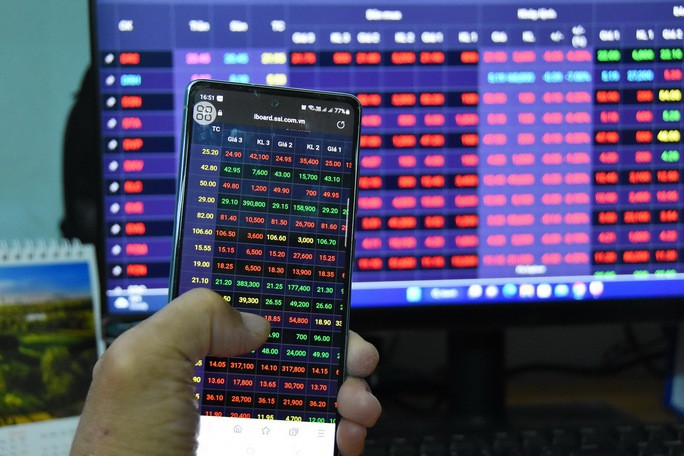

Unlike previous sessions where the market’s decline was cushioned by blue-chip stocks, today (September 22) saw a more negative trend. The VN-Index dipped to 1,616 points, with buying interest emerging at this level.

VIC took the lead in dragging the benchmark index down, closing nearly 3% lower at VND 148,800 per share. Despite this, VIC retained its position as the largest capitalized stock, valued at over VND 577 trillion. Meanwhile, VHM and VRE also declined by more than 2%.

Widespread losses push VN-Index down by over 24 points.

While large-cap real estate stocks corrected, mid-cap stocks such as CEO, DIG, PDR, CII, HDG, and KBC managed to stay in the green. Today’s session saw a rotation of capital, with heavy selling in large-cap stocks.

The VN30 basket saw 27 decliners, with only BID (+3%) and TPB (+2.2%) posting gains. HDB led the decline with a 4% drop, while blue-chips like SHB, VRE, TCB, MSN, SSI, MWG, VIB, HPG, VPB, FPT, and CTG lost 2–3%. Banking stocks were the biggest drag, costing the VN-Index nearly 9.5 points, with six representatives among the top 10 underperformers.

Sensitive to market volatility, brokerage stocks also joined the downward trend, with SSI, VND, SHS, VCI, HCM, and MBS all falling over 2%. Steel stocks faced a similar fate, with NKG hitting the lower limit.

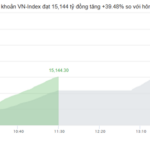

At the close, the VN-Index fell 24.17 points (1.46%) to 1,634.45. The HNX-Index dropped 2.01 points (0.73%) to 274.23, and the UPCoM-Index lost 0.86 points (0.77%) to 110.15. Liquidity increased amid heavy selling pressure, with HoSE trading value reaching nearly VND 35.8 trillion. Foreign investors continued their net selling streak, offloading over VND 1,752 billion, primarily in VHM, VIC, CTG, and STB.

Recent events, such as the U.S. Federal Reserve’s first rate cut in 2025 and developments ahead of Vietnam’s stock market upgrade evaluation, had minimal impact on domestic equities. The market remained subdued, as these moves were largely anticipated.

Stock Market Tomorrow, September 23: Will Stock Supply Continue to Pressure?

The trading session on September 22nd witnessed intense selling pressure. Will stock supply continue to exert pressure in tomorrow’s session?

Technical Analysis for the Afternoon Session of September 22: Breaking the Short-Term Trendline

The VN-Index extended its decline, breaching the short-term trendline support at the 1,645-1,660 range. Similarly, the HNX-Index retreated, falling below the Middle Band of the Bollinger Bands indicator.

Market Pulse 22/09: VN30 Group Under Heavy Selling Pressure as Pessimism Grips the Market

At the close of trading, the VN-Index fell by 24.17 points (-1.46%), settling at 1,634.45 points, while the HNX-Index dropped 2.01 points (-0.73%), closing at 274.23 points. Market breadth favored decliners, with 546 stocks falling and 206 advancing. Similarly, the VN30 basket saw red dominate, as 27 stocks declined, 2 rose, and 1 remained unchanged.