I. MARKET TRENDS IN WARRANTS

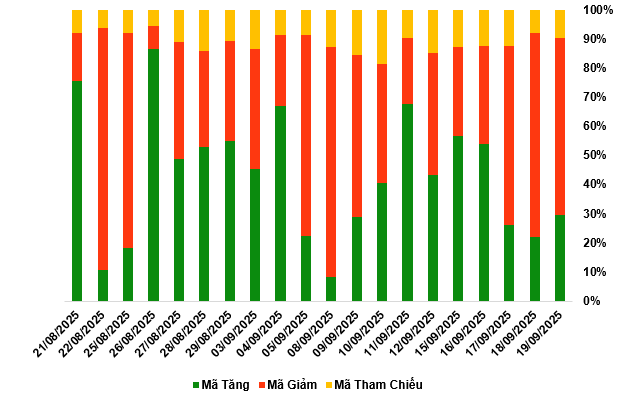

By the close of trading on September 19, 2025, the market recorded 73 gainers, 150 decliners, and 24 unchanged securities.

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

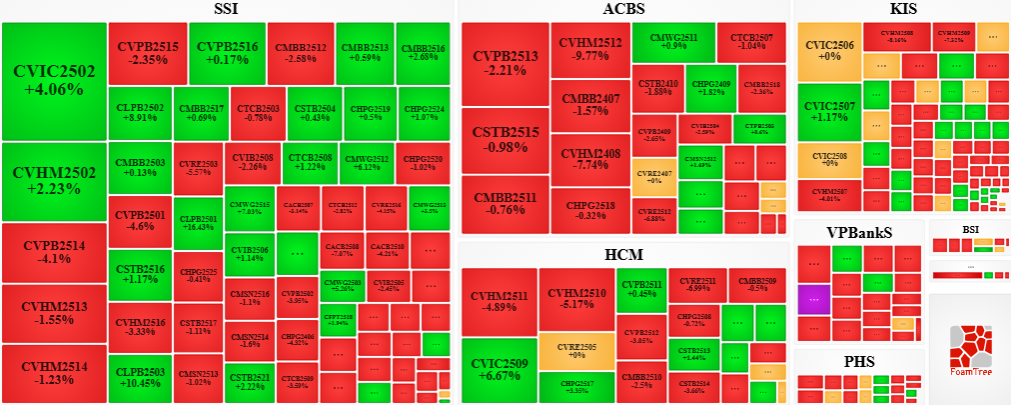

During the September 19, 2025 session, selling pressure dominated the market, leading to price declines in most warrant codes. Notably, the major warrant codes in the declining group were CVPB2513, CSTB2515, CVHM2513, and CMBB2511.

Source: VietstockFinance

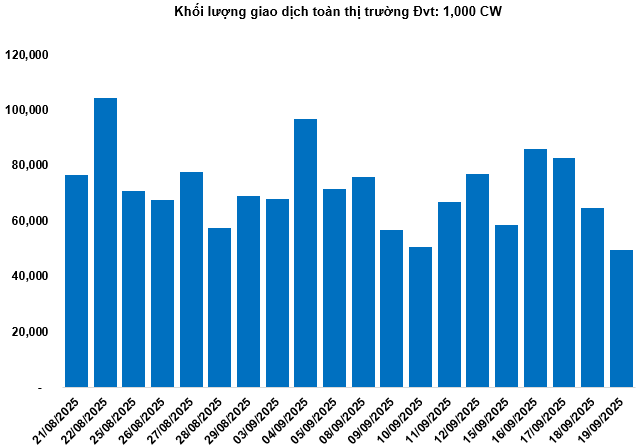

Total market volume on September 19 reached 49.37 million CW, down 23.79%; trading value hit 123.67 billion VND, a 25.51% decrease compared to September 18. Among these, CTPB2502 led the market in both volume and value, with a total volume of 2.12 million CW, equivalent to 7.16 billion VND.

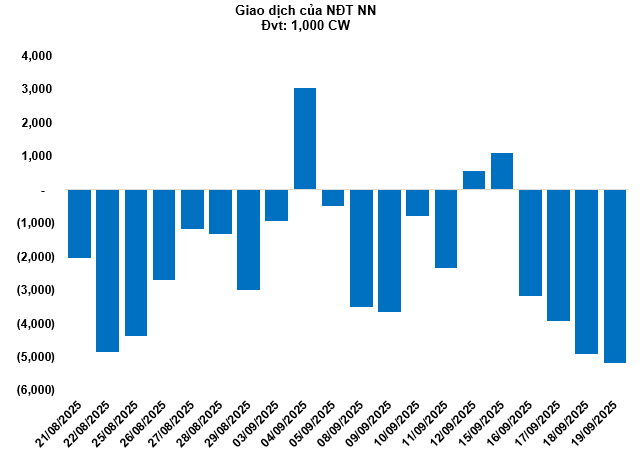

Foreign investors continued net selling on September 19, with a total net sell of 5.18 million CW. CMSN2517 and CHPG2526 were the most heavily net-sold codes. For the week, foreign investors net-sold over 16.08 million CW.

Securities firms SSI, ACBS, KIS, HCM, and VPBankS are currently the issuers with the most warrant codes in the market.

Source: VietstockFinance

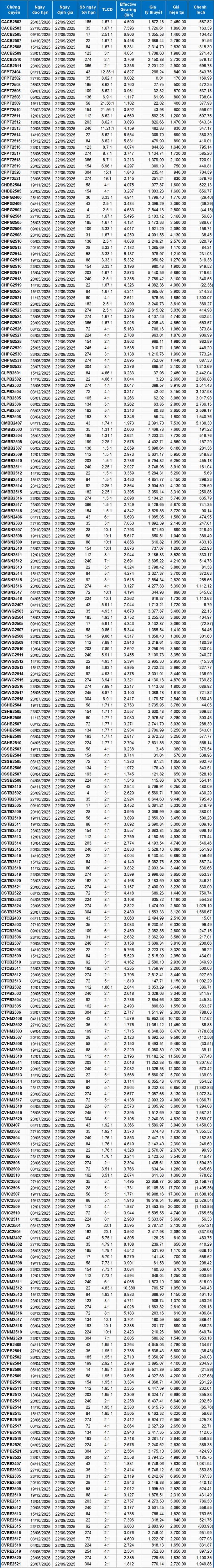

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

Based on the valuation method appropriate as of the starting date of September 22, 2025, the fair prices of warrants currently trading in the market are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model have been adjusted to suit the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with maturity adjustments for each warrant type.

According to the above valuation, CVHM2515 and CVHM2508 are currently the two most attractively priced warrant codes.

Warrant codes with higher effective gearing will experience greater volatility in response to underlying securities. Currently, CVNM2512 and CVNM2502 are the two warrant codes with the highest effective gearing in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 17:58 September 21, 2025

Why Becamex IDC Shareholders Rejected the Largest Stock Deal in History

With a mere 2.85% of total shares voting in favor, Becamex IDC’s proposal to publicly offer 150 million BCM shares has been rejected. A staggering 95.44% of eligible voting shares abstained, effectively blocking the approval of the public offering plan.

Dragon Capital Group Trims Stake as MWG Shares Hit Record High

Dragon Capital’s September 16th report reveals a significant shift in its investment strategy. The group’s funds have collectively divested from Mobile World Investment Corporation (HOSE: MWG), resulting in the group no longer holding a substantial stake in the company.

Stock Market Week 15-19/09/2025: Cautious Tug-of-War

The VN-Index closed the week in the red, marking four consecutive sessions of decline. Cautious sentiment persists as trading volumes remain below the 20-day average. Amid weak liquidity and persistent net selling pressure from foreign investors, the market awaits a stronger catalyst to break free from its current stalemate.