Shares of HTC Holding Joint Stock Company (HNX: CET), Hoa Binh Securities Joint Stock Company (HNX: HBS), and GKM Holdings Joint Stock Company (HNX: GKM) were delisted from September 22nd due to being placed under HNX control for late submission of the 2025 semi-annual financial report review, exceeding the 30-day limit.

Source: HOSE

|

GKM announced signing an audit contract with International Audit and Valuation Company Limited (IAV) on July 30, 2025, for the 2025 semi-annual financial report review and the 2025 annual financial report audit. However, the company has yet to release the 2025 semi-annual financial report review.

The stock is also under warning due to an exception opinion from the auditor, International Audit and Valuation Company Limited (IAV), regarding three issues in the 2024 annual financial report. The first issue is insufficient evidence to assess the recoverability of the amount from the sale of 2.65 million shares of Khang Minh Quartz Stone Joint Stock Company to Phat Dat Construction Materials Investment and Trading Joint Stock Company. As of March 2025, GKM still has nearly 13 billion VND outstanding out of the total transfer value of over 33 billion VND.

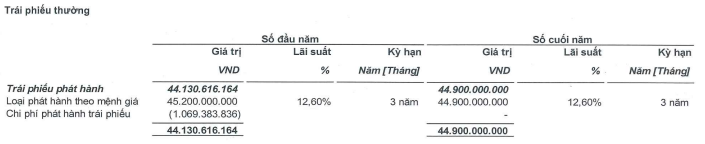

The second opinion relates to overdue bond debt. As of December 31, 2024, GKM had outstanding bond debt of nearly 45 billion VND, with corresponding interest of over 3 billion VND, despite the payment deadline being September 20, 2024. The company has not yet held a bondholder meeting to agree on a plan to address the overdue debt.

IAV stated that it could not gather sufficient evidence to evaluate the company’s ability to repay this debt, assess whether the financial statements need adjustment due to this issue, or determine the company’s short-term continuity.

Lastly, IAV lacked sufficient evidence to comment on the existence, collateral value, and other commitments related to the bond assets, as well as assess their impact on the financial statements.

These are “3 no” bonds, with no conversion, no warrants, and no collateral. The bond issuance helped GKM raise 100 billion VND over 36 months at an interest rate of 12.6%/year.

The bonds were secured by nearly 7.2 million GKM shares from 27 shareholders but were not verified, confirmed, or valued by an asset management organization as of December 31, 2024.

Source: GKM‘s 2025 Semi-Annual Financial Report Review

|

In the case of CET, the company was recently warned for late submission of the 2025 semi-annual financial report review, exceeding the 15-day limit.

According to CET, at the time of the report’s deadline, the company had not yet held the Annual General Meeting, so the proposal for selecting an independent auditor had not been approved. However, on September 5th, CET completed the meeting and approved the relevant content.

“Currently, the company is researching and negotiating with several audit firms that meet the criteria approved by the Annual General Meeting. After signing the audit contract, the 2025 semi-annual financial report review is expected to be implemented and released in October 2025” – CET stated.

In the stock market, despite recent troubles, CET shares have defied the odds, hitting the ceiling in 6 out of the last 7 sessions, surging from 5,200 VND/share to 9,400 VND/share, and even opening the September 22nd session with another ceiling, reaching 10,300 VND/share. If this price is maintained until the end of the session, CET will record a near doubling in just over a week.

|

CET has been hitting the ceiling continuously recently

Source: VietstockFinance

|

VNX Allshare is an index reflecting the overall performance of stocks listed on both HOSE and HNX. Stocks in this index must meet strict criteria regarding listing eligibility, free float ratio, and liquidity.

The index was officially launched on October 24, 2016, with a base index of 1,000 points. In the September 22, 2025 session, after nearly 9 years, VNX Allshare was trading at around 2,840 points as of 10 AM, with a portfolio of 413 stocks.

– 10:33 22/09/2025

Vimedimex’s VMD Stock Placed Under Warning Status

The Ho Chi Minh City Stock Exchange (HoSE) has issued a warning for Vimedimex’s stock (VMD) due to the company’s delayed submission of its audited semi-annual financial report for 2025.