A time deposit certificate (TDC) is a valuable financial instrument issued by banks, serving as proof that an individual or organization has invested in a fixed-term deposit at the bank.

It is considered an alternative to a traditional savings account, typically offering longer terms and more favorable interest rates compared to regular savings accounts.

TDC holders can receive periodic or maturity interest payments, similar to regular savings accounts. Additionally, TDCs can be transferred, gifted, or assigned in accordance with legal regulations, with transfer fees determined by the bank.

According to the State Bank’s regulations, each certificate issued must meet specific conditions regarding value, term, interest rate, and withdrawal terms.

Furthermore, the rights of TDC holders are protected through guarantees of full principal and interest repayment upon maturity, along with provisions for certificate transfer or pledge when necessary.

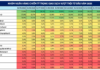

Illustrative image: Nam Khánh |

Currently, the financial market offers three common types of TDCs: registered TDCs, book-entry TDCs, and bearer TDCs.

Registered TDCs are issued in paper or booklet form, clearly stating the owner’s name.

Book-entry TDCs are issued with a fixed face value and are non-transferable. Customers receive the full interest amount on the maturity date.

Bearer TDCs are issued without the owner’s name, offering high flexibility and belonging to the holder. Due to their anonymity and ease of transfer, bearer TDCs are suitable for those seeking convenience in buying, selling, and transferring on the financial market.

Compared to regular savings accounts, both TDCs and savings accounts share high safety and low-risk characteristics. Depositors are guaranteed both principal and interest, with options to transfer, gift, or pledge for loans.

In contrast to regular savings accounts, TDCs often offer more attractive interest rates, appealing to those looking to maximize savings returns.

However, TDCs have lower liquidity, making it less flexible to withdraw funds when needed. Early withdrawals before maturity may result in penalties, loss of interest, and even up to 10% of the principal.

Regarding terms, TDCs have fixed terms, typically ranging from a few months to several years, with specific maturity conditions.

Savings deposits, on the other hand, offer more flexible terms, ranging from no term, short-term (a few days) to long-term (several years), depending on the customer’s needs.

TDCs also generally require a higher minimum deposit compared to savings deposits, making them suitable for individuals or organizations with substantial capital and long-term investment goals.

Tuân Nguyễn

– 08:00 22/09/2025

Today, September 13th: Ring Gold and Gold Bar Prices Continue Their Sharp Decline

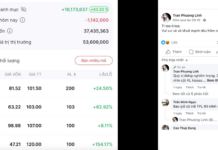

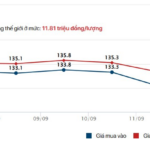

Domestic gold prices continued their steep decline at the opening of today’s trading session. Ring and bullion gold prices at several enterprises plummeted by nearly 2 million VND per tael compared to the same time yesterday.

“Monetary, Gold and Stock Market Management: Strategies for Stability and Growth”

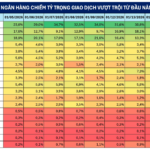

The Deputy Prime Minister, Ho Duc Phoc, has signed and issued an urgent dispatch on the 11th of September 2025, addressing the management and governance of the monetary, gold, and securities markets. This dispatch, numbered 161/CD-TTg, underscores the government’s proactive approach to maintaining stability and devising effective solutions for these vital markets.