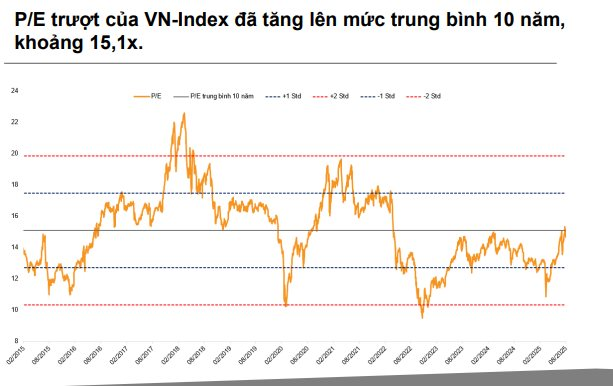

In a newly released strategic report, VNDirect Securities forecasts that the VN-Index will maintain its strong upward momentum in August 2025, pushing market valuation to 15.3x—slightly above the 10-year average. While this valuation is no longer considered cheap, it remains reasonable given Vietnam’s robust economic growth, the potential market upgrade, and the optimistic earnings outlook for listed companies.

Analysts project that companies listed on the Ho Chi Minh Stock Exchange (HSX) will achieve EPS growth of 20–22% in 2025. This supports the VN-Index’s 2025 projected P/E ratio of around 14.x, keeping Vietnamese equities attractively priced and drawing both domestic and foreign investment. Vietnam’s stock market boasts a ROE of 13.3%, outperforming many regional markets.

Following the Fed’s anticipated rate cuts, attention will shift to October 7, when FTSE announces whether Vietnam’s stock market will be upgraded to Secondary Emerging Market status. Simultaneously, Q3 earnings reports from listed companies will provide clearer insights into profit growth prospects.

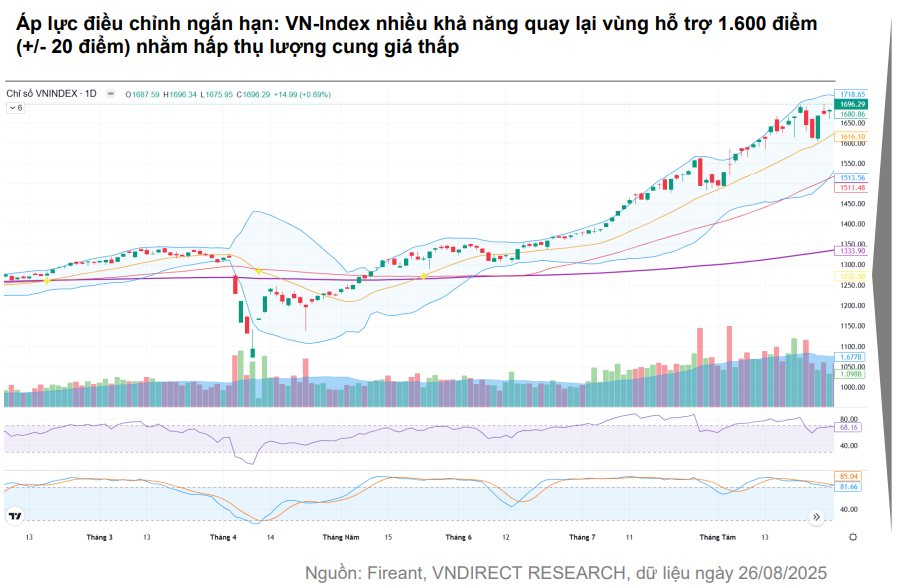

Ahead of these pivotal events, the VN-Index may face short-term pressure, primarily from profit-taking in leading large-cap sectors like banking and securities. Additional risks include currency volatility concerns and prolonged net selling by foreign investors.

The index may retest the 1,600-point level (+/-20 points) to absorb low-price supply before challenging the 1,700-point resistance in Q4. VNDirect advises investors to maintain exposure to fundamentally strong stocks with upside potential. Risk management should be prioritized through portfolio rebalancing and strict control of financial leverage.

Over the next 6–9 months, analysts maintain a positive outlook for Vietnam’s stock market. In the base scenario, the VN-Index is expected to target the 1,850–1,900 range, driven by strong catalysts: potential market upgrade, the Fed’s policy reversal with rate cuts, and robust corporate earnings. These factors collectively create room for significant re-rating and bolster investor confidence.

Trade Stocks with TCBS and Get Up to 40 Million VND Cashback

Embark on your stock trading journey with TCBS and unlock a treasure trove of exclusive benefits. New investors enjoy unlimited commission-free trades, cashback rewards of up to 40 million VND, and highly competitive margin lending rates.

Market Pulse 22/09: Weak Demand Fuels Widespread Sell-Off

Amidst a lack of buying momentum, the market deepened its decline into the red, following unsuccessful recovery attempts near the 1,640-point threshold. By the end of the morning session, the VN-Index closed at 1,635.84 points, down 1.37%, while the HNX-Index fell 0.69% to 274.34 points. Selling pressure dominated, with 466 decliners outpacing 208 gainers. Foreign investors continued their net selling streak, offloading 1.4 trillion VND across all three exchanges.

Expert Insight: VN-Index Could Breach 1,600 Points—Prioritize Risk Management

Anticipating next week’s market dynamics, leading experts unanimously highlight elevated short-term risks, suggesting the VN-Index may retest the 1,600-point threshold.