The stock market opened the final session of the week on September 19th with gains, but quickly lost momentum and entered a volatile trading range. This session also marked the portfolio rebalancing of foreign ETFs. By the close, the VN-Index fell 6.56 points, or 0.39%, to end at 1,658.62. Foreign investors continued their heavy net selling streak, offloading a staggering 3,029 billion VND across the market.

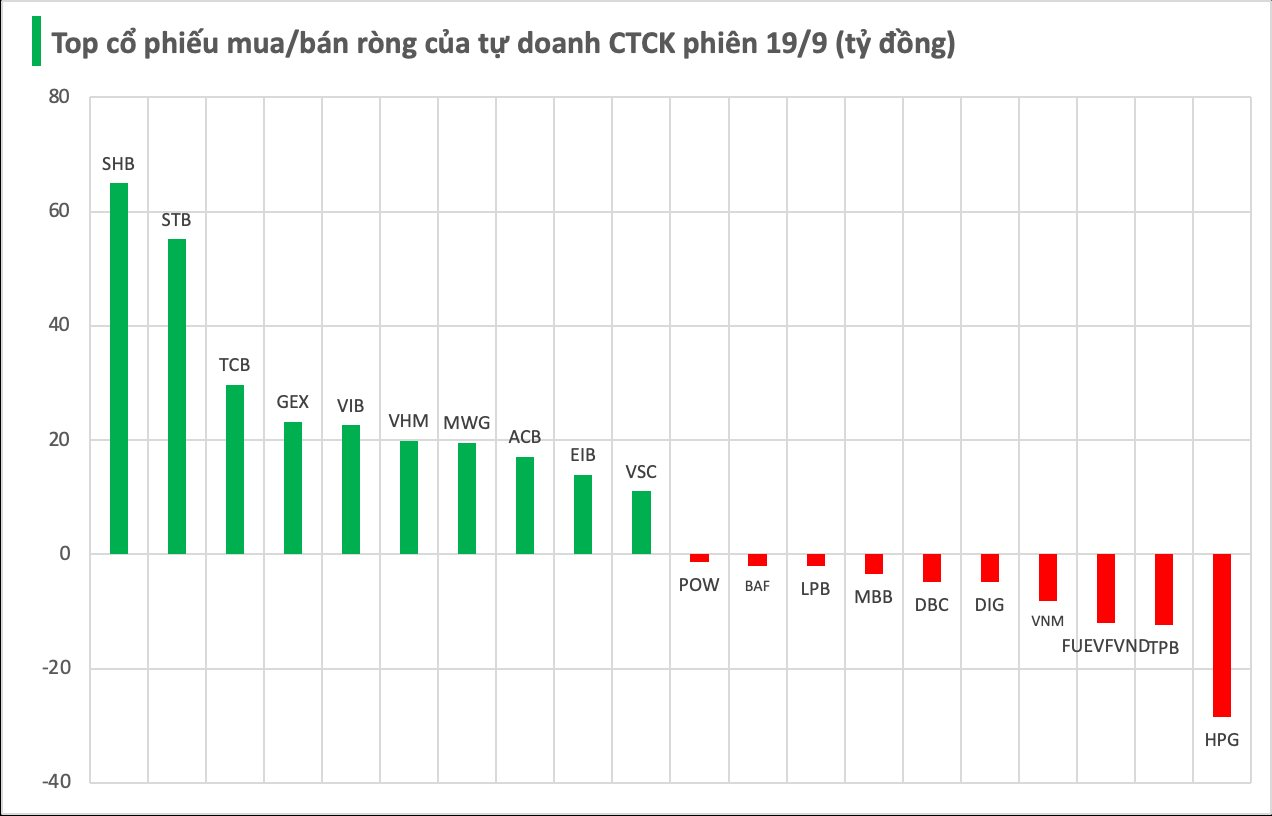

Securities firms’ proprietary trading desks recorded a net buy of 279 billion VND on the Ho Chi Minh City Stock Exchange (HOSE).

Specifically, SHB shares saw net buying of 65 billion VND. STB ranked second on the proprietary trading desks’ net buying list with 55 billion VND, followed by TCB (30 billion), GEX (23 billion), VIB (23 billion), VHM (20 billion), MWG (20 billion), ACB (17 billion), EIB (14 billion), and VSC (11 billion VND).

Conversely, securities firms were net sellers of HPG, with a value of -28 billion VND, followed by TPB (-12 billion), FUEVFVNĐ (-12 billion), VNM (-8 billion), and DIG (-5 billion VND). Other stocks experiencing notable net selling included DBC (-5 billion), MBB (-4 billion), LPB (-2 billion), BAF (-2 billion), and POW (-1 billion VND).

Foreign Investors’ Heaviest Net Selling Week in 2025: Warrants Market Overview for September 22-26, 2025

As the trading session closed on September 19, 2025, the market witnessed 73 stocks advancing, 150 declining, and 24 remaining unchanged. Foreign investors continued their net selling streak, offloading a total of 5.18 million CW.

Unleashing the IPO Boom: A Resurgence After Years of Silence

Vietnam’s stock market is poised to welcome a massive IPO wave, with an estimated value of up to $47 billion over the next three years.