Legalization for Management

The government has recently issued Resolution 05, allowing a 5-year pilot program for the cryptocurrency market. According to Michael Kokalari, Director of Macroeconomic Analysis and Market Research at VinaCapital, this move signifies the government’s acceptance of digital assets after prolonged consideration, as these assets become increasingly familiar to the public.

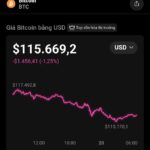

VinaCapital’s analysis reveals that 17 million Vietnamese have engaged in cryptocurrency transactions, with an estimated annual trading volume exceeding $100 billion. The majority of these activities occur on foreign exchanges such as Binance, Bybit, and platforms based in Singapore, South Korea, and Hong Kong.

Currently, 17 million Vietnamese are involved in cryptocurrency trading, with an annual transaction value surpassing $100 billion.

Michael Kokalari notes that the government aims to transition Vietnam’s cryptocurrency activities from a large-scale, informal market dependent on foreign channels to a formal, regulated market. This shift will enable tax management and integration into the domestic financial system.

In July, the National Assembly passed the Digital Technology Industry Law, officially recognizing digital assets and mandating that cryptocurrency platforms obtain domestic licenses. These platforms must also provide direct VND trading gateways by January 1, 2026. Additionally, the government launched NDAChain, Vietnam’s national blockchain platform, facilitating secure financial transactions and online purchases.

“Broadly, the government is focusing on three key objectives: legalizing and taxing cryptocurrency transactions, integrating digital assets into the domestic financial system, and enhancing investor protection and market oversight,” stated Michael Kokalari.

A Promising Market

VinaCapital’s expert believes that, as a new field, learning from other nations’ experiences in integrating digital assets into financial systems will be crucial for shaping Vietnam’s future trajectory.

For instance, since 2021, South Korea has implemented policies such as linking bank accounts to real names, tightly controlling risks, and severely penalizing market manipulation. As a result, trading activities are concentrated on five fully compliant exchanges, which apply various tax structures.

Conversely, other regional countries face risks from a prior open approach followed by tightening regulations. In June 2025, Singapore mandated unlicensed digital asset exchanges to cease operations, while Thailand blocked major foreign platforms. These actions demonstrate that even the region’s most open markets will tighten controls when risks escalate.

Vietnam is promptly launching pilot exchanges to establish a clear regulatory framework before full implementation.

“Therefore, Vietnam is swiftly launching pilot exchanges to establish a clear regulatory framework before full implementation. Under Resolution 05, exchanges must obtain domestic licenses, facilitate VND-based cryptocurrency trading, and maintain a minimum charter capital of 10 trillion VND. Transaction fees remain undetermined but will initially align with stock market fees, approximately 0.15%,” explained Michael Kokalari.

Beyond government initiatives and pilot programs, the private sector is also emerging in the digital asset market. Notably, MB Bank has partnered with South Korea’s Dunamu, operator of Upbit, to develop one of Vietnam’s first regulated platforms adhering to international safety standards.

Tether has engaged in discussions about piloting limited USDT transactions in Da Nang, while Chainalysis has proposed providing blockchain monitoring tools to support Vietnam’s new compliance infrastructure.

“Three key factors underpin the prospects of digital assets in Vietnam: a vibrant market with active retail investor participation, one of Asia’s fastest-growing economies, and a government committed to framing cryptocurrency activities within a structured environment,” concluded Michael Kokalari.

Blockchain Businesses Unrestricted: No Legal Bans Confirmed, Says Attorney Phan Vu Tuan

Blockchain experts view the recent cautious response from businesses as a positive sign of their willingness to adapt to new regulations. However, timely communication and clear guidance from regulatory bodies are essential to ensure a smooth transition.