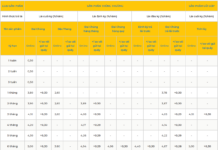

The VN-Index closed the session on September 22nd with a 24-point drop (1.46%), settling at 1,634 points.

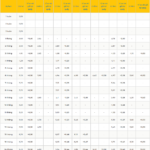

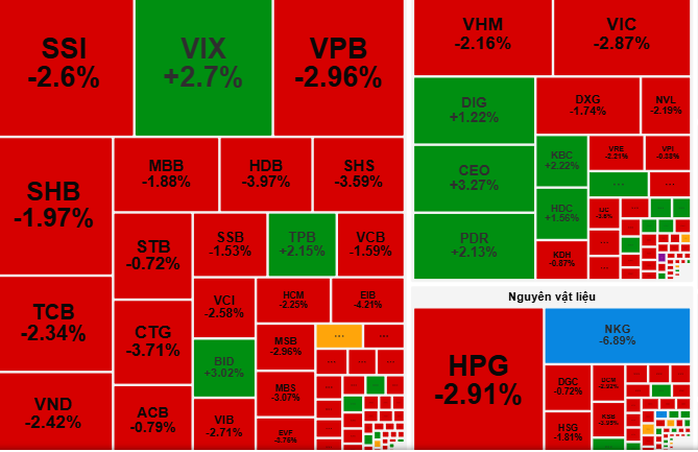

The VN-Index commenced the September 22nd trading session with a modest 2-point decline compared to the reference level. However, selling pressure swiftly intensified, driving the index down to the 1,640-point range during the morning session. Red dominated the market, particularly among banking stocks and previously high-performing shares like HPG, VHM, and VIC. Nonetheless, certain sectors continued to attract investment, notably real estate and public investment, with standout performers including HDG, PDR, and CII.

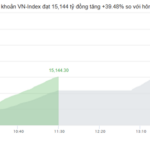

In the afternoon session, the VN-Index momentarily plunged by over 41 points due to widespread selling pressure. However, bottom-fishing demand emerged in the final 15 minutes, particularly among large-cap stocks such as Vingroup and banking shares, helping to mitigate the index’s decline. The VN-Index ultimately closed with a 24-point drop (1.46%), settling at 1,634 points.

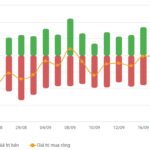

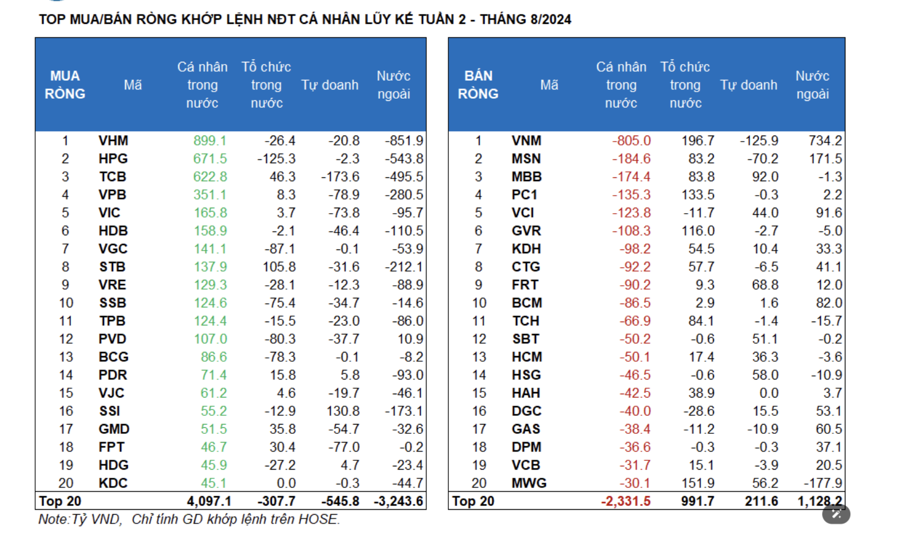

Foreign investors continued their strong net selling, totaling VND 1,733 billion, primarily targeting VHM, VIC, and CTG, further exacerbating market pressure.

According to VCBS Securities, supply currently outweighs bottom-fishing demand, with forecasts indicating continued market volatility in the September 23rd session.

Rong Viet Securities (VDSC) notes the robust selling pressure in the stock market. Increased liquidity suggests the emergence of bottom-fishing capital, but for the market to stabilize and resume its upward trajectory, buying demand must strengthen to absorb the supply of stocks.

VDSC advises investors to closely monitor supply and demand dynamics to assess market conditions, considering speculative purchases of stocks that have retreated to strong support levels or exhibit favorable price patterns.

Meanwhile, VCBS Securities recommends investors closely track market developments, promptly cutting losses upon reaching critical thresholds and awaiting opportunities to deploy capital should the VN-Index stabilize. Real estate and public investment stocks may take center stage in the September 23rd session.

Stock Market Plunges Over 40 Points Before Rebounding: Investors Face Losses Amid Sudden Sell-Off

Technically speaking, experts note that key indicators have collectively breached the support zone of the 20-day moving average, signaling a clear short-term correction.

Market Pulse 22/09: VN30 Group Under Heavy Selling Pressure as Pessimism Grips the Market

At the close of trading, the VN-Index fell by 24.17 points (-1.46%), settling at 1,634.45 points, while the HNX-Index dropped 2.01 points (-0.73%), closing at 274.23 points. Market breadth favored decliners, with 546 stocks falling and 206 advancing. Similarly, the VN30 basket saw red dominate, as 27 stocks declined, 2 rose, and 1 remained unchanged.