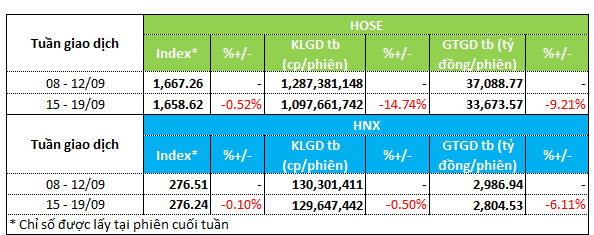

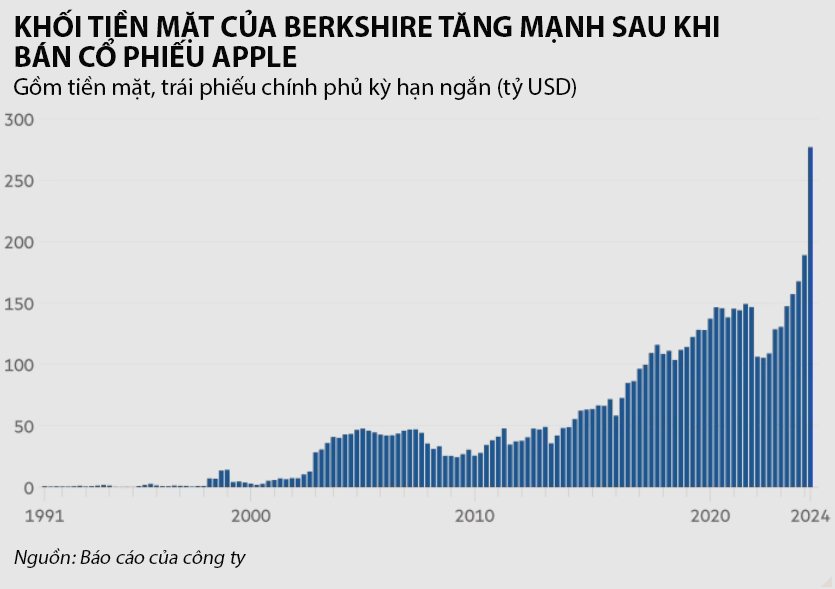

The stock market exhibited a lackluster performance in terms of both index levels and liquidity during the week of September 15-19. Following an initial upswing, the index recorded four consecutive days of decline. By week’s end, the VN-Index dipped by 0.5% to close at 1,658.62 points, while the HNX-Index experienced a marginal decrease of 0.1%, settling at 276.24 points.

Liquidity contracted simultaneously across both trading platforms. On the HOSE, trading volume shrank by 15% to just over 1 billion units per session, with transaction value declining by more than 9% to 33.6 trillion VND. Meanwhile, the HNX witnessed a more modest liquidity reduction, with trading volume edging down by 0.5% to nearly 130 million units per session, and transaction value falling by 6% to 2.8 trillion VND per session.

|

Overview of Liquidity for the Week of September 15-19

|

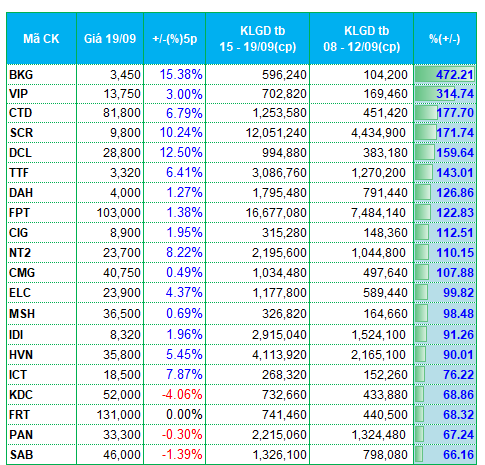

Amid waning investor interest, the liquidity breakout group displayed notable polarization. Some stocks saw a significant surge in trading volume, while others experienced only modest increases.

Several timber stocks witnessed a substantial influx of capital. BKG saw its trading volume skyrocket by nearly 500% to 600,000 units per session, while TTF enjoyed a 140% increase, surpassing 3 million units per session.

The information technology and telecommunications sectors also demonstrated improved liquidity during the week. FPT recorded a trading volume increase of over 100%, reaching nearly 17 million units per session. CMG and ELC posted similar gains of around 100%, whereas ICT lagged slightly with a nearly 70% increase. Nonetheless, ICT still managed a respectable 8% weekly gain.

Conversely, sectors experiencing declines saw more pronounced reductions in liquidity compared to the previous week. The financial sector, particularly securities firms, stood out as the most notable capital outflows.

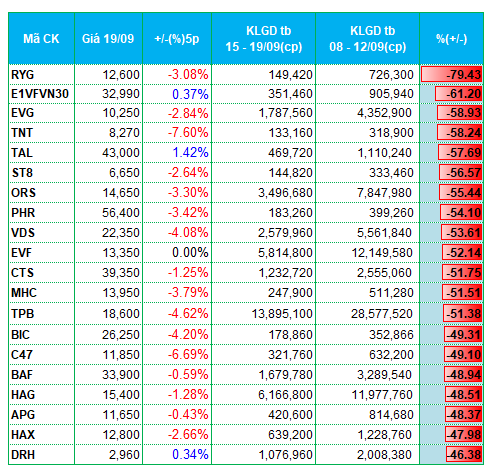

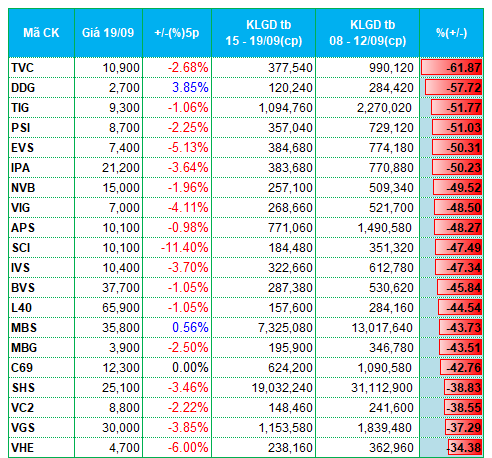

Across both exchanges, numerous securities firms reported significant declines compared to the prior week.

Half of the top liquidity decliners were securities stocks, including: ORS, VDS, CTS, APG, TVC, PSI, EVS, VIG, APS, IVS, BVS, MBS, and SHS. Trading volume decreases ranged from 40% to 60% compared to the previous week, with most of these stocks also experiencing price declines.

Other financial groups, such as banks (TPB, NVB) and insurers (BIC), were also among the week’s top liquidity decliners.

|

Top 20 Stocks with Highest Liquidity Increases/Decreases on HOSE

|

|

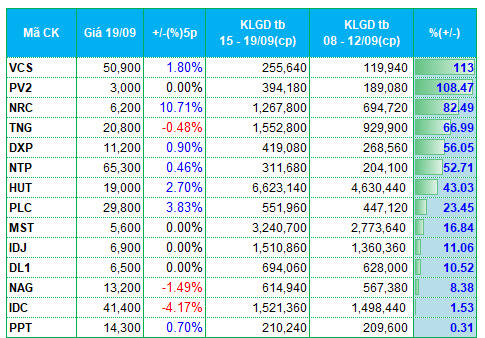

Stocks with Highest Liquidity Increases/Decreases on HNX

|

The list of stocks with the highest increases and decreases in liquidity is based on average trading volumes exceeding 100,000 units per session.

– 08:03 23/09/2025

Vietstock Daily 24/09/2025: Liquidity Hits Record Low

The VN-Index formed a Doji candlestick pattern, accompanied by a sharp decline in trading volume below the 20-session average, indicating persistent market caution. With both the Stochastic Oscillator and MACD continuing to weaken following sell signals, the August 2025 low (around 1,600-1,630 points) is expected to serve as short-term support for the index.

Foreign Block Net Sells Nearly VND 1.8 Trillion Amid VN-Index Volatility: Which Stocks Are the Focus of the Sell-Off?

Foreign investors engaged in robust net selling during the September 22nd session, with selling pressure concentrated on the Ho Chi Minh Stock Exchange (HOSE), totaling VND 1,733 billion.

Market Plunge: Blue-Chip Stocks Retreat, Triggering Sharp Decline in Early-Week Trading

Domestic stocks faced a challenging start to the week, with selling pressure dominating the market and driving the VN-Index down by 24 points. No sector or stock emerged as a strong enough pillar to support the market.