Recently, Binh Son Refining and Petrochemical Joint Stock Company (Stock Code: BSR, HoSE) issued an official announcement regarding the receipt of an administrative penalty decision for tax violations from the Large Enterprise Tax Department.

According to the announcement, Binh Son Refining and Petrochemical committed an administrative violation by incorrectly declaring the tax base, resulting in underpaid taxes. However, all economic transactions were accurately recorded in the accounting system, invoices, and legal documents.

For this violation, Binh Son Refining and Petrochemical was fined over 672.8 million VND. Additionally, the company is required to rectify the situation by paying nearly 288.7 million VND in late tax payments.

Illustrative image

In total, Binh Son Refining and Petrochemical must pay approximately 961.5 million VND in administrative fines and late tax payments to the state budget.

In other developments, Binh Son Refining and Petrochemical recently published the first written shareholder consultation document for 2025.

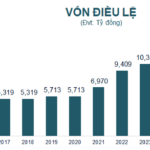

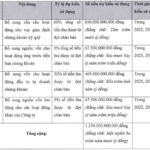

The company plans to propose a capital increase to shareholders in 2025 by issuing over 1.9 billion shares as dividends and bonuses to shareholders.

Specifically, the company will issue more than 930.1 million shares as dividends at a 30% rights ratio, meaning shareholders holding 100 shares will receive 30 new shares.

The total issuance value, based on par value, is nearly 9,301.5 billion VND, sourced from undistributed after-tax profits in the audited 2024 Consolidated Financial Statements (after provisioning for funds as per the 2024 profit distribution plan approved by the 2025 Annual General Meeting of Shareholders).

Simultaneously, the company will issue nearly 976.7 million shares at a 31.5% rights ratio, meaning shareholders holding 100 shares will receive 31.5 new shares.

The total issuance value, based on par value, is nearly 9,766.6 billion VND, sourced from the development investment fund in the audited 2024 Financial Statements of Binh Son Refining and Petrochemical’s parent company.

These issuance plans are expected to be implemented in the third and fourth quarters of 2025, following the State Securities Commission’s (SSC) confirmation of receiving complete reporting documents for the share issuance to increase equity capital from owner’s equity.

Upon completion of the issuances, Binh Son Refining and Petrochemical’s chartered capital will increase from nearly 31,005 billion VND to over 50,073 billion VND.

The company aims to increase its chartered capital to secure owner’s equity for the Dung Quat Refinery Upgrade and Expansion Project.

Additionally, during this shareholder consultation, Binh Son Refining and Petrochemical seeks to rename itself to Vietnam Petroleum Refining Corporation.

Shareholders of Binh Son Refining and Petrochemical listed in the register as of August 28, 2025, will vote on the above proposals and submit their opinions to the company by 2 PM on September 30, 2025.

ABBank Plans to Boost Chartered Capital to Nearly VND 14 Trillion

On September 16th, An Binh Commercial Joint Stock Bank (ABBank, UPCoM: ABB) announced a resolution passed by its Annual General Meeting of Shareholders to increase its chartered capital from VND 10,350 billion to nearly VND 13,973 billion, representing a 35% increase.

State Shareholders Remain Silent, Becamex IDC’s (BCM) Share Offering Fizzles Out

Becamex IDC plans to offer 150 million shares to the public via an open auction, with a starting price of no less than VND 50,000 per share, as outlined in the proposal to shareholders.