As of the afternoon of September 20, the SJC gold bar price was listed by businesses at VND 131 million per tael for buying and VND 133 million per tael for selling, remaining stable compared to the morning.

The prices of gold rings and 99.99% gold jewelry also remained unchanged, with buying at VND 126.8 million per tael and selling at VND 129.5 million per tael.

According to experts, domestic gold market investors are still awaiting the impact of new regulatory policies, including the elimination of the SJC gold bar monopoly, the establishment of a national gold trading platform, and the introduction of gold taxation. If implemented, these measures could narrow the price gap between domestic and international gold prices.

Notably, the imposition of personal income tax on gold transactions could significantly impact the price of this precious metal in Vietnam.

Financial expert Phan Dũng Khánh believes that taxing income from gold trading will not only curb speculation and short-term trading but also increase government revenue.

He emphasizes that when formulating policies, it is crucial to clarify whether the tax applies to individuals, businesses, or both, to avoid “double taxation” and potential tax evasion loopholes.

Many economists argue that taxing gold transactions aligns with market trends.

Regarding taxation methods, Mr. Khánh suggests adopting a similar approach to the stock market, with a 0.1% tax on selling transactions. Buyers would not be taxed until they sell, preventing double taxation.

Historically, the stock market considered a 20% tax on profits, but this proved complex due to the need to prove profit from purchase to sale.

“Taxing based on transaction volume, such as only taxing sales of 1 tael or more, could lead to tax evasion through smaller transactions or split invoices. A moderate tax rate would be easier to control and fairer for all transactions,” Mr. Khánh commented.

Gold Taxation Aligns with Global Trends

Associate Professor Dr. Nguyễn Hữu Huân from the University of Economics Ho Chi Minh City analyzes: Currently, real estate and securities are already taxed, while gold is also an investment channel with profit potential. Therefore, taxing gold profits is appropriate.

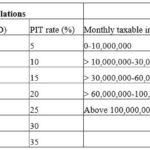

Under current regulations, individuals transferring real estate must pay a 2% tax on the transaction value, and securities are taxed at 0.1% of the transfer price per transaction. Gold taxation could follow a similar model to real estate and securities.

“Taxing gold based on profit is challenging. Many gold purchases made 10-20 years ago lack documentation, making it difficult to determine purchase prices and calculate profits. When taxing gold, we should reference tax rates in other countries as a basis for policy development,” Mr. Huân suggested.

Mr. Huân stresses the need to distinguish between pure gold and gold jewelry. He raises the question: Are gold rings, classified as jewelry, subject to taxation? Are gold purchases for weddings taxable? These issues require clarification before policy implementation.

Additionally, the tax collection process must be clearly defined: Who will collect the tax? Will gold-selling businesses be responsible for collecting and remitting taxes, or will tax authorities handle it directly?

According to Đinh Đức Quang, Director of the Currency Trading Division at UOB Bank Vietnam, gold taxation should be implemented gradually. Typically, before imposing taxes, a transparent and legally sound trading environment must be established. Only when cash flows and transactions are effectively monitored can investors be required to fulfill their tax obligations.

Revised Title:

Amended Personal Income Tax Law: Does It Lack Support Mechanisms for Freelancers?

Taxpayers have expressed concerns regarding the proposed personal income tax (PIT) regulations, highlighting a lack of support mechanisms for freelancers. The current policy on taxing financial investment income remains unclear and lacks legal framework, posing potential risks for citizens. Additionally, the taxation of cryptocurrency assets continues to raise significant uncertainties.

Personal Income Tax on Gold Transactions: Can It Curb Speculation and Narrow Price Gaps?

After a series of price hikes, with a difference of approximately $1,700 per tael since the beginning of the year, gold has emerged as an attractive investment channel, offering lucrative returns. Experts support the proposal to impose personal income tax (PIT) on gold transactions. However, the implementation of this tax should follow a gradual roadmap, distinguishing between investment and accumulation activities to prevent any shock to the public.

Propose Implementing New Family Deduction Rates in 2025 Instead of Delaying Further

A significant number of National Assembly delegations have expressed support for the proposal to implement the new tax deduction rate starting in 2025, rather than delaying it until the following year.

Finance Ministry: Tax Exemption for Public Sector Employees Likely to Spark Backlash

During the consultation process for the draft amendment to the Personal Income Tax Law, the Ministry of Public Security proposed exempting personal income tax on salaries funded by the state budget. However, the Ministry of Finance argued that the regulation should apply uniformly to all individuals whose income reaches the taxable threshold, as any deviation could provoke public backlash.