After a volatile trading session, selling pressure surged in the afternoon, causing the VN-Index to plummet over 40 points before narrowing its decline towards the close. By the end of the September 22nd session, the index had fallen 24.17 points, closing at 1,634. Trading value on HoSE remained robust at over 35.7 trillion VND.

Foreign investors were net sellers, offloading a substantial 1,757 billion VND during the session. A breakdown of their activity is as follows:

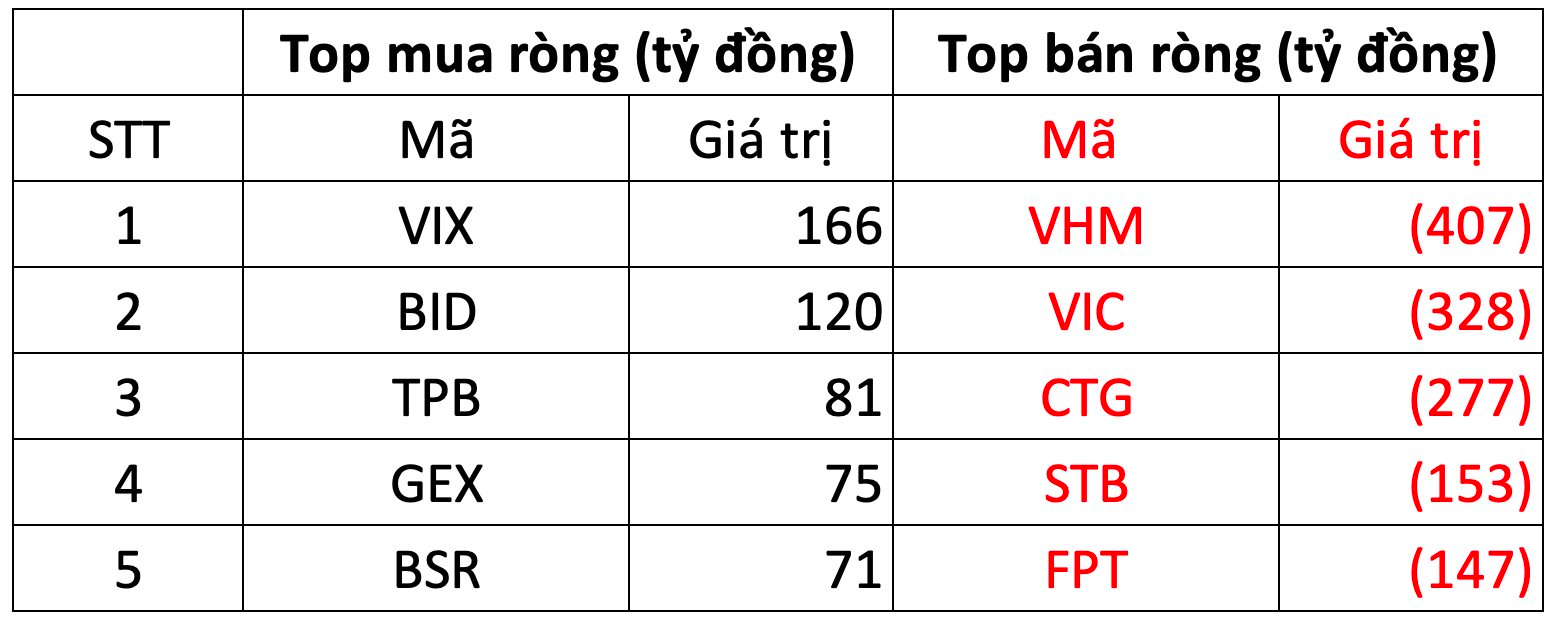

On HoSE, foreign investors were net sellers of 1,733 billion VND

On the buying side, VIX saw the strongest net inflow at 166 billion VND. This was followed by BID (+120 billion VND), TPB (+81 billion VND), GEX (+75 billion VND), and BSR (+71 billion VND).

Conversely, VHM witnessed the heaviest selling pressure, with foreign investors offloading approximately 407 billion VND worth of shares. VIC, CTG, and STB also faced significant selling, with net outflows ranging from 100 to 300 billion VND each.

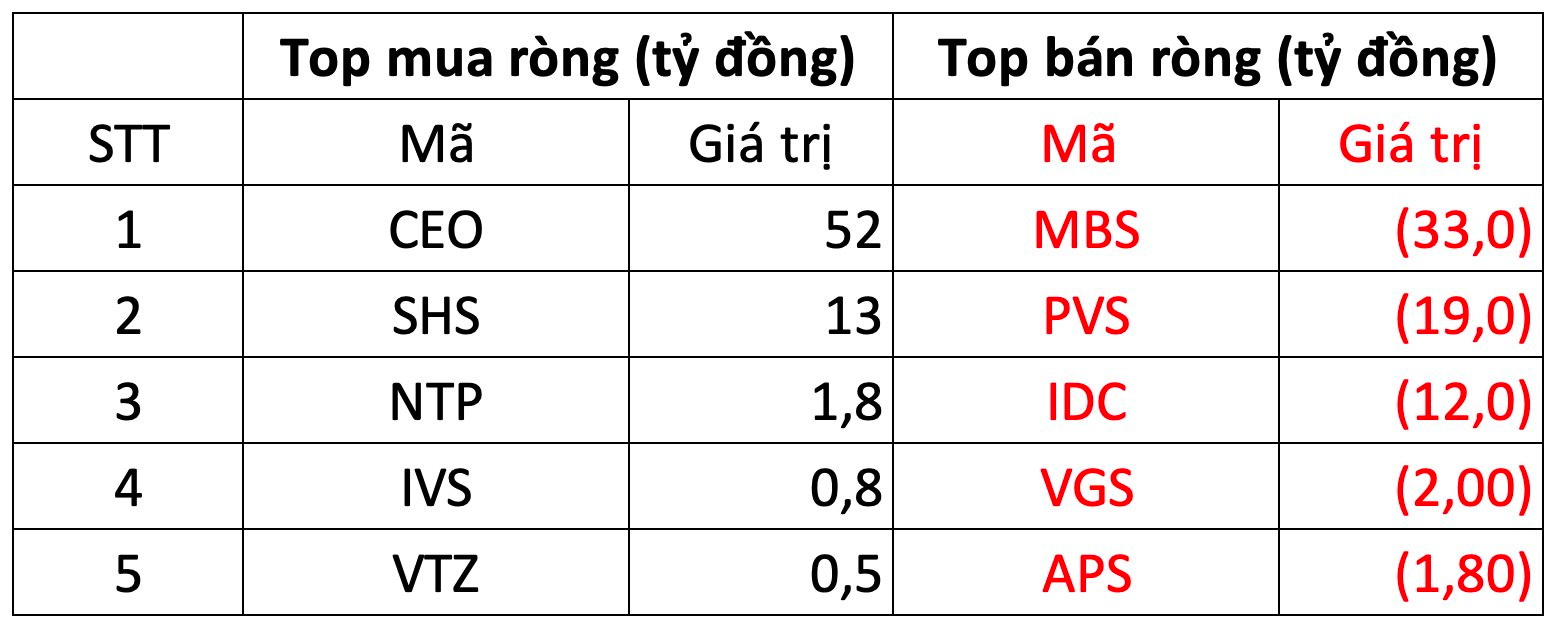

On HNX, foreign investors were net sellers of approximately 17 billion VND

CEO led the buying activity on HNX with a net inflow of 52 billion VND, followed by SHS (13 billion VND) and NTP (2 billion VND).

MBS faced the strongest selling pressure on HNX, with a net outflow of 33 billion VND. PVS and IDC also saw significant selling, with net outflows of 19 billion VND and 12 billion VND, respectively. VGS and APS were also net sold, with outflows of 2 billion VND and 1.8 billion VND, respectively.

On UPCOM, foreign investors were net sellers of approximately 7 billion VND

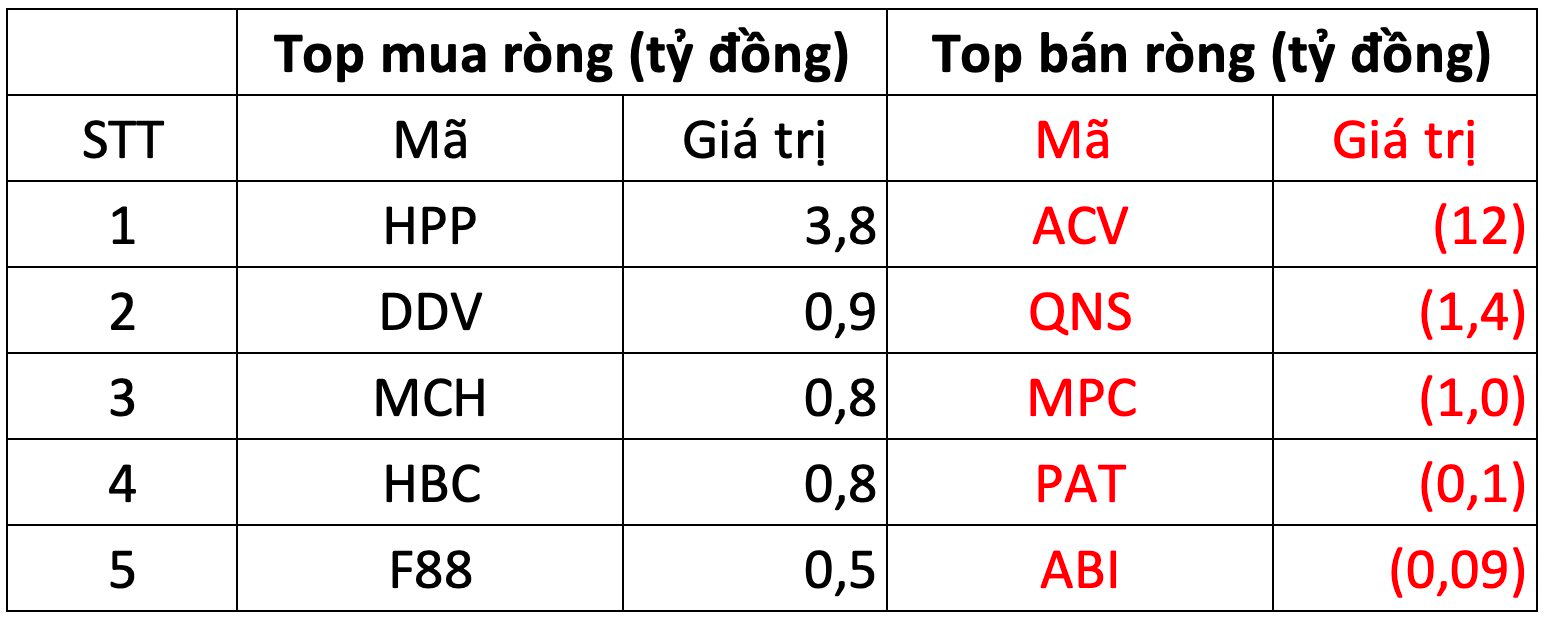

HPP and DDV saw the most buying interest on UPCOM, with net inflows of 4 billion VND and 1 billion VND, respectively. MCH, HBC, and F88 also attracted modest buying interest, with net inflows of a few hundred million VND each.

ACV faced the strongest selling pressure on UPCOM, with a net outflow of 12 billion VND. QNS, MPC, PAT, and ABI also saw selling pressure, with net outflows ranging from a few hundred million VND to 1 billion VND each.

Market Plunge: Blue-Chip Stocks Retreat, Triggering Sharp Decline in Early-Week Trading

Domestic stocks faced a challenging start to the week, with selling pressure dominating the market and driving the VN-Index down by 24 points. No sector or stock emerged as a strong enough pillar to support the market.