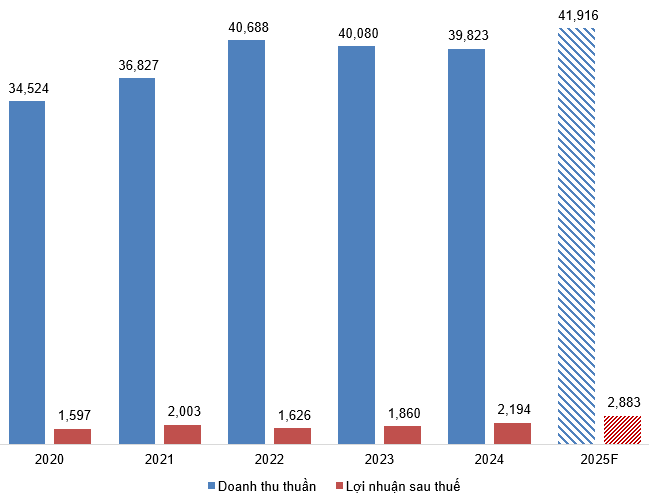

2025 Revenue Forecast Surpasses VND 40 Trillion

In the first half of 2025, BVH recorded a total net revenue of VND 20,635 billion, a 5.2% increase compared to the same period last year, with post-tax profit reaching VND 1,390 billion, a significant 31% surge. In Q2/2025 alone, post-tax profit hit VND 705 billion, soaring 60.7% year-over-year, driven by stable insurance premiums, improved profit margins, and effective financial investment activities.

As we enter the second half of the year, BVH’s outlook remains positive. The life insurance segment is expected to recover more robustly, thanks to gradually increasing new premiums from standardized sales processes. Meanwhile, the non-life insurance segment benefits from growing demand for health and property insurance amid vibrant economic activity. Additionally, the digital transformation strategy plays a pivotal role, helping BVH optimize costs and enhance customer experience, thereby solidifying its leading position in Vietnam’s insurance market.

The author forecasts that full-year 2025 revenue will reach nearly VND 42 trillion, with net profit at approximately VND 2.8 trillion, representing growth rates of 5% and 31%, respectively, compared to the previous year.

Business Performance of BVH from 2020 to 2025F. Unit: Billion VND

Source: BVH

Stock Valuation

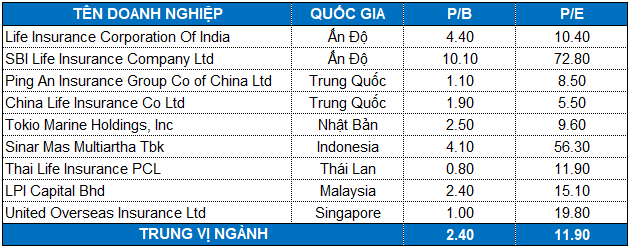

Given BVH’s leading position in Vietnam’s insurance industry, there are no direct comparables among stocks listed on HOSE, HNX, or UPCoM. Therefore, using domestic stocks as peers for valuation would not be reasonable or comprehensive.

The author employs Asian insurance companies as the basis for valuing BVH’s shares. These companies are primarily from China, India, Japan, Indonesia, Thailand, and Malaysia.

Source: Investing.com

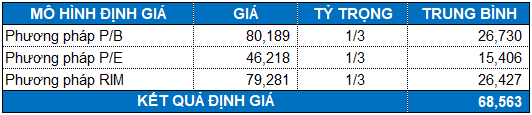

Using Market Multiple Models (P/E, P/B) combined with the Residual Income Model (RIM) in equal weights, the fair value of BVH is estimated at VND 68,563 per share. Thus, BVH’s current market price presents an attractive entry point for long-term investment.

Enterprise Analysis Department, Vietstock Advisory Division

– 09:43 23/09/2025

MSN – Strengthening its Position for Sustainable Growth (Part 2)

The Masan Group (HOSE: MSN) is witnessing positive signals across its various business segments, including WinCommerce, Masan MEATLife, and Masan High-Tech Materials. These divisions are anticipated to significantly contribute to the company’s long-term growth and solidify its foundation for stable operations. With its current valuation, MSN stock presents an attractive investment opportunity for long-term investors seeking exposure to a well-diversified and robustly performing company.

Inauguration of the First Ever International Land Cable Fully Invested by Vietnam: A 3,900km Long Cable Connecting 5 Countries

VNPT has proudly unveiled the VSTN international terrestrial optical cable line, the first of its kind to be wholly owned and operated by a Vietnamese enterprise. This groundbreaking cable line connects Vietnam to Singapore via Laos, Thailand, and Malaysia, marking a significant milestone in the country’s telecommunications landscape.

The Stock Market Ahead of the Trading Session: “Hot Seat” of an Insurer with a Controlling Shareholder After Two Years

The position of Chairman of the Board for this insurance conglomerate has been vacant since August 2022. A challenging yet rewarding opportunity awaits a seasoned leader to step into this role and steer the company towards continued success.