Following a period of rapid growth, the market is now experiencing a phase of consolidation, marked by declining liquidity, reflecting investors’ cautious sentiment. What lies ahead for the market, and how should investors navigate this uncertain landscape?

Two Headwinds for the Stock Market

Analyzing market dynamics, Mr. Nguyễn Anh Khoa, Director of Analysis at Agribank Securities (Agriseco), identifies two key risks to monitor.

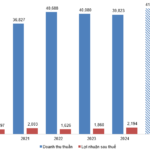

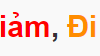

Firstly, the ongoing pressure on exchange rates may impact monetary policy in the near future. This pressure has also led to continued net selling by foreign investors in 2025. Last week marked the ninth consecutive week of net selling, totaling 5.715 trillion VND on HOSE, bringing the year-to-date net selling to nearly 90 trillion VND—almost matching the entire 2024 figure.

Secondly, if Vietnam’s stock market fails to achieve emerging market status in the upcoming FTSE review, short-term adjustments are likely. Most investors had anticipated an upgrade in this review, making the market vulnerable to disappointment.

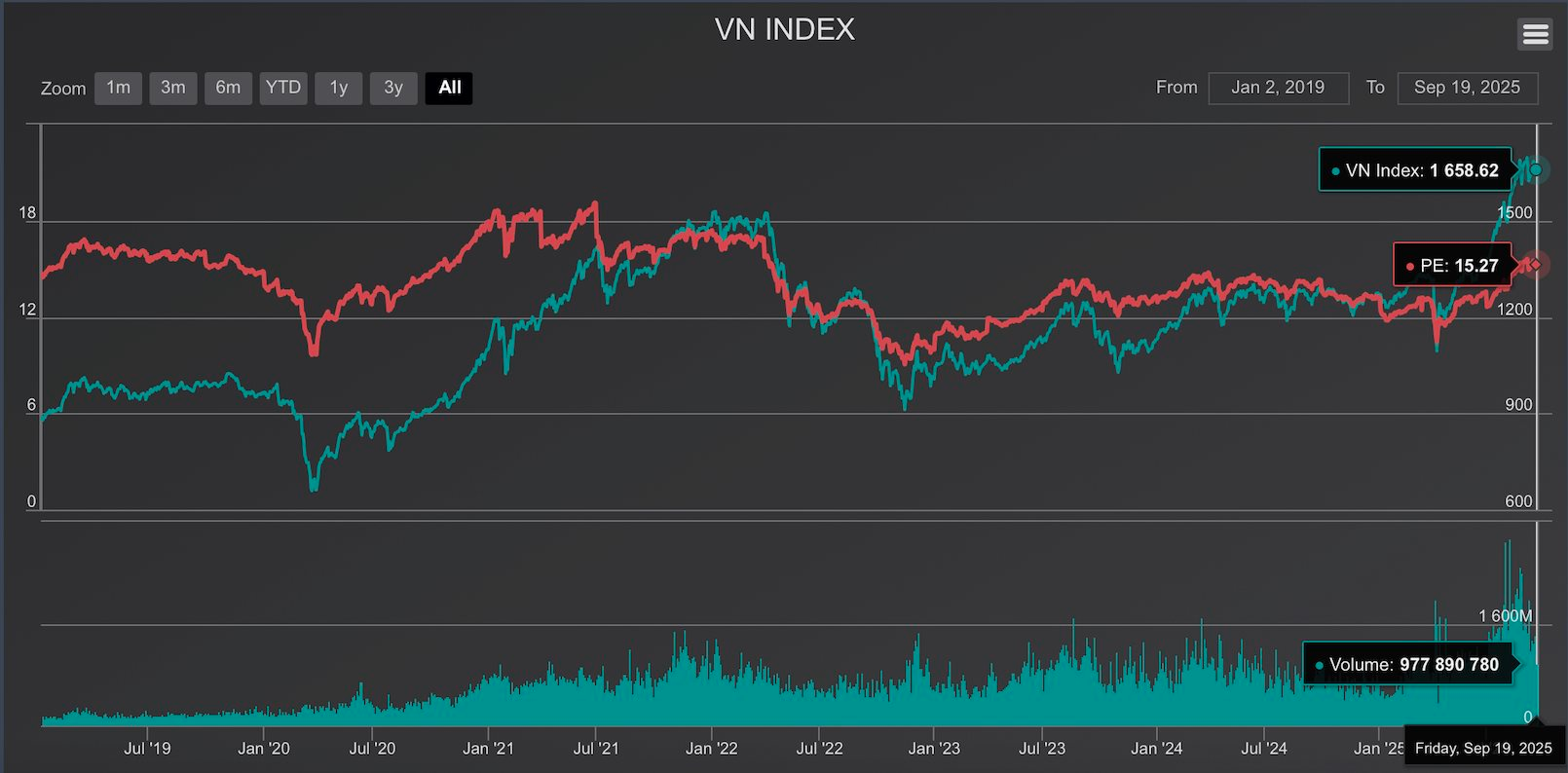

Market liquidity has significantly decreased as investors adopt a cautious stance following the recent rapid price surge. Stock valuations have reached new highs, and many companies are no longer undervalued. Investors are now awaiting critical updates, such as Q3 business results and the potential market upgrade announcement. Additionally, persistent net selling by foreign investors has further dampened market sentiment.

Amid this uncertainty, many investors are opting to stay on the sidelines, but this doesn’t signify a market exodus. Capital is smoothly rotating between sectors, shifting from large-cap stocks to mid-cap equities with unique growth stories. The remainder may be temporarily parked in short-term deposits, awaiting clearer market signals for re-entry.

On a positive note, experts believe the Fed’s rate cut could alleviate pressure on the VND exchange rate. Lower USD interest rates reduce the USD-VND rate differential, diminishing the incentive to hold USD. A weaker USD also reduces the appeal of U.S. financial assets, including its stock market. Moreover, signs of a slowing U.S. economy may encourage international capital to flow into emerging markets like Vietnam.

Beyond the Fed’s actions, the VND/USD rate is supported by Vietnam’s robust trade surplus, thriving tourism, and strong FDI disbursement. Decree 232/2025/NĐ-CP, effective from October 10, 2025, allows gold imports and production, addressing supply issues and narrowing the domestic-international gold price gap, thereby curbing illegal foreign currency demand for gold smuggling.

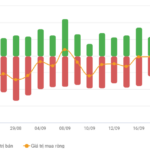

Mr. Khoa notes that the VN-Index is currently below short-term support levels (MA5, MA10, MA20). Profit-taking pressure in the VN30 group and renewed foreign net selling add to market strain. However, declining trading volumes suggest limited selling pressure, reflecting cautious investor sentiment.

In summary, these factors were already priced into the VN-Index’s recent rally. A market correction is possible, especially given the index’s weak short-term technical structure.

A Time for Selective Investing

Currently, the VN-Index’s P/E ratio stands at 15.0x, above the 5-year average but below peak levels (22x in 2018 and over 20x in 2021–2022). While no longer cheap, the market isn’t overheated, leaving room for growth. This phase demands selective investing.

Given short-term unpredictability, disciplined trading and risk management are crucial. Instead of predicting index bottoms, investors should focus on analyzing company fundamentals. Building portfolios around leading companies with strong foundations, prudent capital management, and phased investments can optimize returns.

Short-term investors should maintain reasonable equity exposure, avoid leverage, and monitor market reactions at key support levels. Portfolio adjustments, such as cutting underperforming positions, are essential to preserve capital during corrections.

Long-term investors should prioritize company fundamentals over short-term volatility, focusing on profit growth sustainability and industry prospects. Gradual, strategic investments during market fluctuations enhance risk management.

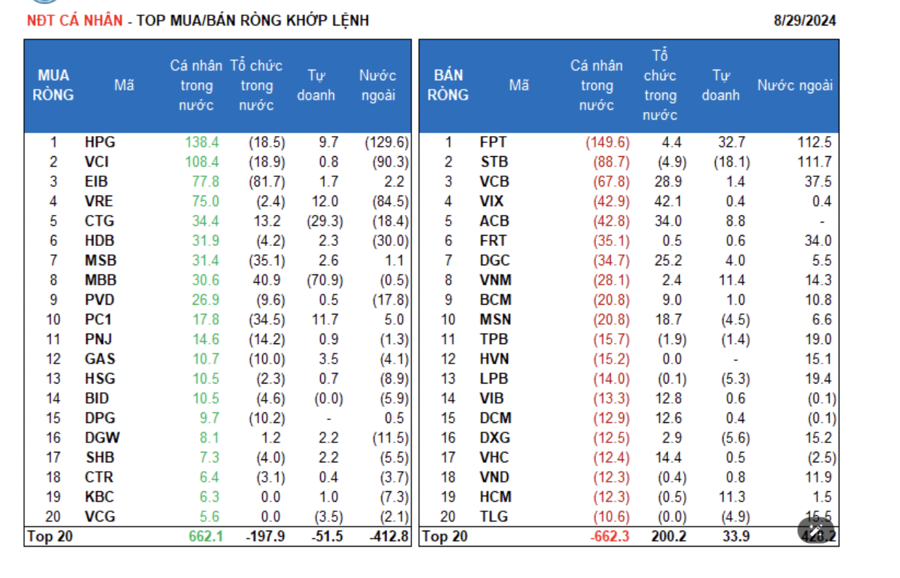

Banking stocks with strong fundamentals, high ROE, and low P/B ratios remain attractive, supported by credit recovery. Many stocks have lagged the VN-Index’s recent gains, offering reasonable valuations.

Recently, sectors like construction, materials, utilities, energy, and logistics have shown renewed investor interest, making them suitable for medium- to long-term accumulation strategies.

RMIT Professor: MoMo and Sky Mavis Are Just the Beginning—Vietnam Poised to Emerge as a Global Startup Powerhouse

Experts believe that, despite a slower start compared to its regional counterparts, Vietnam’s startup ecosystem is emerging as a vibrant and powerful force.

Crafting a Clear Legal Framework to Enhance Protection for Depositors’ Rights

The 49th session of the National Assembly Standing Committee deliberated on the draft amendments to the Deposit Insurance Law, aiming to establish a clear legal framework, enhance the protection of depositors’ rights, and ensure the stability of the financial system.