rollout.

At the top level, the company has seen frequent changes in key personnel: since April 21, 2025, the role of Director and Legal Representative has shifted from Ms. Cao Mai Ngọc Anh (born 1990) to Ms. Phạm Thị Thanh Hoài (born 1987). The capital structure has also undergone significant changes.

Established on May 2, 2024, with a registered capital of 25 billion VND, where Ms. Ngọc Anh held 91.79%, Ms. Vũ Lê Kim Ngân 8.2%, and Mr. Nguyễn Khánh Hoàng 0.01%, the capital was reduced to 10 billion VND just four months later. Post-adjustment, Ms. Ngọc Anh increased her ownership to 97.49%, while Ms. Kim Ngân’s share dropped to 2.5%.

Another notable point is the involvement of Mr. Chris Blank, founder and former CEO of Pharmacity, as the chain’s communications leader, though he is not listed in the business registration documents.

Vietnam Post Launches a Chain of General Stores

In December 2024, Vietnam Post (Vietnam Post Corporation) set a goal to open nearly 1,000 Post Office General Stores. This is part of a plan to develop new business spaces, diversify retail activities, and leverage the existing post office network, combining consumer goods retail in a multi-service model.

Beyond the number of stores, the long-term goal is to make the “Post Office General Store” chain and its e-commerce platform one of the top 3 largest retail systems in Vietnam by 2030.

By mid-2025, Vietnam Post had opened three additional “Post Office General Stores” in Ho Chi Minh City (on June 28-29, 2025), in addition to previously piloted stores.

In 2025, the plan is to expand to approximately 300 stores across 26 provinces and cities nationwide.

In reality, the new stores are still being rolled out on a small scale, with product variety and brands not yet meeting customer expectations; the model remains in the testing phase at many locations.

KIDO Launches Chuk Chuk F&B Franchise Chain

Launched in June 2021, KIDO set a goal to establish a Chuk Chuk F&B franchise chain with 1,000 stores nationwide by 2025, targeting an annual revenue of around 7,800 billion VND.

The company aimed to have 50-58 stores in Ho Chi Minh City by the end of 2021, along with kiosk and cart models, followed by expansion to Hanoi and northern provinces. Development formats included large outlets, kiosks, carts, franchising, nationwide coverage, and international expansion.

By around May 2022, Chuk Chuk had 35-36 stores in Ho Chi Minh City, with some stores opened in Hanoi, Dong Nai, Binh Duong, and Vung Tau. The total number of stores did not grow as quickly as expected, remaining between 50-60 stores from 2022 to 2023.

In July 2022, KIDO “divested” from TTV Trading Investment Joint Stock Company, the operator of the Chuk Chuk chain. The brand was also renamed from Chuk Chuk Ice Cream – Coffee – Tea to Chuk Coffee & Tea/Chuk Tea & Coffee.

Nova Market / Nova Commerce Launches Mini Supermarket Chain

Nova Market has very ambitious plans, backed by the NovaGroup ecosystem. Nova Market launched its first three stores in Ho Chi Minh City in March 2022, with a goal to open 300 Nova Market outlets in 2022. By 2025, the target is to develop over 2,000 outlets.

Nova Market is a mini supermarket/convenience store chain focusing on fresh food, frozen food, beverages, canned goods, nutritional products, and convenience items like fast food, boxed meals, desserts, and bottled drinks.

Nova Market plans to expand not only in Ho Chi Minh City but also to provinces and NovaGroup urban projects such as Aqua City, Nova Phan Thiet, Nova Ho Tram, NovaWorld Mui Ne, and NovaWorld Da Lat.

By mid-2022, Nova Market had only 12 stores in locations like Ho Chi Minh City, Binh Thuan, and Vung Tau. By August 2022, there were 30 stores. Since then, no official information has been released about new store openings.

From Presumptive to Declaration: What Do Business Households Need to Prepare?

“VPBank, in collaboration with the Vietnam Tax Consulting Association (VTCA) and MISA Joint Stock Company, hosted a workshop titled “Transitioning from Tax Registration to Tax Declaration: What Do Business Households Need to Prepare?”. The event was graced by the presence of tax authorities, finance and accounting experts, media representatives, and nearly 5,000 business households who joined online.”

Profitable Growth Strategy: Masan’s Long-Term Play

July 2025 marked a positive step forward for Masan as its retail arm, WinCommerce, continued its strong growth trajectory, reinforcing expectations for a robust second half of the year.

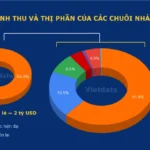

The Ultimate Recession-Proof Industry: A $70 Billion Behemoth, with Retail Giants Scrambling to Open Stores in Rural and Urban Areas Alike

The pharmaceutical retail market is often deemed “recession-proof”, owing to the consistent demand for pharmaceuticals, which remains imperative despite macroeconomic fluctuations. In the context of Vietnam, with its aging population and growing middle class, the demand for healthcare, and by extension, the pharmaceutical industry, is experiencing unwavering growth, as highlighted by Vietdata, a prominent provider of reports on the Vietnamese economy.