Technical Signals of VN-Index

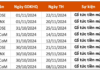

During the morning trading session on September 22, 2025, the VN-Index continued its downward trend, breaking below the short-term trendline (equivalent to the 1,645-1,660 point range).

The Stochastic Oscillator indicator issued a sell signal, and the MACD is trending downward (following a sell signal in late August 2025), suggesting that short-term volatility is likely to persist.

Technical Signals of HNX-Index

During the morning trading session on September 22, 2025, the HNX-Index declined, falling below the Middle line of the Bollinger Bands.

All oscillating indicators have issued sell signals, indicating that the HNX-Index is likely to test the lower boundary of the Triangle pattern (equivalent to the 269-272 point range) this week.

HDG – Ha Do Group Corporation

On the morning of September 22, 2025, HDG shares rose, accompanied by trading volumes exceeding the 20-session average, reflecting investor optimism.

Currently, HDG remains above the Middle line of the Bollinger Bands, while the Stochastic Oscillator continues to rise after issuing a buy signal. This suggests that short-term recovery prospects remain intact.

YEG – Yeah1 Group Corporation

During the morning trading session on September 22, 2025, YEG shares rose, with trading volumes surpassing the 20-session average, indicating strong investor confidence.

Additionally, the stock is well-supported by the 50-day SMA and 200-day SMA lines, as the Stochastic Oscillator continues to rise after issuing a buy signal and exiting the oversold zone, maintaining a positive outlook.

Currently, the MACD is narrowing its gap with the Signal line. If the indicator issues a buy signal again, the short-term recovery will be more sustainable.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning trading session. Therefore, the signals and conclusions are for reference only and may change after the afternoon session concludes.

Technical Analysis Department, Vietstock Advisory Division

– 12:09 PM, September 22, 2025

Awaiting the Next Big Catalyst: Will Stock Markets Remain in Limbo?

The stock market just concluded its quietest trading week since early July, with the VN-Index closing at 1,658 points. Broad-based selling pressure emerged amid sharply declining liquidity and persistent net selling by foreign investors. Analysts anticipate that next week, the market will likely remain in an accumulation phase, awaiting catalysts from third-quarter earnings reports and, notably, the FTSE’s upcoming review for a potential upgrade.

VNDirect: Stocks Poised to Re-Test 1,600 Level Before Targeting 1,900 Points

Over the next 6–9 months, our analysts maintain a positive outlook on Vietnam’s stock market. In the base scenario, the VN-Index is projected to target the 1,850–1,900 point range.

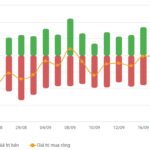

Market Pulse 22/09: Weak Demand Fuels Widespread Sell-Off

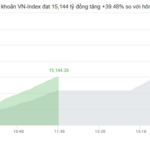

Amidst a lack of buying momentum, the market deepened its decline into the red, following unsuccessful recovery attempts near the 1,640-point threshold. By the end of the morning session, the VN-Index closed at 1,635.84 points, down 1.37%, while the HNX-Index fell 0.69% to 274.34 points. Selling pressure dominated, with 466 decliners outpacing 208 gainers. Foreign investors continued their net selling streak, offloading 1.4 trillion VND across all three exchanges.