Vice Chairman of the National Assembly Vu Hong Thanh delivers a speech. (Photo: Doan Tan/TTXVN)

|

On the afternoon of September 22, continuing the agenda of the 49th Session, the Standing Committee of the National Assembly provided feedback on the draft Law on Deposit Insurance (Amended).

Regarding the core content of the draft Law, Governor of the State Bank of Vietnam Nguyen Thi Hong stated that the development of the Law on Deposit Insurance (Amended) aims to establish a comprehensive and clear legal framework. This framework will enable deposit insurance organizations to better protect the rights of depositors, ensure the stability of credit institutions, and maintain social security and safety.

The Law’s development closely aligns with and fully institutionalizes the policies of the Party and the State, as well as the five policies approved by the Government. It retains provisions that remain relevant and addresses shortcomings identified during the implementation of the 2012 Law on Deposit Insurance. The Law ensures consistency with other legal regulations and draws on international best practices, tailored to Vietnam’s context.

The draft Law consists of 8 chapters and 44 articles, including 28 amended articles, 7 newly added articles, 2 repealed articles, and 9 unchanged articles.

Regarding the rights and obligations of deposit insurance organizations, the draft Law expands their authority to inspect participating institutions as directed by the State Bank, access special loans from the State Bank, and participate in the resolution of troubled institutions. This includes appointing qualified individuals to management roles, evaluating restructuring plans, purchasing long-term bonds, and providing special loans to insured institutions.

Concerning the delegation of authority to ministries, agencies, and deposit insurance organizations, Governor Nguyen Thi Hong noted that the draft Law maintains the Ministry of Finance’s authority to regulate the financial regime of deposit insurance organizations. It also grants the Ministry additional powers to oversee accounting and reporting standards.

Governor of the State Bank of Vietnam Nguyen Thi Hong addresses the session. (Photo: Doan Tan/TTXVN)

|

The draft Law delegates certain responsibilities from the Government to the Governor of the State Bank, including regulations on information provision, reissue of deposit insurance certificates, and insurance payout limits. It also transfers authority over insurance fees and other matters from the Prime Minister to the State Bank.

Presenting the review report, Chairman of the National Assembly’s Committee on Economics and Finance Phan Van Mai urged the drafting agency to refine the Law, ensuring alignment with Party policies, constitutionality, legality, and consistency with the legal system. He emphasized the need for a thorough assessment of resources and conditions required for the Law’s implementation.

Regarding the rights and obligations of deposit insurance organizations, the Committee recommended clarifying their role in fee determination, specifying the entity responsible for setting fees, and defining the scope and content of inspections to avoid overlap with other supervisory bodies.

The Committee also called for clear provisions on conditions for state budget support, borrowing from credit institutions or the State Bank, and the distinct roles of the State Bank, deposit insurance organizations, and the Vietnam Cooperative Bank in managing troubled credit unions.

Speaking at the session, Chairman of the National Assembly’s Committee on Law and Justice Hoang Thanh Tung urged the drafting agency to align the Law with existing legislation, including the Law on Credit Institutions, the State Bank Law, the State Budget Law, and the Accounting Law. He also highlighted the need to ensure consistency with pending laws under consideration at the 10th Session.

Regarding the obligations of insured institutions, Hoang Thanh Tung noted the absence of provisions mandating the disclosure of insurance participation at headquarters and branches. He recommended aligning these requirements with the Law on Credit Institutions.

Concluding the session, Vice Chairman of the National Assembly Vu Hong Thanh endorsed the necessity of the Law and praised the Government’s comprehensive preparation. He commended the thorough preliminary review by the Committee on Economics and Finance.

To ensure the Law’s quality, Vu Hong Thanh urged the Government to address key issues, including legal consistency, institutionalizing anti-corruption measures, clarifying fee determination processes, and avoiding redundant oversight functions. He emphasized the importance of a robust legal framework to safeguard depositors and maintain financial stability.

Diep Truong

– 15:59 22/09/2025

President Lương Cường Meets with Leaders of Major U.S. Economic Corporations

On the morning of September 21st, local time (evening of the same day, Hanoi time), President Lương Cường and his spouse, along with the High-Level Vietnamese Delegation, arrived in Seattle, Washington, to engage in a series of bilateral activities.

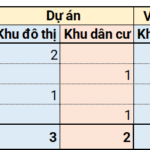

Exclusive Investment Opportunity: September 13-19, 2025 – 3 Mega Urban Projects, 2 Residential Developments, Totaling Over 13.4 Trillion VND

During the week of September 13-19, 2025, four provinces in Vietnam launched investment calls for five major projects, totaling over 13.4 trillion VND in capital. Notably, Gia Lai province unveiled a mega urban development project valued at more than 7.3 trillion VND, while Phu Tho province introduced a similar urban project exceeding 5.7 trillion VND.