Kim Tien Thao Kidney Stone Treatment by OPC Pharmaceuticals

|

POF is a fund managed by PVI Fund Management JSC (OTC: PVIASSET), a subsidiary of PVI Holdings (HOSE: PVI).

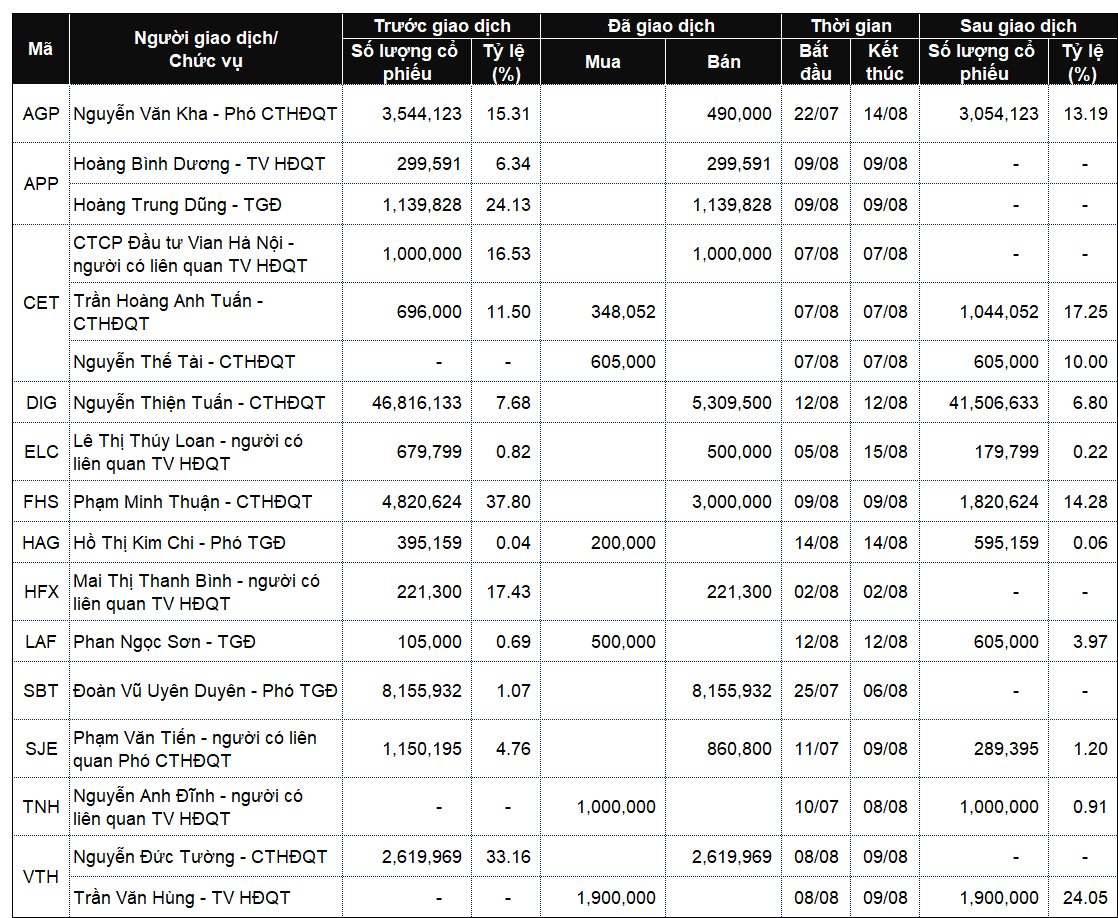

POF announced plans to sell nearly 8.6 million shares, representing 13.4% of the pharmaceutical company’s equity, valued at VND 1.45 trillion. The transactions will be executed via negotiated deals or order matching on the exchange from September 25 to October 3.

Aside from POF, OPC Pharmaceuticals’ major shareholders include Mr. Trinh Xuan Vuong, a non-executive board member holding 13.9%, Vietnam National Pharmaceutical Corporation with 13.4%, and Pacific Partners JSC owning 12.9%.

On the stock market, OPC shares have trended downward in recent months despite overall market optimism. From early July to September 22, the stock price fell 5%, while the VN-Index surged nearly 19%. Average trading volume was over 4,000 shares per session. On the morning of September 23, only a few hundred OPC shares were traded.

OPC’s financial performance has shown a gradual decline since peaking in 2022. In the first half of 2025, the company reported consolidated revenue of VND 448 billion, up 2.4% year-on-year, but net profit after tax dropped 17% to VND 46 billion.

| OPC Stock Performance in 2025 |

– 09:45 23/09/2025