The Department of Industry and Trade of Vinh Long Province announced that on August 7th, the 20% retaliatory tariff imposed by the United States officially took effect on goods exported from Vietnam. This directly impacts Vietnam’s key export sectors, including many products from Vinh Long businesses.

Key products from the Mekong Delta are vulnerable to the U.S. retaliatory tariffs.

The 20% tariff increases the cost of Vietnamese goods in the U.S. market, reducing their competitiveness compared to untaxed or low-tariff competitors. Additionally, stricter rules of origin inspections (goods with low domestic value may face up to 40% tax) are expected, though the U.S. has not yet detailed its “transshipment” determination process. This could delay customs clearance, increase storage costs, and heighten penalty risks.

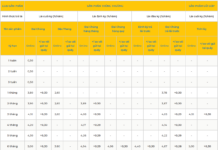

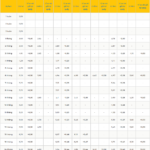

According to the Vinh Long Department of Industry and Trade, September’s export turnover is estimated at over $293 million, down 2.5% from August but up 28% year-on-year. In the first nine months, exports reached over $2.7 billion, an 18% increase year-on-year.

The U.S. is Vinh Long’s largest export market, accounting for 32% of total turnover, followed by Japan, China, and the EU. The 20% retaliatory tariff directly affects approximately one-third of the province’s export turnover, targeting key products such as agricultural goods, seafood, fruits, textiles, and handicrafts.

Statistics show Vietnam’s exports to the U.S. in August dipped 2% from July but rose 18% year-on-year. While Vietnamese goods maintain their market presence, long-term trends depend on businesses’ adaptability.

The Vinh Long Department of Industry and Trade urges the central government to swiftly develop policies to support businesses in expanding and diversifying export markets.

Industry experts advise businesses to enhance transparency, implement traceability systems, renegotiate contracts with partners to share risks, diversify markets, and leverage new-generation free trade agreements.

The U.S. tariffs challenge businesses to restructure export strategies, enhance competitiveness, and ensure product origin transparency. With thorough preparation and local government support, businesses can maintain their U.S. market position and expand into other promising markets.

Pangasius, a key export from the Mekong Delta, saw U.S. exports reach $234 million in the first eight months of this year, up 3.7% year-on-year, with total exports exceeding $1.4 billion, a 10% increase. Despite modest growth, the U.S. remains a critical market due to its high value, stringent requirements, and global influence.

The Vietnam Association of Seafood Exporters and Producers notes that sustaining growth amid complex tariffs and technical barriers demonstrates pangasius’s strengthening position in the mid-to-high-end segment. This encourages businesses to further standardize and build their brand in this market.

U.S. Tax Challenges: A Critical Litmus Test for Businesses

The 20% reciprocal tax imposed by the U.S. on imports from Vietnam presents a significant challenge, yet it also serves as a critical test for businesses to restructure their market strategies and enhance competitiveness. With thorough preparation and support from local authorities, companies can not only retain their market share but also explore opportunities for expansion.

“FiinGroup Founder on The Investors: From the Brink of Shutdown to the Vision of Building Vietnam’s Capital Market Information Infrastructure”

“Nguyen Quang Thuan, Chairman of FiinGroup and FiinRatings, is not just the founder of a financial data analytics enterprise. With his expertise and initiatives, he is a pioneer in fostering the development of Vietnam’s capital market, striving for transparency, efficiency, and long-term sustainability.”

Profits Surge for Vinh Hoan Corporation Despite US Tariff Concerns

The Vinh Hoan Corporation (HOSE: VHC) reported a net profit of nearly VND 500 billion in the second quarter of 2025, a 56% increase compared to the same period last year, despite earlier warnings that countervailing duties imposed by the US could impact profits.

Seafood Exports Surpass $10 Billion: Unveiling the 2 Star Products

The seafood industry has witnessed impressive growth in exports, inching closer to the significant milestone of $10 billion annually. This remarkable journey can be largely attributed to the stellar performance of two key players: shrimp and catfish. As the industry surges ahead, these two aquatic powerhouses have emerged as the primary contributors to its success, solidifying their status as the backbone of this thriving sector.