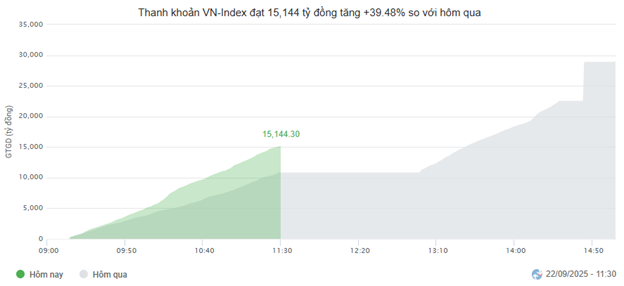

Liquidity is improving but in a negative direction as selling pressure dominates. Trading value on the HOSE reached over 15 trillion VND, a nearly 40% increase compared to the same time in the previous session. Liquidity on the HNX also recorded a 72% increase, with a value of over 1 trillion VND.

Source: VietstockFinance

|

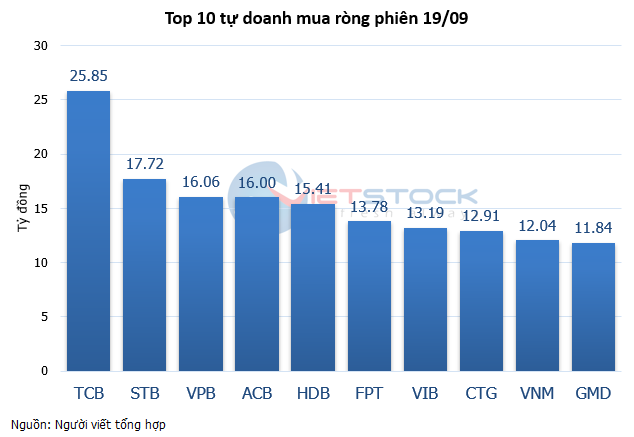

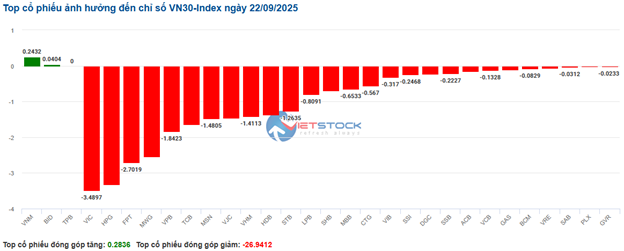

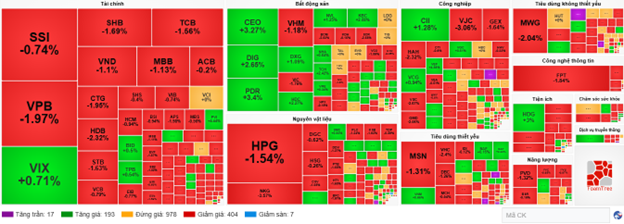

In terms of impact, stocks like VHM, CTG, TCB, VPB, and VIC are putting significant pressure on the overall index, collectively reducing the VN-Index by more than 9 points. Conversely, BID, HVN, and VNM are the few bright spots amidst the widespread decline, but they only managed to lift the index by half a point.

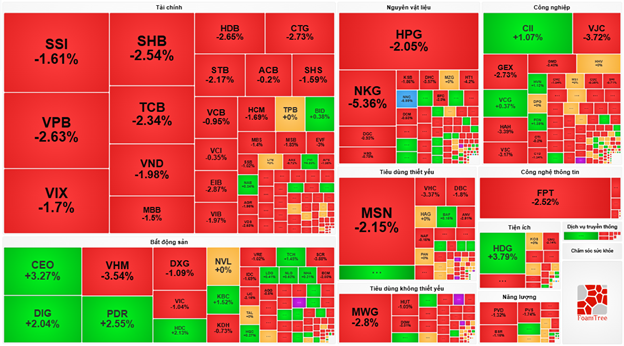

Selling pressure is prevalent across all sectors. The information technology sector is currently experiencing the sharpest decline at 2.46%, primarily influenced by FPT (-2.52%), CMG (-1.96%), ELC (-1.26%), and POT (-4.59%).

Key capitalization sectors such as finance and industry are both down by over 1%. Numerous stocks are seeing declines of more than 2% with notable liquidity, including VPB, SHB, TCB, HDB, CTG; VJC, GEX, VSC, GMD, HAH, and GEE. Meanwhile, the real estate sector has seen a similar decline but with more mixed movements, as positive demand is observed in CEO (+3.27%), DIG (+2.04%), PDR (+2.55%), HDC (+2.13%), and KBC (+1.52%), while VHM, DXG, VRE, IDC, SCR, and IJC are adjusting significantly.

Source: VietstockFinance

|

Foreign investors continue to show no signs of support, maintaining a net sell position of 1.4 trillion VND across all three exchanges. The heaviest selling is seen in VHM (214 billion VND), CTG (146 billion VND), and MWG (128 billion VND). On the buying side, the values are modest, with VND and DIG leading but only netting around 23 billion VND each.

| Top 10 Stocks with Strongest Net Buying and Selling by Foreign Investors |

10:30 AM: Selling Pressure Continues to Intensify

Pessimism is dominating the market, causing all major indices to decline. As of 10:30 AM, the VN-Index fell by 15.21 points, trading around 1,642 points. The HNX-Index decreased by 0.28 points, trading around 275 points.

Stocks in the VN30 basket are facing heavy selling pressure, reducing the overall index by more than 26 points. Notable contributors include VIC, HPG, FPT, and MWG, which have taken away 3.48 points, 3.32 points, 2.7 points, and 2.54 points, respectively. On the buying side, only VNM and BID remain in the green, but their impact is negligible.

Source: VietstockFinance

|

Red is now dominating across all sectors. The financial sector continues to see outflows, with most stocks declining sharply. Specifically, CTG is down 2.15%, TCB by 1.82%, VPB by 2.47%, and MBB by 1.5%…

The real estate sector is also bathed in red, with leading stocks like VIC, VHM, BCM, and KDH all down by over 1%. In contrast, green is only seen in KBC, PDR, DIG, and TCH.

Additionally, the materials sector is not faring well, with selling pressure dominating. Red is prevalent among steel stocks, with HSG down 1.3%, HPG by 2.05%, and NKG by 3.83%. Chemical stocks like GVR, DGC, DCM, and PHR are also seeing slight declines.

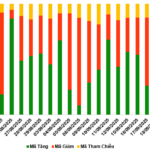

Compared to the opening, sellers continue to dominate. There are 404 declining stocks and 193 advancing stocks.

Source: VietstockFinance

|

Opening: Strong Market Divergence at the Start of the Session

The VN-Index and HNX-Index opened this morning fluctuating around the reference level, indicating lingering caution. However, there are positive contributions from the finance, energy, and essential consumer sectors.

Leading the way is the energy sector, which started with a slight green despite some strong divergence. Green is spreading across stocks like BSR (+1.73%), VTO (+1.27%), and VIP (+1.09%)…

Following closely is the essential consumer sector, with buying concentrated in stocks like MCH (+0.31%), VNM (+0.48%), QNS (+0.21%), and HAG (+1.62%)…

Next is the finance sector, with a mix of green and red. On the positive side, VCB is up 0.32%, BID by 1.26%, ACB by 0.2%, and LPB by 0.11%…

In contrast, the real estate sector opened on a less positive note. Industry giants like VIC, BCM, and VRE are down, and the remaining stocks in the sector are showing insignificant gains.

– 11:05 AM, September 22, 2025

Expert Insight: VN-Index Could Breach 1,600 Points—Prioritize Risk Management

Anticipating next week’s market dynamics, leading experts unanimously highlight elevated short-term risks, suggesting the VN-Index may retest the 1,600-point threshold.

Foreign Investors’ Heaviest Net Selling Week in 2025: Warrants Market Overview for September 22-26, 2025

As the trading session closed on September 19, 2025, the market witnessed 73 stocks advancing, 150 declining, and 24 remaining unchanged. Foreign investors continued their net selling streak, offloading a total of 5.18 million CW.