|

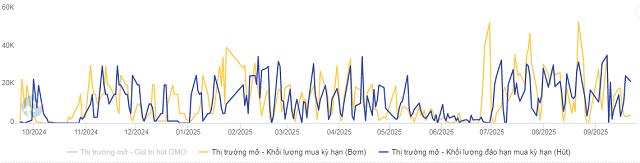

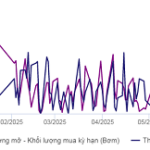

Trends in Net OMO Operations Over the Past Year. Unit: Billion VND

Source: VietstockFinance

|

Specifically, the State Bank of Vietnam (SBV) issued only VND 56.097 trillion through the term purchase channel with a fixed interest rate of 4%, due to a significant reduction in activity during the sessions on September 19 and 22. Meanwhile, the maturity volume on this channel reached VND 83.178 trillion, resulting in a net withdrawal of VND 27.081 trillion for the week. The outstanding volume on the term purchase channel thus decreased to VND 157.905 trillion.

|

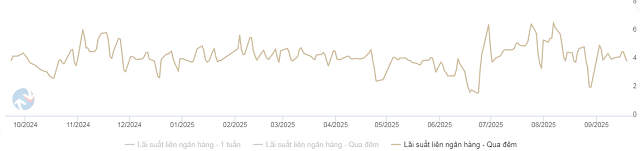

Trends in Overnight Interbank Interest Rates Over the Past Year. Unit: %/year

Source: VietstockFinance

|

In the interbank market, the overnight interest rate dropped to 3.89%/year on September 19, a 23 basis point decrease compared to the previous week. However, trading volume increased by over 10% from the previous week, averaging more than VND 555 trillion per day.

|

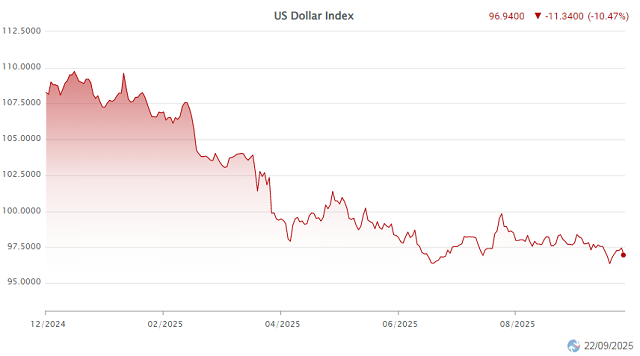

DXY Trends from the Beginning of 2025 to September 22

Source: VietstockFinance

|

In the international market, the US Dollar Index (DXY) experienced significant fluctuations around the time the U.S. Federal Reserve (Fed) cut interest rates by 25 basis points. On September 16, the DXY fell to 96.63 points, its lowest level in three years. After the Fed officially announced the rate cut to the 4 – 4.25% range on September 17, the DXY recovered and closed the week of September 19 at 97.65 points, nearly unchanged from the previous week.

The rate cut occurred amid signs of weakening in the U.S. labor market: the August unemployment rate rose to 4.3%, the highest since October 2021, while new job growth slowed significantly.

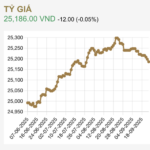

Domestically, the USD/VND exchange rate at Vietcombank closed the week of September 19 at 26,175 – 26,445 VND/USD (buy – sell), a slight increase of 9 VND on the buying side but a decrease of 31 VND on the selling side compared to the previous week.

– 11:13 23/09/2025

Year-End Exchange Rates and Solutions for Businesses

In the final months of 2025, currency exchange rate pressures are emerging as a critical challenge directly impacting the financial health of import-export businesses. As the USD continues to strengthen against the VND, the business landscape is painted with contrasting hues, where one’s opportunity becomes another’s obstacle.

“The State Bank’s ‘Triple Pronged Attack’ to Curb Rising Exchange Rates”

Amidst the backdrop of a steadily rising USD/VND exchange rate in late August and early September, the State Bank of Vietnam has implemented a series of measures to cool down the market. However, upward pressure on the exchange rate remains significant, despite the near-certainty of a Fed rate cut at its September meeting.