Mixed Movements in Digital Currencies

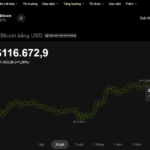

On the morning of September 19th, the cryptocurrency market opened with mixed movements among major coins. According to data from the OKX exchange at 7:30 AM, Bitcoin (BTC) remained the focal point, rising nearly 1% over the past 24 hours and trading above $117,300. Analysts consider this level crucial, as many predict a 70% chance of BTC setting a new peak within the next two weeks.

Among altcoins, the trend was clearly divided. Ethereum (ETH) dipped slightly by 0.02%, falling below $4,600, while BNB lost nearly 0.5%, settling at $982. In contrast, Solana (SOL) gained over 1% to reach $248, and XRP inched up 0.05%, staying above $3. The tug-of-war between major coins indicates that market funds are being selectively allocated rather than pouring into a single channel.

According to CoinTelegraph, Axel Adler Jr., a cryptocurrency researcher, noted that the market is currently in a balanced state, neither overheating nor experiencing a sell-off wave.

This equilibrium is seen as a favorable foundation for Bitcoin’s potential breakout after a brief sideways phase, as investor sentiment remains stable and awaits clearer trend signals.

Adler also emphasized that October often brings positive developments for Bitcoin.

Bitcoin trading above $117,300. Source: OKX

How High Will Bitcoin Go as the Market “Heats Up” Again?

Institutional investor capital is providing strong support for Bitcoin. In less than two weeks, U.S. Bitcoin ETFs have attracted $2.8 billion, signaling a resurgence of confidence in the market.

Despite pressure from the U.S. Federal Reserve’s interest rate policies, Bitcoin has risen over 8% in September, from around $107,000 to nearly $118,000. This has sparked expectations of further breakthroughs.

Some experts caution that prices may adjust to the $113,000–$114,000 range before resuming an upward trend. This is considered a critical support zone to test market resilience. If Bitcoin holds above $117,500, a deep correction is unlikely, and a move toward $124,000 becomes possible.

Seasonal factors are also highlighted as supportive signals. As demand increases at specific times of the year, combined with ETF inflows and a more positive market sentiment, Bitcoin could capitalize on the opportunity to break out after its sideways movement.

However, challenges remain. Sustaining key price levels depends on technical factors, Fed policy moves, and external risks such as global economic fluctuations. Negative news on inflation or tighter monetary policies could still pressure Bitcoin downward.

Crypto Market Trial: What Concerns Investors When Switching Exchanges?

Unlocking the complexities of cryptocurrency repatriation, our experts dissect the pressing concerns that leave investors uneasy about transferring digital assets from abroad to Vietnam. With a keen eye for detail, we navigate the intricate landscape, offering clarity and confidence in every step of the process.

Bitcoin and a Wave of Cryptocurrencies Surge Ahead of a Major Event

As Bitcoin and numerous altcoins experience a surge in value, global investors are turning their attention to the Federal Reserve’s monetary policy meeting, a pivotal event that could shape the future of the cryptocurrency market.