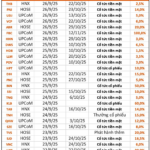

This week, 27 companies announced dividend payment dates. Among them, 22 firms will pay cash dividends, 3 will issue stock dividends, and 2 will conduct additional share offerings.

Doubling Chartered Capital

Phuoc An Port Joint Stock Company (stock code: PAP) is seeking shareholder approval via written consent, with submissions due by 11:30 AM on October 2nd. Specifically, PAP plans to privately issue 125 million shares to investors at a price no lower than VND 10,600 per share.

Phuoc An Port JSC expects to raise VND 1,325 billion from the share issuance.

The issued shares will be restricted from transfer for one year. The issuance is planned for 2025–2026. Post-issuance, PAP’s chartered capital will increase from VND 2,320 billion to VND 3,570 billion.

The entire proceeds of VND 1,325 billion will be allocated to cover costs associated with tender packages (equipment procurement, construction, consulting, etc.) for the Phuoc An Port investment project.

Chuong Duong Joint Stock Company (stock code: CDC) has approved the issuance of nearly 8.8 million bonus shares, equivalent to a 20% ratio—meaning shareholders holding 100 shares will receive 20 new shares. The issuance will be funded from equity as per the 2024 audited financial statements. Post-issuance, CDC’s chartered capital will rise to nearly VND 528 billion.

Additionally, Chuong Duong plans to offer up to 53 million shares to existing shareholders at VND 10,000 per share, with no transfer restrictions. If completed, CDC’s chartered capital will double to over VND 1,055 billion.

The proceeds from this offering will be used as follows: VND 31.4 billion to repay personal debts, over VND 123 billion to repurchase bonds, and over VND 373 billion to restructure short-term bank loans.

Miza Joint Stock Company (stock code: MZG) announced the issuance of nearly 10.6 million shares to existing shareholders at VND 10,000 per share. If completed, Miza’s chartered capital will increase to VND 1,165 billion.

Chuong Duong JSC’s chartered capital will double to over VND 1,055 billion after offering up to 53 million shares.

The entire proceeds will be used to repay principal or partial principal of existing loans, including VND 76 billion to Vietnam Modern Limited Liability Bank, VND 19 billion to MB, and VND 11 billion to BIDV.

Continued Divestment from Saigonres

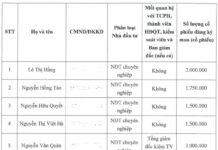

From September 9–15, REE Real Estate LLC—an affiliate of Mr. Nguyen Van Khoa, Vice Chairman of Saigon Real Estate Corporation (Saigonres, stock code: SGR)—sold 2 million SGR shares, reducing its ownership to 21.92% of chartered capital.

Subsequently, from September 23 to October 21, REE Real Estate registered to sell an additional 3 million shares, further reducing its stake to 17.63%. The purpose of these transactions is portfolio restructuring. REE Real Estate LLC is a subsidiary of REE Corporation (stock code: REE), operating in the real estate sector.

REE Real Estate LLC continues to divest from Saigonres.

Earlier, from June 9 to July 7, Mr. Pham Thu, Chairman of Saigonres, sold 7 million SGR shares out of a registered 9.8 million, reducing his ownership to 29.82% of chartered capital.

On September 29, Pho Yen Mechanical Engineering JSC (Fomeco, stock code: FBC) will finalize the shareholder list for a 100% cash dividend payment for 2024, equivalent to VND 10,000 per share. With 3.7 million outstanding shares, FBC will allocate VND 37 billion for this dividend payment.

Phu Nhuan Jewelry Joint Stock Company (stock code: PNJ) announced September 29 as the final registration date for the second 2024 cash dividend payment at a 14% rate. With over 337.9 million outstanding shares, PNJ is expected to disburse approximately VND 473 billion in dividends.

Upcoming Dividend Ex-Dates (Sept 22-26): Top Cash Dividends Reach 100%, SSI & PNJ Lead the Way

This week, 22 companies are distributing cash dividends, with rates ranging from a high of 100% to a low of 1.5%.

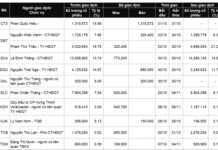

LPBS Offers 878 Million Shares to Shareholders

LPBS is set to launch an offering of 878 million shares to existing shareholders, commencing on September 15 and concluding on October 15, 2025. Upon successful completion, the company’s chartered capital is projected to rise to 12,668 billion VND.