Even Big Names Fail to Meet Quorum Requirements

In recent years, the annual Shareholders’ Meetings (SHM) season has witnessed a paradox. While many companies present ambitious business plans and call for shareholder unity, even major players on the stock market have had to postpone their meetings due to insufficient attendance.

In 2023, prominent names like Hoa Binh Construction Group (UPCoM: HBC), C.E.O Group (CEO), and DIC Corporation (HOSE: DIG) were unable to hold their first annual SHM due to inadequate shareholder attendance.

At Hodeco’s (HOSE: HDC) first SHM in 2024, held on April 6th, only 47.91% of voting shares were represented. The second meeting, on May 2nd, saw attendance drop to 36.05%, but as the second meeting only requires a minimum of 33%, it proceeded.

This unfortunate trend isn’t limited to manufacturing, construction, or business sectors. Financial institutions like VNDIRECT Securities (HOSE: VND), APG Securities, and Asia Pacific Securities (APS) also failed to hold their first annual SHM in 2024.

In 2025, HDC and CEO again failed to convene their first annual SHM.

A notable case is CII (HOSE: CII), which failed to hold its first SHM for three consecutive years (2022-2024). Notably, before the 2023 and 2024 meetings, CII offered cash gifts to attending shareholders. In 2025, CII went further, announcing a lottery with prizes up to 500 million VND for attending or proxy shareholders.

These cases highlight a critical issue in investor relations (IR): focusing communication efforts solely before SHMs can be perceived as vote-seeking rather than providing valuable information.

When IR Becomes Seasonal

The root cause lies in outdated IR practices. Many companies neglect year-round investor engagement, only intensifying communication efforts just before SHMs.

This distorts the core purpose of SHMs. Instead of being a strategic dialogue forum where shareholders exercise ownership, it becomes a tense vote-gathering exercise. Companies aim for quorum to pass pre-drafted resolutions rather than genuinely listening to and engaging with shareholders as partners.

Without timely, comprehensive updates and effective leadership communication channels, loyal shareholders are hard to come by.

This apathy not only risks failed SHMs but also erodes trust, negatively impacting stock value and long-term company image. Worse, strategic plans requiring timely shareholder approval may stall due to poor IR.

Consistent and Regular Engagement

To address this, companies must overhaul their IR strategies—shifting from reactive, seasonal efforts to proactive, continuous, and direct engagement.

Instead of waiting for reports or SHMs, companies should regularly update investors on business performance, project progress, anomalies, and challenges. A well-maintained IR section on the company website, detailed analytics, emails, and social media are effective communication channels.

IR should be a two-way street. Companies must create opportunities to listen to shareholders. Quarterly analyst meetings and online leadership Q&A sessions not only address concerns but also demonstrate respect and openness toward investors.

IR involves informing investors about company performance, relaying shareholder feedback to leadership, and clarifying issues. Actively seek investor feedback and create interaction opportunities beyond traditional IR schedules.

Given Vietnam’s market dominance by retail investors, leveraging AI to analyze market sentiment and personalize messages for investor segments is essential. Virtual meeting platforms enable remote shareholder participation, enhancing efficiency and reducing costs.

Every shareholder, big or small, is integral to the company. Thoroughly addressing even individual investor queries builds more credibility and goodwill than any meeting gift, making shareholders feel valued and heard.

When IR is conducted seriously and consistently, SHMs return to their essence as a celebration of ownership—where plans are made through understanding and consensus, not tense vote-gathering. Investor trust is built over time through transparency, respect, and engagement.

– 10:00 23/09/2025

15th Annual IR Awards Ceremony to be Held on October 2, 2025

The IR Awards program, dedicated to fostering “Transparency and Fairness in the Stock Market,” is set to unveil the most outstanding Investor Relations (IR) performers in Vietnam’s securities market. These exceptional companies will take center stage at the 15th IR Awards Ceremony, scheduled for October 2, 2025, where their achievements will be celebrated in a prestigious event.

The Stock Market Guru’s Guide to IR: Riding the Wave of Market Upgrades

The Vietnamese stock market is on the cusp of a historic opportunity as FTSE Russell is considering an upgrade in October 2025. This upgrade will potentially attract a significant influx of foreign capital. However, not all businesses will be able to capitalize on this opportunity, as suggested by Nguyen Thi My Lien, Head of Analysis at Phu Hung Securities Co..

“AI’s IR Evolution: Unlocking the Challenges Within”

In recent years, artificial intelligence (AI) has become a buzzword across industries – from marketing and operations to risk management and market research. Investor relations (IR), a specialized field requiring a blend of financial expertise and communication skills, is also embracing this transformative wave.

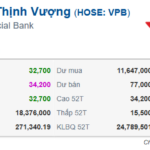

The Top-Performing Small-Cap Companies for IR Awards 2025

CCL, CNG, HAX, NAF, ST8, and TIP are the Small Cap companies that have been nominated for the prestigious IR Awards 2025. These outstanding businesses have showcased their excellence and are now part of the final round of voting for the IR Awards.