The ex-dividend date for the stock dividend is October 7th. The capital for this distribution will be sourced from the undistributed after-tax profits as per the audited financial statements as of December 31, 2024. Following the issuance, Sao Mai’s chartered capital is expected to increase to approximately VND 4,072 billion.

This marks the second consecutive year that ASM has maintained a 10% stock dividend payout, mirroring the 2023 distribution. Previously, the company had suspended dividend payments in 2022, after a consistent payout period from 2019 to 2021.

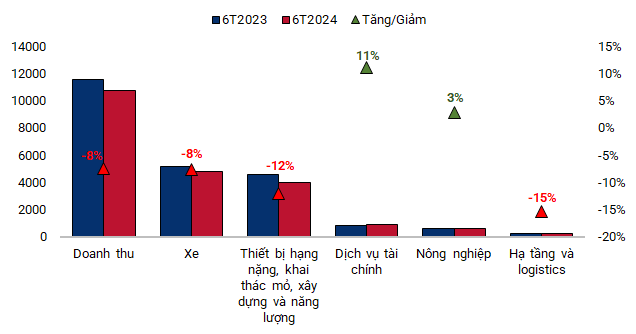

Half-Year Business Performance Hits 8-Year Low

As a diversified conglomerate operating in real estate, aquaculture, renewable energy, hospitality, and construction, Sao Mai reported consolidated revenue of VND 6,609 billion for the first half of 2025, a 2% increase year-over-year. However, net profit plummeted by 78% to just VND 34 billion, the lowest in eight years. This figure represents only 4% of the annual profit target, despite revenue reaching nearly half of the yearly goal.

| Sao Mai’s Half-Year Business Performance Over the Years |

The company attributes the profit decline to an 11% rise in management expenses due to the operation of Lamori Resort and other non-capitalized costs, coupled with a 28% increase in financial expenses from loan interest and exchange rate differences.

A view of the Lamori Resort project in Tho Xuan (formerly) district, Thanh Hoa province – Illustrative image

|

As of the end of June 2025, ASM’s total financial debt stood at over VND 13,100 billion, a 4% decrease from the beginning of the year. Of this, more than 46% is short-term debt. Interest expenses for the first half of the year reached nearly VND 358 billion, up 12%.

On the stock market, ASM shares traded at VND 8,580 per share on the morning of September 22nd, up 17% over the past three months but still down 7% year-over-year. Average daily liquidity for the year exceeds 1 million shares per session. ASM had previously dropped below VND 6,000 per share in early April 2025 before rebounding to nearly one and a half times its current price level.

| ASM Stock Price Movement Over the Past Year |

– 11:58 AM, September 22, 2025

VEFAC Shocks Again with 330% Dividend Advance Proposal, Total Payout Nearing 5.5 Trillion VND

After distributing over VND 7.2 trillion in dividends at a rate of 435% in July, Vietnam Exhibition Fair Center Corporation (VEFAC, UPCoM: VEF) is now proposing an interim dividend payout of 330%, equivalent to nearly VND 5.5 trillion. As the majority shareholder with over 83% ownership, Vingroup stands to be the primary beneficiary.

Vĩnh Hoàn Finalizes 20% Cash Dividend Payout

Vinh Hoan Corporation (HOSE: VHC) has announced the record date for shareholders to receive an interim cash dividend for 2025, set at a rate of 20% (equivalent to VND 2,000 per share). The ex-dividend date is September 29, with payment expected to commence from October 15.