Industrial Real Estate Giants Enter the Market

A surge in FDI and significant growth in manufacturing activities during the first half of this year are propelling Vietnam’s industrial real estate market. Both domestic and international enterprises are not only expanding their industrial land banks but also investing comprehensively in infrastructure, logistics, and ready-built factories.

According to Mr. John Campbell, Director of Industrial Services at Savills Ho Chi Minh City, the 32% year-on-year increase in FDI into the manufacturing sector during the first six months of 2025 marks a significant milestone. This growth is not limited to the manufacturing industry but also contributes to Vietnam’s overall economic trajectory. It represents a breakthrough in both scale and structure, solidifying the path toward high-value and sustainable industrial growth.

This growth is not coincidental but stems from a volatile global context. The manufacturing sector’s value-added has risen by over 10% year-on-year, contributing nearly 2.6 percentage points to GDP. This indicates a structural shift rather than a temporary boom.

Mr. Campbell highlights that the substantial increase in project numbers demonstrates Vietnam’s role as a prioritized link in the global production network, not merely a beneficiary of production shifts.

Industrial real estate is a hotspot attracting FDI.

Savills experts identify multiple global factors driving FDI into Vietnam. The “China + 1” strategy, aimed at supply chain diversification, is a key driver. Trade tensions between the U.S. and China, coupled with global tariff pressures, are prompting multinational corporations to seek politically stable destinations with favorable tax regimes like Vietnam.

Free trade agreements such as RCEP, CPTPP, and EVFTA grant Vietnam access to approximately 65% of the global market, enhancing its appeal for export-oriented manufacturing. Additionally, its strategic location near China offers competitive labor costs and seamless regional supply chain connectivity.

The trend toward green and high-tech FDI is also prominent, with projects like Lego’s green factory and chip packaging investments. These initiatives reflect a shift toward modern, environmentally friendly industrial models, positioning Vietnam as a global manufacturing hub beyond cost advantages.

In the industrial real estate market, ready-built factories (RBF) are outpacing land purchases in project numbers. Mr. Campbell describes this as a “turning point” for Vietnam’s industrial real estate. RBFs offer rapid deployment and lower initial investment, achieving occupancy rates of 88-89% across regions, the highest in three years.

The rising demand for RBFs is driving rental yields and occupancy rates, fueling industry expansion. While industrial land supply continues to grow, building from scratch is more time-consuming and capital-intensive, making RBFs an attractive option for flexible investors, especially in high-tech and ESG-compliant sectors.

What Do Foreign Investors Seek in Industrial Real Estate?

Mr. Campbell notes that international investors now have specific requirements for industrial real estate. They prioritize quick operational readiness, stable power supply with renewable energy options, dual power systems, and direct power purchase agreements (DPPA). Sustainability is critical, with projects requiring LEED/EDGE certifications and green industrial zones. Proximity to seaports and highways, along with a transparent legal environment, including clear land pricing processes, are also essential. A skilled workforce, particularly in electronics and semiconductors, is a non-negotiable requirement.

To bolster industrial real estate development, Mr. Campbell recommends expanding connectivity infrastructure, such as completing 3,000 km of highways and upgrading seaports and inland container depots (ICDs). Encouraging the development of RBFs and build-to-suit (BTS) projects with higher standards is also crucial.

Incentive policies should align with global minimum tax standards while maintaining attractiveness. Finally, cultivating a specialized workforce for the semiconductor and high-tech manufacturing sectors will be pivotal. These measures will ensure the healthy growth of the industrial real estate market and strengthen Vietnam’s position in the global supply chain.

The New Industrial Revolution: Kinh Bac Leads the Pack in the Industrial Real Estate Race

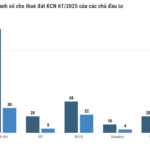

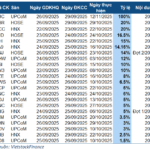

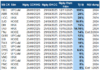

The industrial real estate sector remains resilient in the face of US tariff policies, as evidenced by the Vietcap Securities Company’s report on the performance of listed industrial park investors in the first half of 2025. Despite the challenges, these investors maintained stable land leasing revenues, showcasing the enduring demand for industrial properties.