With a series of positive factors from the government’s commitment to economic growth and a low-interest-rate environment, Vietnam’s stock market is showing numerous bright spots. As of now, the benchmark index representing the HoSE market has surged by 33.01%.

However, the continuous rise of the VN-Index has become a “challenge” for investment funds. Data from Fmarket reveals that many funds are lagging behind the VN-Index, with year-to-date returns (as of September 15, 2025) lower than the benchmark index.

Experts explain that while the VN-Index has performed positively in 2025, its impressive growth was concentrated in July and August. Additionally, capital flows were highly polarized, focusing primarily on a few stock groups or sectors. Therefore, achieving high returns requires investing in the right sectors, stocks, and at the right time.

On the other hand, investment funds cannot “all-in” on a single sector or stock like individual investors. They must diversify their portfolios, adhere to weight limit rules, and maintain stock liquidity. This makes it challenging for funds to consistently outperform the VN-Index.

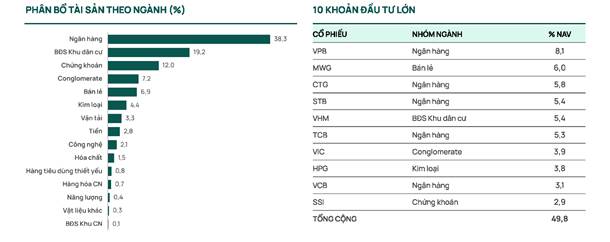

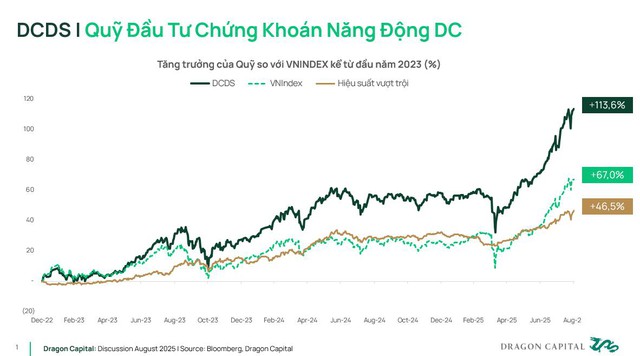

In this context, DCDS (Dynamic Capital Securities Investment Fund) stands out with a net asset value exceeding 300 billion VND and outperforming the VN-Index. As of the valuation date on September 15, 2025, the DCDS fund certificate price reached 109,435.73 VND per unit, marking a 34.38% increase since the beginning of the year.

Explaining DCDS’s Outperformance

DCDS’s ability to generate “alpha” while the HoSE benchmark index soared reflects its well-structured portfolio and flexible, rational investment strategy.

Before April, DCDS increased its cash ratio to 24% and invested at the right time when the market experienced a significant decline. Two notable picks were VIC and VHM. As known, this duo has shown impressive growth, significantly contributing to the VN-Index’s recovery after the tariff shock.

In its flexible investment strategy, by the end of June 2025, DCDS reduced its holdings in VIC and VHM while investing in banking stocks such as TCB, STB, MBB, and CTG. The overall banking stock ratio in DCDS’s portfolio increased from 28.28% at the end of May 2025 to 31.73% by the end of June 2025.

Furthermore, in July 2025, DCDS acquired VPB shares, which constituted 2.88% of its portfolio, and later increased this ratio to 8.07% by the end of August 2025.

Banking stocks were the key drivers behind the VN-Index’s consecutive record highs in July and August. Notably, VPB shares alone achieved an 89.2% return during these two months.

Thanks to its flexible and precise pivot strategy, DCDS’s investment gains/losses have been impressive over the past three months, significantly contributing to the fund’s outperformance compared to the VN-Index.

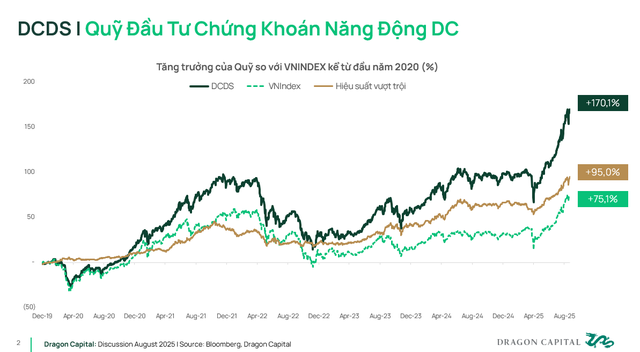

Looking beyond 2025, DCDS’s performance over the 3-year and 5-year periods is equally impressive.

According to experts, a 5-year period is sufficient to accurately assess an investment fund’s performance, reflecting the management team’s capabilities in stock selection, asset allocation, and risk management. DCDS’s 5-year performance is remarkable, reaching 170.1%, significantly outpacing the VN-Index’s 75.1%.

This impressive performance can be attributed to DCDS’s ability to invest in a broad market, allowing its portfolio to include 50-60 stocks, compared to 20-40 stocks in other funds. This enables DCDS to actively manage a diversified portfolio while ensuring liquidity, even as the fund’s assets grow with market development.

Despite having a larger asset base than many other funds, DCDS maintains a highly diversified portfolio and flexible, rational management, consistently ranking among the top performers in the market.

Long-term positive growth is a crucial factor for investors to confidently invest in DCDS fund certificates or employ strategies like SIP (Systematic Investment Plan) or DCA (Dollar-Cost Averaging). Notably, 30% of investors holding DCDS for over 2 years have achieved a 45% return.

Success Driven by Human Factors

When discussing an investment fund’s performance, alongside portfolio and investment strategy, it would be a significant oversight not to mention the fund management team. This is the critical factor determining the fund’s investment performance.

Established in May 2004, the DCDS team has over two decades of experience in Vietnam’s stock market, weathering various storms such as the 2008 economic crisis and the Covid-19 pandemic. This experience is a vital foundation, enabling the DCDS management team to effectively gauge market trends and capital flows.

The fund’s management board comprises seasoned professionals. Dr. Le Anh Tuan, Director of the Investment Division and CEO of Dragon Capital Vietnam since October 1, 2025, has 16 years of industry experience; Mr. Vo Nguyen Khoa Tuan, Senior Business Director in Securities (16 years); Mr. Nguyen Sang Loc, Business Director and Portfolio Manager (15 years); and Ms. Luong Thi My Hanh, Asset Management Director for the Domestic Division (21 years) all possess high expertise and extensive experience.

Human factors are the most critical foundation for DCDS’s continued pursuit and success with its “weather all weathers” strategy, ensuring the fund performs well in both favorable and challenging economic and market conditions.

In conclusion, DCDS’s outstanding performance in 2025 (and over the broader 3-year and 5-year periods) is the result of a combination of factors: Vietnam’s stable macroeconomy, the stock market’s growth, and the fund’s flexible, intelligent investment strategy executed by an experienced management team.

Trade Stocks with TCBS and Get Up to 40 Million VND Cashback

Embark on your stock trading journey with TCBS and unlock a treasure trove of exclusive benefits. New investors enjoy unlimited commission-free trades, cashback rewards of up to 40 million VND, and highly competitive margin lending rates.