Selling off at the lowest point of the session may result in losses or an exit from the downward trend, but conclusions can only be drawn after observing subsequent sessions. Nonetheless, the VN-Index staged a significant late-session rebound.

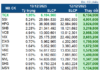

A massive sell-off across most stock groups, particularly large-cap stocks, caused the VN-Index to plunge by over 40 points in the early afternoon session before narrowing its losses to close the September 22nd session down 24.17 points (-1.46%) at 1,634 points.

Notably, active trading by investors boosted market liquidity, with trading volume surpassing 1.2 billion shares and trading value on the HOSE reaching over VND 35.7 trillion. Foreign investors were net sellers, offloading nearly VND 1.8 trillion on the HoSE.

High Probability of Further Corrections in Upcoming Sessions

According to Mr. Đỗ Bảo Ngọc, Deputy Director of Kien Thiet Securities, despite positive news such as the Fed’s rate cut or ETF portfolio rebalancing, the market’s prolonged sideways movement in terms of index points and declining liquidity have tested investors’ patience.

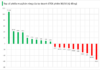

The sell-off pressure concentrated on strongly performing pillar stocks, including banking, securities, and Vingroup-related stocks, driving the market sharply lower. However, some investors holding cash stepped in to “buy the dip” toward the end of the session, helping the index recover from its intraday lows.

“It’s challenging to determine whether selling during a sharp decline is right or wrong, but given prolonged negative accounts and fading upward momentum, many investors choosing to exit the market is entirely understandable,” said Mr. Đỗ Bảo Ngọc.

From a technical perspective, experts note that major indices have collectively breached the 20-day MA support level, signaling a clear short-term correction. Notably, the VN-Index shows signs of forming a head-and-shoulders pattern, with three relatively close peaks in both time and height. When prices break below the neckline with significant volume, the pattern is confirmed, typically leading to a deeper market downturn.

Experts suggest that the formation of a head-and-shoulders pattern, combined with the index breaching the 20-day MA, indicates a high probability of further corrections in upcoming sessions. In the short term, the VN-Index will test nearby support levels, with 1,600 points (±5 points) and 1,607 points being critical levels for investors to monitor.

As the market transitions from an uptrend to sideways movement with correction signals, a defensive strategy should be prioritized. Investors are advised to observe market reactions at these support levels and await stronger accumulation signals before considering re-entry. Maintaining a reasonable stock allocation and avoiding high leverage in this phase is a prudent approach aligned with current market dynamics.

Prioritize Risk Management

Given the market’s short-term unpredictability, Mr. Nguyễn Anh Khoa, Director of Analysis at Agriseco Securities, emphasizes the importance of adhering to trading discipline and risk management. Instead of focusing on predicting the index’s bottom, investors should shift their attention to analyzing corporate fundamentals, building portfolios based on leading companies with strong foundations and cautious capital management, and staggering investments to optimize returns.

Short-term investors should maintain a reasonable stock allocation, limit leverage, and focus on monitoring market reactions at key support levels. Additionally, portfolio restructuring by removing positions that have breached stop-loss thresholds or underperformed relative to the broader market is essential to preserving purchasing power during corrections.

Meanwhile, medium- to long-term investors should focus on corporate fundamentals rather than short-term market fluctuations, specifically assessing profit growth sustainability and industry/company prospects over the coming years. A strategy of staggered investments, accumulating quality stocks during market volatility, will enhance risk management amid short-term market swings.