The 2025 Capital Increase Wave

In a recent announcement, Kafi Securities officially completed its capital increase to VND 7.5 trillion by issuing rights to existing shareholders. Kafi now ranks among the top 10 securities companies with the largest assets in the market.

SSI Securities also plans to issue up to 415.6 million shares to existing shareholders at VND 15,000 per share. This will increase its chartered capital to VND 24,934.9 billion. Previously, the company completed a private placement of over 104 million shares, raising its capital to VND 20,759 billion.

Tien Phong Securities (ORS) will soon issue 287.9 million shares to TPBank at VND 12,500 per share. The purpose is to increase capital and supplement resources for business operations. If successful, its chartered capital will rise from VND 3,360 billion to over VND 6,239.3 billion.

After a three-year hiatus, HCMC Securities (HSC) announced on June 9th a plan to issue nearly 360 million shares at VND 10,000 per share to existing shareholders. This will increase its capital from VND 7,208 billion to VND 10,808 billion, supporting margin lending and proprietary trading.

Several other firms, including JB Vietnam Securities (JBSV), Xuan Thien Securities (XTSC), Thien Viet Securities (TVS), Rong Viet Securities (VDS), and LPBank Securities, are also planning capital increases.

Additionally, the market is witnessing a strong IPO wave among securities companies.

Kỹ Thương Securities (TCBS) is in the spotlight with its IPO of over 231 million shares at VND 46,800 per share, aiming to raise VND 10.8 trillion. Its capital is expected to increase from VND 20,801.6 billion to VND 31,601.6 billion. The IPO attracted 26,220 investors, oversubscribed by 2.5 times.

Following TCBS’s successful IPO, VPBank Securities (VPBankS) approved an IPO of up to 375 million shares, representing 25% of outstanding shares. This will increase its capital from VND 15 trillion to VND 18.75 trillion.

VPS Securities will hold an extraordinary shareholders’ meeting in October 2025 to discuss its IPO plan. It proposes issuing 710 million shares at a 1:1.25 ratio, increasing capital from VND 5.7 trillion to VND 12.8 trillion.

Does Capital Increase Signal a Market Peak?

This capital increase wave echoes past uptrends—whenever the market surges, securities firms tend to raise capital.

|

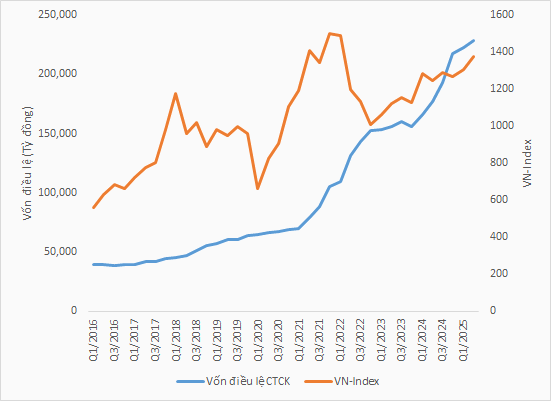

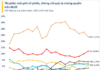

Securities Firms’ Capital Increases During Uptrends

Source: VietstockFinance. * Chartered capital and VN-Index data as of each quarter-end

|

During the 2016-2018 rally, as the VN-Index rose from 550 to 1,200 points, securities firms’ capital increased from VND 40 trillion to VND 65 trillion.

During the COVID-19 recovery in 2020-2022, the HOSE index surged from 680 to 1,500 points, driving securities firms’ capital from VND 70 trillion to VND 152 trillion.

After a lull, securities firms resumed capital increases in Q4 2023. By Q2 2025, capital had risen to VND 230 trillion from VND 156 trillion in early 2024.

Historically, market peaks often coincide with the completion of these capital increases. Why does this happen?

First, securities firms must maintain regulatory capital adequacy ratios. As business expands, they need more capital to support brokerage, proprietary trading, and underwriting. During market booms, firms leverage opportunities in brokerage, trading, and investment banking.

Competitive pressure also drives capital increases to maintain market share.

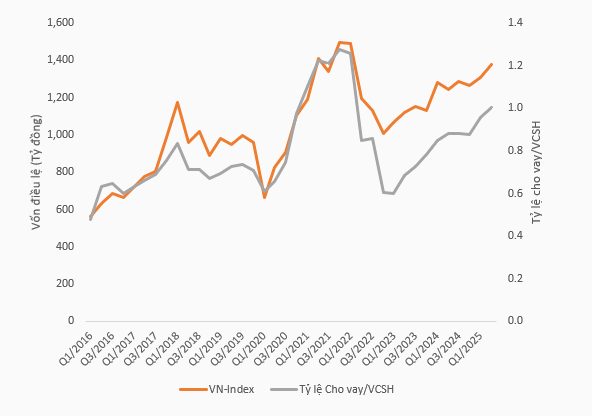

Additionally, margin lending demand spikes during rallies. Firms often reach the 2x leverage limit, prompting capital raises to meet demand.

|

Margin Lending to Equity Ratio of Securities Firms

|

|

Margin Lending to Equity Ratio of Select Securities Firms

Source: VietstockFinance

|

While not a direct cause of market peaks, capital increases often signal a maturing rally. Firms struggle to predict cycles, so capital raises are reactive to uptrends. Market exuberance outpaces capital supply, leading to rapid absorption but unmet demand. Firms must continuously recycle capital to keep up.

During downturns, capital raises stall, creating a plateau until the next cycle.

Despite peak correlations, capital increases strengthen firms by enhancing safety buffers, enabling better services, and investing in infrastructure.

The IPO wave is positive, offering quality investments and boosting Vietnam’s securities market.

The 2025 capital wave also prepares firms for KRX’s “non pre-funding” mechanism, launched in May 2025. This requires substantial capital for foreign transactions. Upcoming T+0 trading and short selling will further strain firms’ resources.

– 08:18 22/09/2025

Bình Sơn Petrochemical Refinery Fined for Tax Violations

Bình Sơn Refinery has been slapped with a hefty administrative fine and tax arrears totaling nearly VND 961.5 million due to tax violations.

Banks Race to Boost Capital, Strengthening Their Financial Cushion

Numerous banks are actively issuing dividend-paying shares and employee stock ownership plans (ESOPs) to bolster their chartered capital, enhance financial capabilities, and comply with regulatory capital adequacy requirements.