TPBank Counter Savings Interest Rates for September 2025

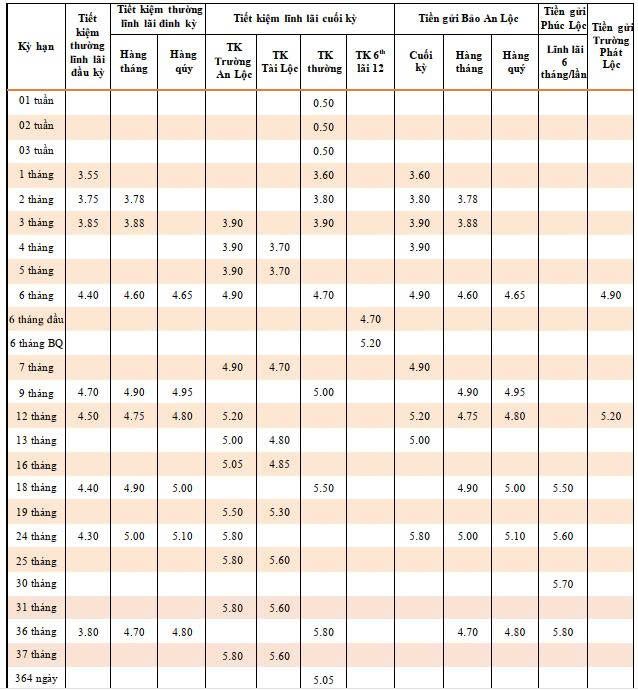

According to the latest survey, TPBank (Tien Phong Commercial Joint Stock Bank) offers counter savings interest rates for individual customers ranging from 0.5% to 5.8% per annum, with interest paid at maturity.

Specifically, short-term deposits of 1 to 3 weeks remain at a uniform rate of 0.5% per annum, unchanged from the previous month.

For 1-month, 2-month, and 3-month terms, the interest rates are 3.6%, 3.8%, and 3.9% per annum, respectively.

The 6-month term offers a rate of 4.7% per annum, while the 9-month and 18-month terms provide rates of 5.0% and 5.5% per annum, respectively.

The highest interest rate of 5.8% per annum is applied to the 36-month term.

Source: TPBank

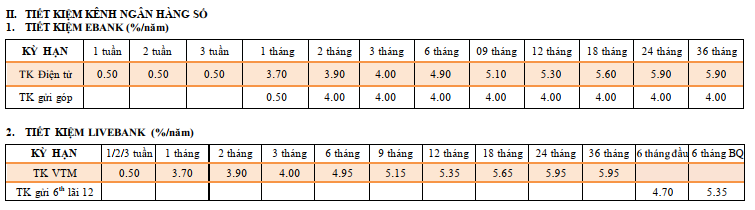

TPBank Online Savings Interest Rates for September 2025

In September, TPBank offers online savings interest rates on EBank ranging from 0.5% to 5.9% per annum.

Terms under 1 month have a rate of 0.5% per annum, while 1-month, 2-month, and 3-month terms offer rates of 3.7%, 3.9%, and 4.0% per annum, respectively. The 6-month and 9-month terms provide rates of 4.9% and 5.1% per annum, respectively. For terms between 12 and 24 months, the rates range from 5.3% to 5.6% per annum.

The highest rate of 5.9% per annum is applied to terms between 24 and 36 months.

Customers should note that TPBank may offer different interest rates to specific customers, not exceeding the maximum rates set by the State Bank of Vietnam for each term.

If customers with fixed-term savings accounts wish to withdraw funds before maturity, the applicable interest rate will be the lowest non-term rate effective on the early withdrawal date.

Tin Vũ

TPBank and “Em Xinh Say Hi”: Unleashing Borderless Creativity, Connecting with Gen Z Emotions

Riding the wave of excitement from its sold-out concerts and programs, TPBank continues to cater to Gen Z with a suite of sleek, top-tier features, transforming the TPBank App into a cornerstone of authentic fandom culture. From the dazzling stages of Em Xinh to the personalized features within the app, TPBank’s signature purple hue not only embodies boundless creativity but also plays a pivotal role in empowering Vietnam’s youth to reach new heights.

“The Power of $100,000: How TPBank’s CEO, Nguyen Hung, Unlocked the Secret to Successful Digital Transformation by Tapping into the Heart of Community Needs”

“A digital Vietnam is within our grasp and is not a distant dream,” said TPBank CEO Nguyen Hung at a recent seminar on digital transformation. Emphasizing that the key to successful digital transformation lies not in technology itself but in meeting the genuine needs of the people, he shared insights into the pioneering role of the VNeID app and the financial industry in leading this digital revolution.

The Top Movers and Shakers in the Stock Market Today

The stock market is a dynamic and ever-changing landscape, and keeping track of the biggest movers is crucial for investors. Vietstock’s statistical insights offer a glimpse into the stocks that have been making the most significant gains and losses in recent sessions. This information is pivotal for savvy investors looking to make informed decisions and stay ahead in the game.