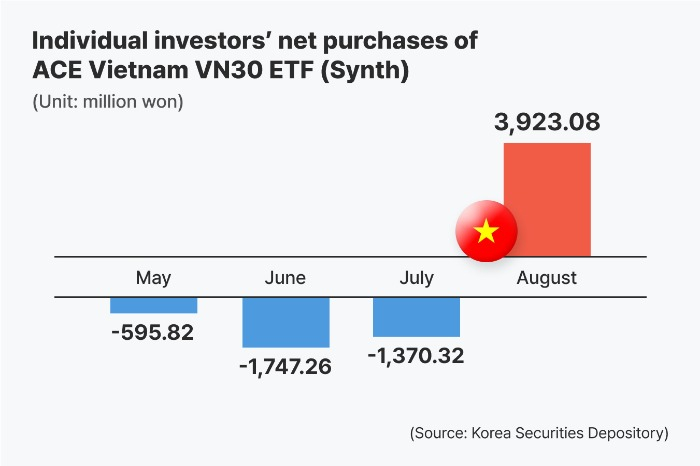

According to data released by the Korea Securities Depository (KSD) as of September 2nd, South Korean investments in Vietnamese stocks surged by 22% since the end of April, reaching $290.3 million. This uptick reflects growing optimism among South Korean investors regarding Vietnam’s economic prospects.

Leading this capital inflow is the ACE Vietnam VN30 (Synth) ETF, the only ETF listed in South Korea tracking Vietnamese equities. In August, the fund attracted approximately KRW 3.9 billion ($2.8 million) from individual investors, marking a significant reversal from the net outflows seen in the previous three months. In the first two days of September alone, an additional KRW 1.4 billion was injected into the ETF, which comprises 30 of Vietnam’s top blue-chip stocks.

Launched in 2016 and managed by Korea Investment Management (KIM), a firm with a Vietnamese branch, the ETF’s net assets reached KRW 302.7 billion ($218 million) by early September.

Delivering impressive performance, the fund ranked 22nd among the best-performing ETFs on the Korea Exchange in August. Its value soared by 15.67% during the month, driven by Vietnam’s VN-Index, which climbed 12% over the same period. This performance stands out in contrast to South Korea’s stock market, which has traded sideways between 3,100 and 3,200 points since July.

Several factors have fueled Vietnamese stocks’ rally. Robust economic growth is a key driver, with Vietnam’s GDP expanding by 7.5% in the first half of the year—the fastest six-month growth rate in 15 years, nearing its 2025 annual target of 8%.

Additionally, Vietnam’s market has been bolstered by government stimulus measures and a significant trade agreement with the U.S., reducing tariffs on Vietnamese exports from 46% to 20%.

Investors are also betting on Vietnam’s potential reclassification from a frontier market to an emerging market by FTSE Russell in its October review, an event that could attract substantial capital inflows.

“Vietnam’s stock market is expected to maintain its upward trajectory until September or October, when the decision on its emerging market status is announced,” noted Kim Geun-ah, an analyst at Hanwha Securities. “However, we should prepare for a correction after such a sharp rally in a short period.”

Thien Van (Source: The Korea Times)

– 10:07 22/09/2025

“Vietnam: Shining Star in the $95 Billion ATP Stage of the Global Semiconductor Supply Chain”

The May 2024 report by the Semiconductor Industry Association (SIA) and BCG projects a significant growth for Vietnam in the Assembly, Testing, and Packaging (ATP) of chips, with its global market share expected to rise from 1% in 2022 to an impressive 8% by 2032.