At the Shareholder’s Day 2025 event held on September 20th, a shareholder posed a question to Coteccons’ leadership: “When will we clearly see the global path Coteccons has long spoken of? And is this why Coteccons’ stock has never surged?”

In response, Bolat Duisenov, Chairman of Coteccons’ Board of Directors, emphasized that the company’s global expansion is not a new initiative. In fact, Coteccons has successfully executed and delivered several international projects.

“For instance, in Taiwan, Coteccons became the first Vietnamese construction company to receive a local operating license. The legal preparation and risk assessment process alone took 15 months. Both parties were initially unfamiliar with each other’s processes, but we successfully completed the formalities and launched the project,” Mr. Bolat stated.

According to the Chairman, establishing a global presence requires meticulous preparation, including legal compliance, certifications, and risk management. The company aims to build a sustainable foothold in new markets, rather than focusing on isolated projects.

“We have a clear roadmap and several projects in the pipeline. Once officially signed, they will become part of our backlog and contribute to Coteccons’ future revenue and profitability. However, some details cannot be disclosed yet, as the Vietnamese proverb says, ‘Speaking too soon may lead to failure,’” he added.

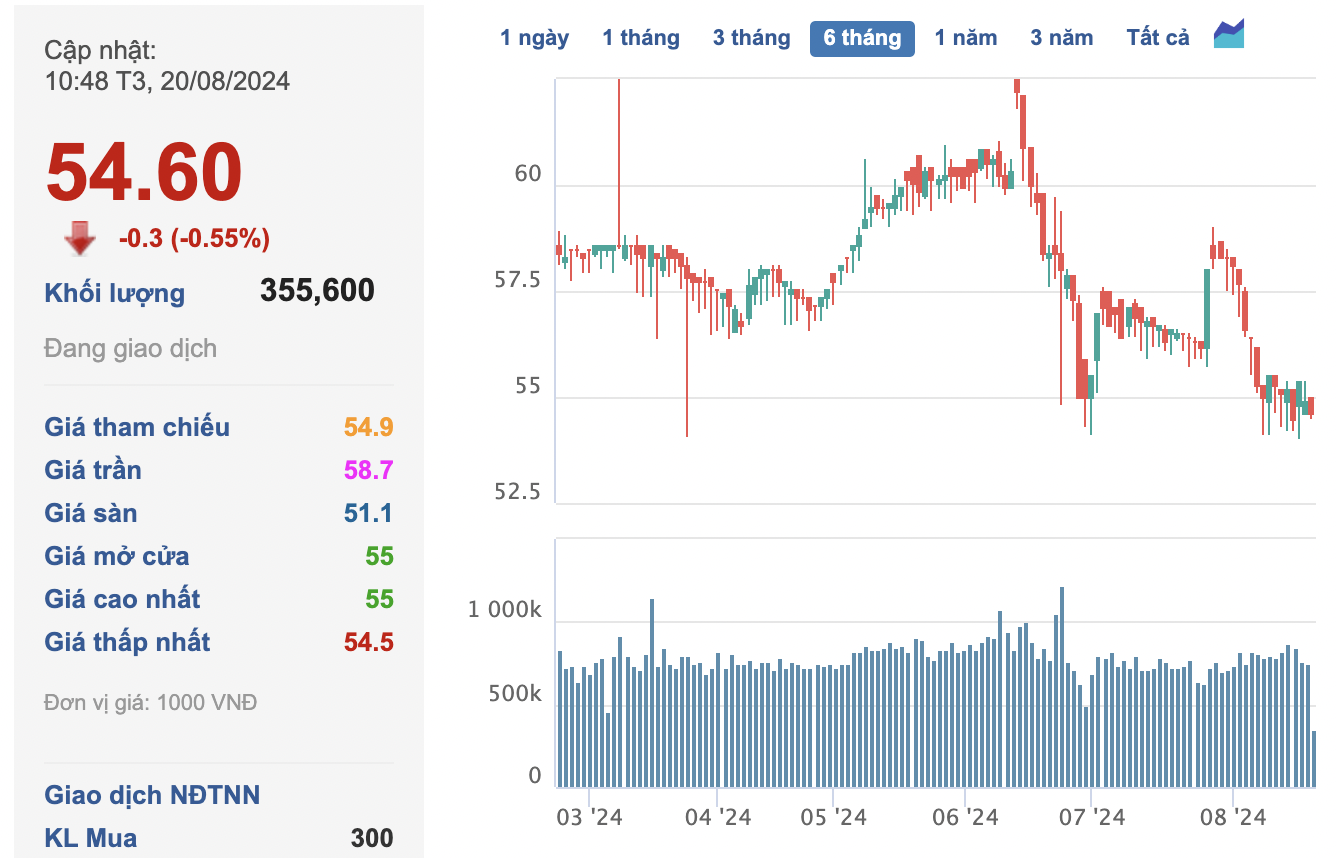

Regarding stock performance, Mr. Bolat asserted: “I believe Coteccons’ stock is currently at a healthy and stable level. Our responsibility is to consistently deliver positive business results to ensure sustainable stock growth. As Warren Buffett once said, buying stock is not just purchasing a piece of paper, but owning a part of the business. Long-term investors focus on Coteccons’ foundation and long-term prospects, not short-term fluctuations.”

The Chairman further emphasized: “We are confident that with our current foundation, Coteccons will continue to grow and deliver real value to shareholders.”

The Emerald 68: Future Residents Experience the Project’s Quality Firsthand

With the strategic partnership between the dynamic duo of developers, Lê Phong and Coteccons, The Emerald 68 has swiftly emerged as the focal point of Northeast Ho Chi Minh City. This exceptional project seamlessly combines a prime location, transparent legal framework, superior quality, and an unparalleled price point, setting a new benchmark in the region.

Market Pulse 19/09: Strong Divergence Persists as Foreign Investors Ramp Up Net Selling of VHM

At the close of trading, the VN-Index fell by 6.56 points (-0.39%), settling at 1,658.62 points, while the HNX-Index dropped by 0.68 points (-0.25%), closing at 276.24 points. Market breadth tilted toward the downside, with 434 decliners outpacing 323 advancers. Similarly, the VN30 basket saw red dominate, as 24 stocks declined, 4 advanced, and 2 remained unchanged.

“VinFast’s Speedy Success: Coteccons Delivers 12,000 sq. ft. Factory in Just 14 Days”

Coteccons, Vietnam’s leading construction contractor, celebrated its 21st anniversary with a grand gala event, themed “Coteccons 20+1: Leading through Service.” This special occasion, dubbed Coteccons Day, marked a significant milestone in the company’s journey, highlighting its commitment to excellence and leadership in the industry.

The Ultimate Guide to Investing: Unlocking the Secrets to Financial Freedom

“Former Chairwoman of the Board of Directors of Hong Ha Food Industry Corporation (HOSE: HSL), Ms. Nguyen Thi Tuyet Nhung, has completely divested her 12.44% stake in the company, officially exiting the shareholder registry. This development comes amidst a surge in HSL’s stock price, which has climbed to historic highs, witnessing a remarkable increase of over 275% in just three months.”