Despite positive macroeconomic signals such as the U.S. Federal Reserve’s interest rate cut and the anticipated upgrade of Vietnam’s stock market, today’s market dynamics (September 19) reveal a prevailing cautious sentiment and selling pressure.

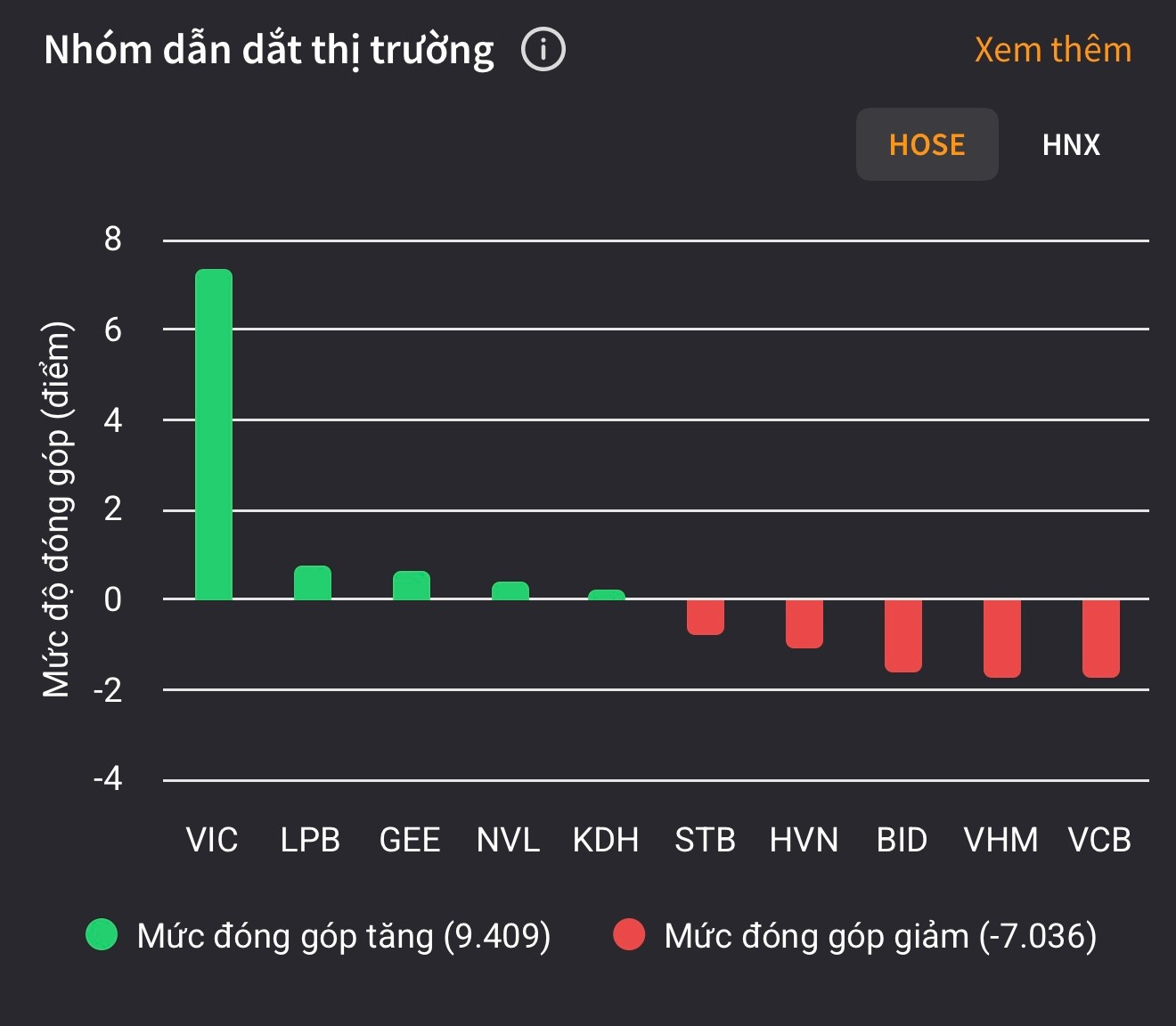

VIC defies market trends, contributing over 7 points.

A rare highlight was VIC stock, surging 5.66% and becoming the largest pillar, adding nearly 7 points to the VN-Index. However, VIC’s solo rally wasn’t enough to counterbalance the heavy selling pressure in large-cap stocks, particularly in the banking sector. Numerous banking stocks plunged into the red: STB (-3.16%), BID (-2.45%), EIB (-2.06%), VCB (-1.41%), VPB, and HDB also shedding over 1%. The banking sector was the primary drag on the index.

Alongside banks, securities firms also faced selling pressure. VIX dropped nearly 5%, VND lost 2.78%, and SSI declined 1.1%, while most other sector peers adjusted downward. MBS and SBS maintained slight gains but failed to make a significant impact.

In contrast, the real estate sector showed strong polarization. Some stocks attracted positive inflows and performed well: NVL (+5.63%), CEO (+3.38%), CII (+2.18%), SCR (+2.08%). Meanwhile, blue-chip peers like VHM (-1.74%), VRE (-2.48%), and KBC (-1.63%) continued to weaken. This divergence indicates selective capital flow rather than sector-wide momentum.

Total market liquidity exceeded VND 30,873 billion, up nearly 5% from the previous session, primarily driven by late-session trades likely tied to ETF portfolio rebalancing. Both the STOXX Vietnam Total Market Liquid Index and MarketVector Vietnam Local Index announced new portfolio adjustments, effective September 22, with changes implemented this week.

At the close, the VN-Index fell 6.56 points (-0.39%) to 1,658.62. The HNX-Index dipped 0.25% to 276.24, while the UPCoM-Index edged down 0.08% to 111.01. Total market liquidity surpassed VND 30,873 billion.

Why Becamex IDC Shareholders Rejected the Largest Stock Deal in History

With a mere 2.85% of total shares voting in favor, Becamex IDC’s proposal to publicly offer 150 million BCM shares has been rejected. A staggering 95.44% of eligible voting shares abstained, effectively blocking the approval of the public offering plan.

Foreign Block’s Sudden Net Sell-Off Surges Past 3,000 Billion VND in ETF Rebalancing Session: What’s Driving the Sell-Off?

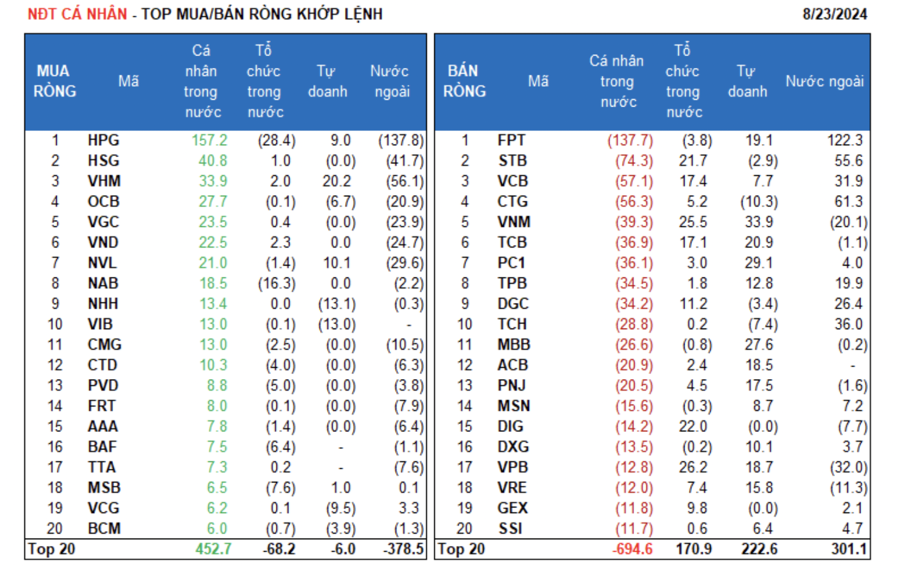

In the afternoon session, FPT emerged as the most heavily bought stock across the entire market, recording a net purchase value of 314 billion VND.