Dowaco’s Doriv purified water product – Illustrative image

|

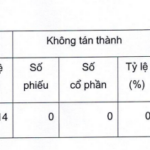

Dowaco has recently released the minutes of a written shareholder vote, with a deadline of September 15th. The results indicate that both proposals were rejected, although the minutes do not specify the reasons for the opposition.

Notably, the proposal to adjust the 2025 business plan received nearly 64% disapproval votes. Given the current shareholder structure, it is likely that this opposition came from Sonadezi (UPCoM: SNZ), which holds 63.99% of the shares. Conversely, over 32% of the approval votes are expected to come from shareholders associated with Board Member Nguyễn Văn Thiền (who directly owns 1%), along with Biwase (BWE) holding 18.83% and TDM Water with 12.06%. Mr. Thiền is currently the Chairman of Biwase, while TDM is a strategic shareholder in Biwase.

According to the proposal, Dowaco suggested adjusting the 2025 net revenue (excluding exchange rate differences) to 1.162 trillion VND, a 2% decrease compared to the plan approved at the Annual General Meeting. Within this, water revenue is expected to decrease by 3% to 1.092 trillion VND, accounting for 94% of total revenue; construction revenue is projected to drop by 20% to 19.9 billion VND; conversely, financial revenue is anticipated to increase by 60% to 40 billion VND.

Despite the reduction in revenue targets, the company aims to increase the after-tax profit target (excluding exchange rate differences) by 12% to 302 billion VND. Simultaneously, the proposed capital investment plan for construction is significantly reduced by 37%, from 471 billion VND to 295 billion VND.

This adjustment proposal comes as Dowaco achieved nearly 656 billion VND in revenue in the first half of 2025, a slight 1% increase year-over-year and a historic high. However, total expenses rose by 11%, primarily due to foreign exchange losses from foreign currency loans, causing financial costs to surge by over 272%. Consolidated after-tax profit decreased by 40% to just over 122 billion VND, the lowest in six years for a semi-annual period. Compared to the adjusted plan, Dowaco has achieved approximately 56% of its revenue target and 40% of its profit target for the year.

In comparison to the current plan, Dowaco has met 55% of its revenue target and 45% of its after-tax profit target for the year.

|

Dowaco’s Semi-Annual Business Results Over the Years |

Board and Supervisory Board Remuneration Also Rejected

Not only the business plan but also the proposal regarding salaries and remuneration for the leadership was rejected. According to the draft, the Chairman of the Board is expected to receive 142 million VND/month, the Head of the Supervisory Board 97 million VND/month, and each member of the Board and Supervisory Board 85.8 million VND/person/month. Additionally, the Chairman of the Board is proposed to receive 21.12 million VND/month, and each member of the Board and Supervisory Board 17.16 million VND/person/month. The voting results show that Sonadezi did not approve, while the shareholder group associated with Nguyễn Văn Thiền did not provide an opinion.

On the stock market, DNW shares are currently trading around 34,000 VND/share, up 8% over the past three months but down slightly by 2% over the past year. Average liquidity is below 7,500 shares/session, reflecting a concentrated shareholder structure where major shareholders hold nearly 95% of the capital. The price of DNW reached a historic high of 35,400 VND/share in early September 2025 before a slight correction.

| DNW Stock Price Movement Over the Past Year |

– 13:43 22/09/2025

Sacombank Shareholders Reject Proposed Amendment to Legal Representative Clause in Bank’s Charter

Sacombank (HOSE: STB) has officially announced the resolution of its Annual General Meeting of Shareholders, which decided not to approve amendments or supplements to the bank’s charter.

“IPA Seeks Buyers for 50 Million Privately Placed Shares”

Introducing IPA’s latest venture: a proposed private placement of 50 million shares, with a vision to revolutionize the market. The funds raised from this offering are intended to be utilized for the sole purpose of redeeming bonds previously issued in 2024. This strategic move showcases IPA’s commitment to financial prudence and paves the way for a robust future.

“An Cuong Wood Elects New Board Member, Expanding Business Operations”

The Ho Chi Minh City Stock Exchange-listed An Cuong Wood JSC (HOSE: ACG) has announced the appointment of Ms. Vu Hau Giang to its Board of Directors, replacing Mr. Phan Quoc Cong, who has stepped down. The Company has also approved an expansion of its business operations into the industrial machinery and equipment sector.

Presenting an Enticing Offer: BAF Proposes the Sale of 65 Million Shares at VND 15,500 Each

The amount of 1,007.5 billion VND raised will be used to purchase feed, additives, and materials for pig farms, totaling 557.5 billion VND, and to invest 450 billion VND in the purchase of piglets, weaned pigs, and breeding pigs. The disbursement is planned for the period between the fourth quarter of 2024 and the fourth quarter of 2025.