The Vietnamese Government Office has released a statement outlining Prime Minister Pham Minh Chinh’s conclusions from a meeting with the Policy Advisory Council earlier this month.

Regarding the real estate market, the Prime Minister acknowledged its role as a growth driver but noted certain underperforming indicators. He emphasized the persistent high demand for housing among citizens, urging the implementation of measures to boost supply.

Specifically, the Prime Minister directed the swift resolution of legal bottlenecks hindering stalled projects and the streamlining of administrative procedures in construction investment. He also called for an increased focus on social housing and tighter control over real estate inventory. The Policy Advisory Council has been tasked with leading the research and development of a comprehensive real estate market plan.

According to the Ministry of Construction’s report, by the end of Q2, the total real estate inventory reached nearly 25,300 units, comprising 11,700 land plots, 10,290 detached houses, and 3,287 apartments. Compared to the first quarter, apartment inventory saw the most significant increase at over 40%, while detached houses rose by approximately 9%, and land plots remained relatively stable.

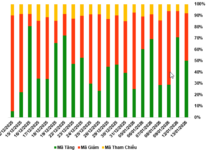

Our analysis of over 100 real estate companies listed on the Vietnamese stock market reveals a combined inventory value exceeding VND 531 trillion, an 11% increase since the beginning of the year. This marks an all-time high, with major developers like Vinhomes, Novaland, Vingroup, Kinh Bac, and Khang Dien reporting record-high inventory levels in their financial statements.

Real estate in downtown Ho Chi Minh City. Photo: Quynh Tran |

Experts attribute the bloated inventory to soaring prices, making properties unaffordable for most buyers. Many projects fail to align with actual living or investment needs, while the market lacks affordable options, overly focusing on luxury segments.

A survey of over 7,600 respondents revealed that 52% are reluctant to purchase apartments in the latter half of the year due to skyrocketing prices. Financially, most respondents indicated a budget of under VND 3 billion for home purchases.

In the same statement, the Prime Minister urged accelerated public investment to achieve full capital disbursement this year. He also stressed the need to modernize the stock market, balance supply and demand in the gold market to prevent policy exploitation, and stabilize the Vietnamese currency’s interest rates.

On exchange rates, he emphasized maintaining stability, boosting exports to sustain trade surpluses, and intensifying state-owned enterprise equitization to minimize losses and grow state capital.

Vietnam aims for an 8.3-8.5% GDP growth this year and double-digit growth from 2026 to 2030. The Policy Advisory Council deems these targets and inflation rates comparable to those of economies experiencing miraculous growth, such as Japan, South Korea, and China.

Ngoc Diem

– 11:44 22/09/2025

The Sugarcane Industry Under the Twin Pressures of Oversupply and Smuggled Goods

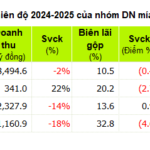

The Vietnamese sugar industry faced a challenging second quarter in 2025 due to a perfect storm of excess supply and illicit imports. This led to a significant drop in profits and rising inventories for many businesses. However, a handful of enterprises maintained their growth trajectory by strategically managing costs and consumption strategies. With a keen eye on expenses and a focused approach to sales, these resilient companies navigated the turbulent market conditions with relative stability.

“Illicit Tax-Evading Schemes Boost Textile Profits in Q2”

The strategy to boost orders ahead of the US’s 46% tariff implementation proved a remarkable success for Vietnam’s textile industry in Q2 2025. While the subsequent reduction to a 20% tariff provided some relief and potential for growth in Q3 and Q4, it also presented a conundrum for long-term strategic planning.

Van Phu – Invest Reports 4Q 2024 Profit Surge of 305%

The ramp-up in sales and deliveries at The Terra – Bac Giang project in Q4 2024 has significantly boosted Van Phu – Invest’s (HOSE: VPI) revenue and profit after tax to VND 749.8 billion and VND 101.1 billion, respectively, reflecting a remarkable surge of 457% and 305% compared to the same period in 2023.

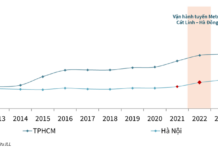

The Rise of Hanoi’s Condo Prices Has Stabilized, but a Drop is Unlikely

“With a notable slowdown in condo price hikes, the market is poised for greater stability, says economic expert, Associate Professor Dr. Dinh Trong Thinh. He predicts an end to the feverish market conditions witnessed in the past, as the upward trajectory in condo prices levels off.”