Following the announcement, CET’s stock price continued to surge, hitting its ceiling on September 23rd.

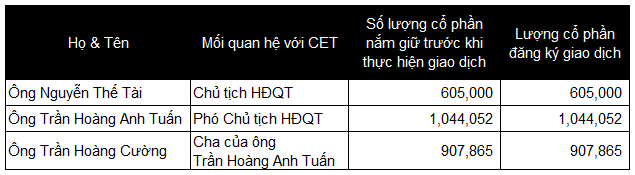

According to trading registration information, Chairman Nguyen The Tai and Vice Chairman Tran Hoang Anh Tuan both intend to sell their entire stakes in CET. Additionally, Mr. Tuan’s relative, Tran Hoang Cuong (Mr. Tuan’s father), has also registered to sell his entire holdings. All three transactions are scheduled to take place between September 25th and October 23rd. After these transactions, none of the three will remain shareholders of CET.

The transaction volumes are detailed in the table below:

|

CET Leaders and Relatives Seek to Divest

Unit: shares

Source: Trading Registration Information

|

The eagerness to sell among insiders comes after CET’s stock price experienced a continuous surge, reaching its highest level since August 2017. This upward trend persists despite the stock being under warning from HNX for delayed submission of the 2025 semi-annual audited financial report.

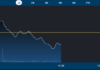

Historically, CET has seen dramatic price fluctuations, with sharp increases followed by steep declines. From 2021 to 2024, shareholders witnessed their portfolio values rise and fall like a rollercoaster. Notably, in its first year of listing in 2017, CET peaked at 16,909 VND per share (adjusted for splits) before plummeting by 76%.

As of the close on September 23rd, the company’s market capitalization stands at just over 68 billion VND, despite the stock price rising by 146% this year.

Recently, on September 17th and 22nd, CET saw trading volumes of 1.53 million and 1.15 million shares, respectively. These figures are significant compared to the over 6 million shares currently in circulation.

Meanwhile, two independent Board of Directors members for the 2023-2028 term at CET, Mr. Do Van Dat and Ms. Ha Le Thuy Vy, have resigned for personal reasons.

| CET’s Trading History from Its First Trading Day (July 18, 2017) to Present |

– 3:58 PM, September 23, 2025

Vietstock Daily 24/09/2025: Liquidity Hits Record Low

The VN-Index formed a Doji candlestick pattern, accompanied by a sharp decline in trading volume below the 20-session average, indicating persistent market caution. With both the Stochastic Oscillator and MACD continuing to weaken following sell signals, the August 2025 low (around 1,600-1,630 points) is expected to serve as short-term support for the index.

Stocks Surge for 10 Consecutive Sessions: DAT Issues Another “Template” Explanation

Following a remarkable five-session consecutive surge from September 8th to 12th, shares of Tourism and Seafood Development Investment Corporation (HOSE: DAT) continued their upward trajectory, hitting the upper limit for five additional sessions. This unprecedented rally prompted the Ho Chi Minh City Stock Exchange to request an official explanation from the company.