Illustrative image

Retail rice prices in Japanese supermarkets are nearing record highs, despite a surge in low-cost imports. Domestic rice remains the preferred choice for consumers, while imported rice primarily supplies restaurants.

Japan’s Ministry of Agriculture reported that during the week of September 8–14, the average retail price of rice reached ¥4,275 (approximately $29) for 5 kg, a 2.9% increase from the previous week. This is just shy of the record ¥4,285 set in May.

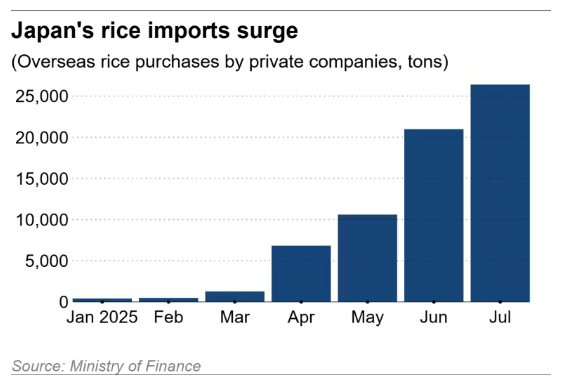

Japan’s rice imports hit a record high in July. Source: Nikkei

Private rice imports in July soared to 26,397 tons, over 200 times higher than the same period last year. However, this has had minimal impact on retail prices. Nikkei’s POS data reveals that in August, imported Calrose rice accounted for only 0.8% of total supermarket rice sales.

A major wholesaler noted, “Even imported Japonica rice is harder and less sticky. Flavor-conscious consumers consistently choose domestic brands.”

At a Saitama supermarket, despite Calrose rice from California being priced at ¥3,300/5 kg—lower than its Japanese counterpart at ¥4,083/5 kg—most shoppers favored domestic rice.

Another factor sustaining high rice prices is the cost of purchasing new-crop rice. This year, fresh rice prices range from ¥4,000 to ¥4,500 per 5 kg, significantly higher than last year’s ¥3,500. In some Tokyo areas, prices exceed ¥5,000.

Despite the surge, imported rice constitutes a tiny fraction of Japan’s 6.79 million tons of domestic rice harvested in 2023. Most imports cater to restaurants, particularly large chains like Yoshinoya Holdings and Matsuya Foods Holdings, which blend domestic and imported rice.

Flavor differences are less noticeable in dishes like curry or fried rice, ensuring steady restaurant demand. However, retailers anticipate that consumers will continue to favor domestic rice on supermarket shelves.

Experts predict that rice prices in Japan will remain elevated due to extreme heat reducing grain quality. In Ibaraki Prefecture, Kiuchi Nosan is harvesting 50 hectares of rice across eight varieties, primarily Koshihikari. Preliminary assessments indicate that only 80% of the rice meets Grade 1 standards, a 15% drop from last year due to heat-induced grain opacity.

Kiuchi Yasuhiro, Chairman of Kiuchi Nosan, stated that while many clients are eager for early Grade 1 rice deliveries, declining quality during the main harvest could push market prices even higher than last year.

Source: Nikkei Asia