Vietnam Prosperity Cryptocurrency Asset Exchange Joint Stock Company (CAEX) recently announced its new registration details on September 19, 2025, with an initial charter capital of 25 billion VND.

The company’s headquarters is located on the 4th floor of Building No. 5, Dien Bien Phu Street, Ba Dinh District, Hanoi, Vietnam. CAEX is registered to operate in the field of providing services related to cryptocurrency assets.

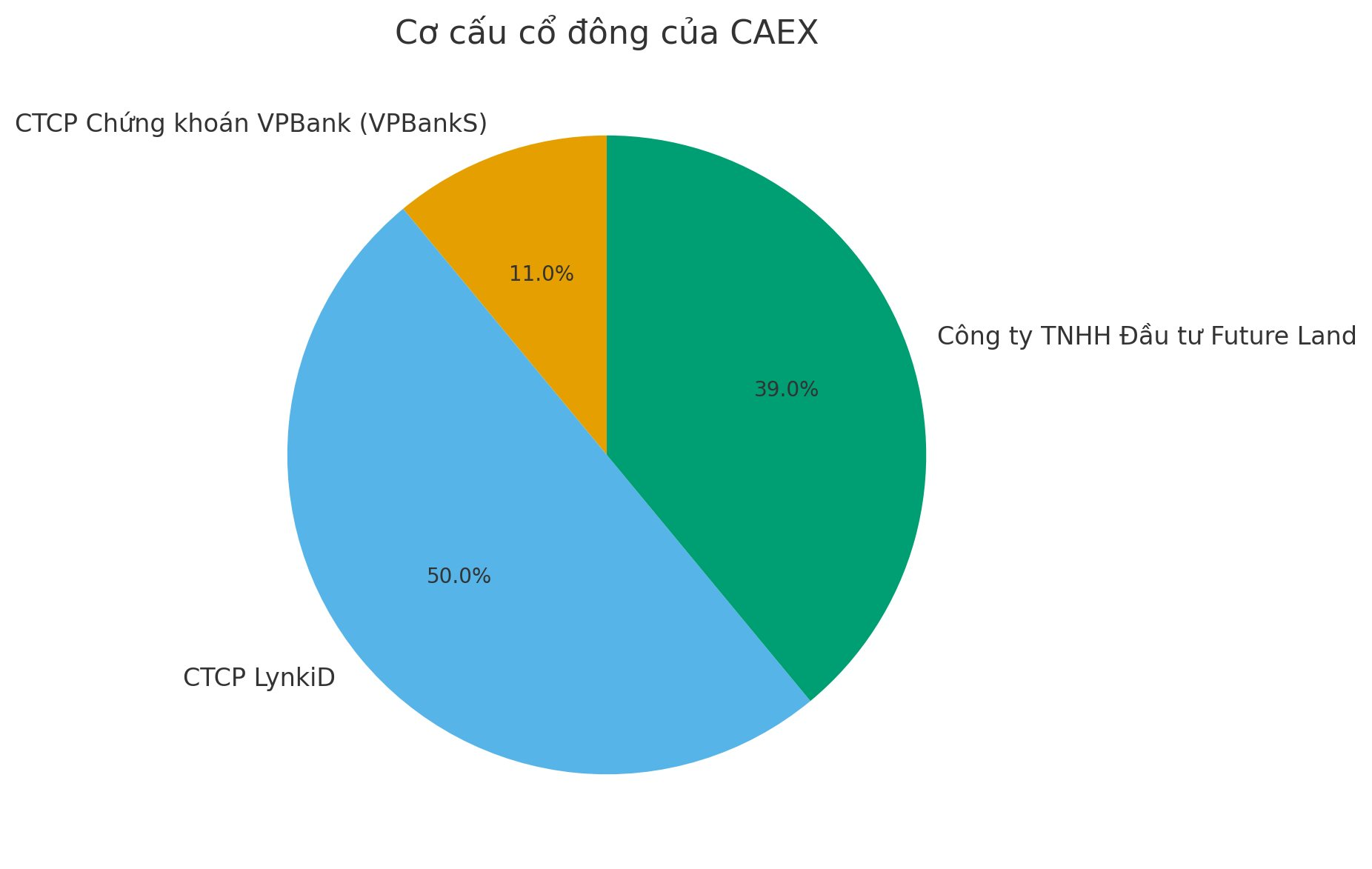

Regarding the shareholder structure, VPBank Securities JSC (VPBankS) contributes 11% of the capital, equivalent to 2.75 billion VND. The remaining capital of CAEX is contributed by LynkiD JSC with 50% and Future Land Investment LLC with 39%.

LynkiD, originally known as LynkiD Services and Technology JSC, was established on May 14, 2020, with a charter capital of 2 billion VND at the 5th floor of VPBank Building on Hue Street. Its largest shareholder is Thao Nguyen Investment and Services LLC (98%), with Mr. Luong Phan Hien (born in 1988) as the Chairman of the Board of Directors.

The company’s main business field is electronic information portals (e-commerce websites, online promotion websites, e-commerce trading platforms, electronic information pages, and social networks).

LynkiD operates in the field of building and operating a multi-platform loyalty points system in Vietnam. It develops an open loyalty ecosystem, allowing users to accumulate and convert points from various brands and industries into rewards, vouchers, and gifts.

Currently, the company is VPBank’s exclusive loyalty partner, enabling the bank’s customers to earn points directly from financial transactions and use them within the LynkiD ecosystem.

In 2024, the company changed its name to LynkiD JSC, maintaining its charter capital at 2 billion VND.

Meanwhile, Future Land Investment LLC was established on December 27, 2023, with an initial charter capital of 3 billion VND, focusing on the real estate sector. Just three months later, by March 2024, the company increased its charter capital to 120 billion VND. Ms. Nguyen Thi Dieu Anh serves as the Chairwoman of the Board of Directors.

Previously, Vietnam Prosperity Joint Stock Commercial Bank (VPBank) announced it was finalizing procedures to participate in the pilot implementation of a cryptocurrency asset exchange.

VPBank Securities JSC (VPBankS), a subsidiary of VPBank, will lead the project. To execute this, VPBank plans to mobilize a team of experts in blockchain, finance, cybersecurity, and collaborate with top consulting firms to build the exchange according to international standards.

At the annual General Meeting of Shareholders in April, VPBank’s CEO, Mr. Nguyen Duc Vinh, emphasized that cryptocurrency assets are a new and important field but also carry significant risks, requiring a strict legal framework and the participation of financially robust institutions. He noted that the bank has researched, analyzed, and engaged with multiple partners to prepare for entering this market.

Legal Framework and Opportunities for Cryptocurrency Exchange Investors

According to regulations, to obtain a license, companies establishing a digital asset exchange must have a minimum charter capital of 10 trillion VND, with at least 65% contributed by organizations and over 35% by financial institutions such as banks, securities companies, insurance firms, or technology companies. Additionally, business performance, management capabilities, and technological systems are crucial factors.

Over the years, global cryptocurrency assets have seen explosive growth. In just five years, Bitcoin surged from nearly $10,500 to a peak of over $124,000, a nearly 12-fold increase, becoming an attractive investment channel alongside stocks, gold, and real estate.

In Vietnam, cryptocurrency assets have quickly gained traction as a novel and promising investment channel. A report by Chainalysis revealed that blockchain market capital inflows into Vietnam during 2023-2024 exceeded $105 billion, generating nearly $1.2 billion in profits (2023). Vietnam ranks among the top three countries in cryptocurrency adoption, with a penetration rate 3-4 times higher than the global average. According to Triple-A, in 2023, over 21% of Vietnam’s population owned digital currency, the second-highest globally, just behind the UAE.

Companies Already Approaching the Vietnamese Digital Asset Market

Not just VPBank, several other organizations have also moved to enter the digital asset market.

In August, MB Bank signed a cooperation agreement with Dunamu Group, the operator of Upbit exchange, to launch a cryptocurrency exchange in Vietnam. Under the agreement, Dunamu will provide technology, legal advice, investor protection support, and workforce training.

On August 26, VIX Cryptocurrency Asset Exchange JSC (VIXEX) was established with a charter capital of 1 trillion VND. Its founding shareholders include VIX Securities JSC (15%), FTG Vietnam JSC (64.5%), and 3C Communication-Computer-Control JSC (20.5%).

Earlier, in May 2025, Techcom Cryptocurrency Asset Exchange JSC (TCEX), part of the Techcombank and TCBS ecosystem, was officially launched. The company started with a charter capital of 3 billion VND, which was quickly increased to 101 billion VND.

Additionally, some companies have been preparing early for this “game.” Notably, SSI Securities established SSI Digital Technology JSC (SSID) in 2022. Recently, SSID and SSI Fund Management LLC partnered with Tether, U2U Network, and Amazon Web Services (AWS) to develop a digital financial infrastructure ecosystem, blockchain, and cloud computing in Vietnam.

VPBank Successfully Issues $300 Million International Sustainable Bond

VPBank (HOSE: VPB), a leading Vietnamese commercial bank, has made history by becoming the first bank in Vietnam to successfully issue $300 million in sustainable bonds on the international market. This milestone marks a significant advancement for Vietnam’s banking sector on the global stage of sustainable finance.

Unveiling VPBank’s New Super Profit Premier Edition

Building on the success of its Super Profit tool, VPBank has recently upgraded and launched a new, superior version: Super Profit Premier. This enhanced version guarantees 24/7 deposit and withdrawal access for customers, while also expanding yield limits to deliver even more flexible and highly efficient financial experiences.

“VPBank Elevates Cultural Experience in Tailored Customer Service Strategy”

Introducing VPBank’s latest cultural offering – the Sound Healing Concert. Following the success of their K-pop extravaganza, VPBank turns their attention to catering to their introverted customers with a night of soothing music. This concert is more than just entertainment; it’s a testament to the bank’s unwavering customer-centric strategy, aiming to bring their patrons “inner prosperity.”